In his Budget 2017 speech, Finance Minister Arun Jaitley proposed to reduce the existing rate of taxation of those with income between Rs 2.5 lakh to Rs 5 lakh from 10 per cent to 5 per cent.

Finance Minister Arun Jaitley on Wednesday tabled the Union Budget for the year 2017-18 where he announced in personal income tax limits. The move which is much appreciated is aimed at softening the impact on demonetisation. Here is you can use the financial calculator to know your Income Tax slabs, rates, and rebates post-Budget 2017.

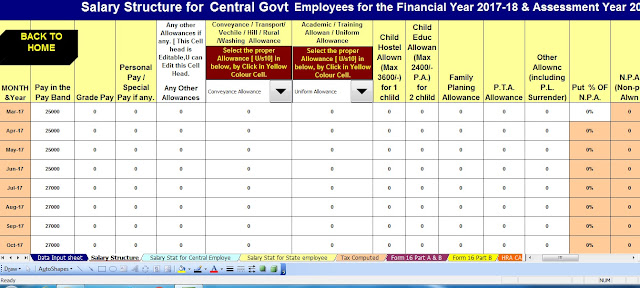

Download All in One Income Tax preparation Excel Based Software for Central & State Employees for the Financial Year 2017-18 & Assessment Year 2018-19 as per the Finance Budget 2017 [ This Excel Utility have all the amended tax section and new tax slab]

1) This Excel Utility can prepare at a time Tax Compute Sheet + Individual Salary Structure as per Central & State Salary Pattern + Calculate Automatic House Rent Exemption Calculation U/s 10(13A) + Automatic Form 16 Part A&B and Form 16 Part B for F.Y.2017-18)

2) Automatic Convert the amount into the In-Words.

3) All Amended Income Tax Section have in this Utility.

4) Income Tax Slab Rate have in this Utility as per Finance Budget 2017-18,

In his Budget 2017 speech, Finance Minister Arun Jaitley proposed to reduce the existing rate of taxation of those with income between Rs 2.5 lakh to Rs 5 lakh from 10 per cent to 5 per cent.

According to the new figure, a person with a taxable income (after deductions such as Section 80C etc) of Rs 3.5 lakh will pay a tax of Rs 2575 as against Rs 5150, which was paid earlier. Also, persons with taxable income of over Rs 5 lakh to Rs 50 lakh will have to pay Rs 12875, which also included the cess saved.

However, those who are earning over Rs 50 lakh to Rs 1 crore will be paying a flat surcharge of 10 per cent on the total tax payable by them. For example, if a person is earning Rs 60 lakh annually he/she has to pay Rs 1,45,204 additional tax due to the surcharge.

Those who have an income of over Rs 1 crore would continue to pay the surcharge of 15 per cent but would get the meager benefit of saving Rs 12,875 (including saving of chess but excluding the saving on surcharge). For example, if a person has a gross income of Rs 1.2 crore will pay Rs 29,65,706 as taxes including surcharge and cess against Rs 39,80,512, which was payable earlier.

Income Tax Slab & Rate as per Union Budget 2017 for the Financial Year 2017-18 & Assessment Year 2018-19

Income Slab | Tax Rate |

Income up to Rs 2,50,000 | Nil |

Income up to Rs 2,50,000/- to Rs 5 lakh | 5 per cent |

Income up to Rs 5 lakh to Rs 10 lakh | 20 per cent |

Income more than Rs 10 lakh | 30 per cent |

Income more than Rs 50 lakh | 30 per cent + 10 per cent surcharge |

Income more than Rs 1 crore | 30 per cent + 15 per cent surcharge |

0 Comments