What is Form 26AS

Form 26 AS is a tax credit statement. It has the details of your tax payment. The tax payment may by made by you, your employer or anyone else. It presents the details of all the taxes paid against a PAN. The income tax department provides this statement to all of its taxpayers. You can view and download your form 26AS whenever required

You must refer to form 26AS before e-filing income tax return. By going through the form 26AS, you would have the exact idea of tax payment. This information can sometimes reveal the fraud. I have gone through such situation.

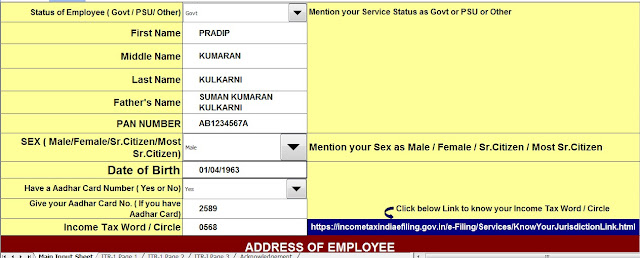

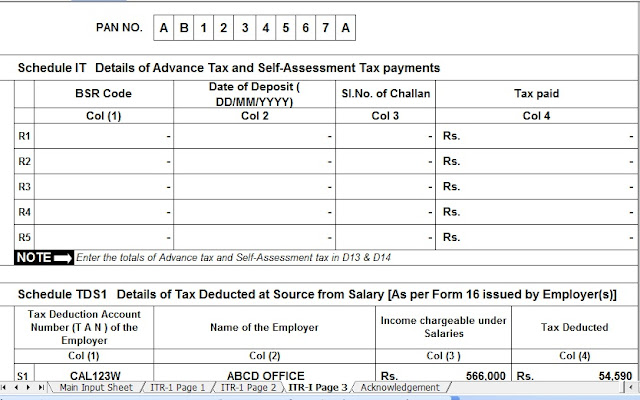

Download Automated Excel Based Off Line Income Tax Return SAHAJ (ITR-I) for Financial Year 2015-16 & Assessment Year 2016-17 [This Excel Utility can automatic prepare your Tax Return ITR-I (Off Line) who's Taxable Income less than 5 Lakh, and you can submit the same to the any Income Tax Office]

Last year, a famous fund aggregator company has contacted me to put his banner ad on Plan Money Tax. We made a deal for 4 months. It has paid me after the end of every month. But it used to deduct Rs 200 from the agreed payment. On inquiry, the company representative told me that it is a nominal TDS. I was OK with that, anyway I would have to pay the income tax. It all went smooth and we ended the contract after 4 months.

Before writing this article, I have gone through my form 26AS. To my surprise, they have deposited only Rs 200. While they have deducted Rs 800 from my payment. The amount is not very big, therefore I am not very keen to put my energy on that. But it could be a big amount as well. So it is better to check the form 26AS frequently.

What Information You can Get from Form 26AS

The form 26AS keeps record of every transaction between you and income tax department. It may be debit as well as credit.

- Details of tax deducted by your employer.

- Details of tax deducted by other deductors including Banks.

- Tax collected by the sellers.

- Advance tax paid by you.

- Self-assessment tax paid by you.

- Details of income tax refund received by you.

- Details of the High-value Transactions in respect of shares, mutual fund etc.

Why Should you view/download Form 26AS

Taxe is a complicated matter. But you can’t escape it. You have to deal with it. You have to pay tax according to your income. Not paying tax is illegal.

But we all want to save tax as far as possible. That is why the tax matters are very important to us.

Since income tax is very important to us, the form 26AS is also important. It is our passbook in relation to income tax debit and credit. So, to be on right side of the law we must keep track of the Form 26AS

Important Facts About Form 26AS

- Every Form 26AS is linked to a PAN.

- You can download from 26AS from the TRACES website.

- You can view form 26AS from FY 2008-09 on wards.

Ways To get Form 26AS

There are three ways to view/download form 26 from the TRACES. Among these three two does not require registration at TRACES website.

0 Comments