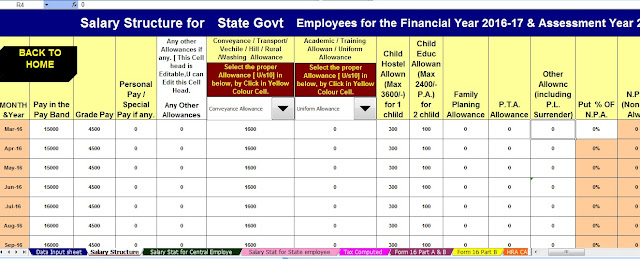

Download All in One TDS on Salary for Central & State Employees for F.Y 2016-17 & Ass Yr 2017-18 [ This Excel Utility Can prepare at a time Tax compute Sheet + Automatic HRA Calculation + Automatic Form 16 Part A&B and Part B for FY 2016-17]

Finance Budget 2016 has already introduced the rebate U/s. 87A and in this section it has not restricted the exemption to any particular Financial or Assessment year. Further in Recently Presented Budget 2016 by Finance Minister Arun Jaitley section 87A was amended and Raised up to Rs. 5 thousand.

So in our view Rebate U/s. 87A is Available to Resident Individuals , whose total income does not exceed 5 Lakh rupees in even for Financial Year 2016-17 and for Subsequent Years.

Download Govt and Non-Govt employees TDS on Salary for FY 2016-17 [ This Excel Utility can prepare at a time your Tax Compute Sheet + Arrears Relief Calculation + HRA Calculation + Form 16 Part A&B and Part B for the financial year 2016-17]

Also, it is declared by the Finance Budget 2015, that the enhance the limit of Income Tax Section 80U from 50,000/- to 75,000/- and for Blind or Phy.disable person can avail Rs. 1,25,000/-

The Tax Section 80D which is most popular for Medical Insurance which increased Rs. 25,000/- for below 60 years and Rs. 30,000/- for Sr.Citizen.

0 Comments