Income tax act provides the scope of claiming the deduction from gross total income. Income earned by an individual under different heads like salary, business or profession is clubbed together to calculate the gross total income. Then eligible deductions are claimed and tax is calculated on the balance income. Here we shall discuss deductions allowed for the assessment year 2018-2019 under chapter VI-A of IT Act, which includes section 80C to 80U.

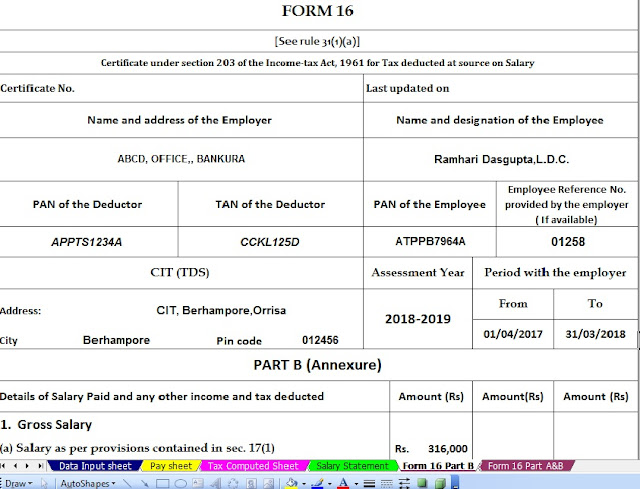

Click to Download Automated Master of Form 16 Part A&B for F.Y. 2016-17 and A.Y.2017-18[This Excel Based Utility can prepare at a time 100 employees Form 16 Part A&B for F.Y.2016-17]

Click to Download Automated Master of Form 16 Part B for F.Y. 2016-17 and A.Y.2017-18[ This Excel Based Utility can prepare at a time 100 employees Form 16 Part A&B for F.Y.2016-17]

Section 80C

The individual taxpayer can claim deduction up to Rs. 1,50,000/- under section 80C of Income Tax Act.

1) Tuition fees towards full-time education of children,

2) Principal amount of home loan repaid during the financial year,

3) Amount paid towards stamp duty and registration of the house purchased during the year is eligible for claiming the deduction.

4) Apart from this taxpayer can also claim deduction in respect of contribution towards employee provident fund or public provident fund,

5) Subscription to Equity Linked Saving Scheme,

6) NSC, Senior Citizen Saving Scheme,

8) Life insurance premium paid subject to qualifying limit.

Section 80CCD

An individual contributing an amount in National Pension System (NPS) is eligible for claiming deduction under section 80CCD(1).

The aggregate amount of deduction under sections 80C, 80CCC and 80CCD(1) shall not exceed Rs.1,50,000/- (Section 80CCE).

In budget 2015 a new sub-section (1B) has been inserted so as to provide for an additional deduction in respect of any amount paid, of up to Rs. 50,000 for contributions made by any individual assessee under the NPS.

Section 80D

Deduction up to Rs. 25,000 is allowed in respect of premium paid to buy or to keep a health insurance policy in force for self, spouse and dependent children. Additional deduction of Rs. 25000 is allowed in respect of the premium paid for health insurance policy of parents.

The limit is Rs. 30000 for senior citizens. Expenses up to Rs. 5,000 towards preventive health checkup can also be included within the prescribed limit under section 80D.

People aged above 80 and not covered by health insurance are allowed deduction of 30,000 rupees for medical expenses.

Section 80DD

Those who have a dependent with a disability can claim a deduction in respect of their maintenance including medical treatment under section 80DD of the Income Tax Act.

The deduction allowed is Rs. 75,000 if the disabled dependent is not suffering from severe disability.

The deduction allowed is Rs. 1,25,000 if the disabled dependent is a person with severe disability. A person with a disability means a person suffering from not less than 40% of any of the disabilities as defined in the act. Severe disability means 80% or more of one or more of the disabilities.

Section 80DDB

Deductions of expenses on medical treatment of specified ailments (such as AIDS, cancer and neurological diseases) can be claimed under Section 80DDB.

The maximum amount of deduction allowed from gross total income is restricted to Rs 40,000 on condition that no medical reimbursement is received from any insurance company or employer for this amount. In the case of reimbursement, the deduction will be allowed for the amount over and above the amount received from an insurer or an employer.

The deduction in respect of a senior citizen is allowable up to sixty thousand rupees and in respect to a Super senior citizen, a deduction up to eighty thousand rupees would be allowed.

Section 80E

The deduction can be claimed for interest paid on loan taken for pursuing higher education by the assessee himself or for the purpose of higher education of his relative.

You can deduct the entire interest amount from your taxable income without any cap, however, there is no benefit available on the repayment of principal amount of the loan.

Parents are also eligible to claim a deduction of interest paid by them on loan taken for their children’s education. Higher education would mean any course of study pursued after passing the Senior Secondary Examination or its equivalent from any school, board or university recognised by the government. The tax benefits on education loan are only valid once you start the repayment and moreover they are only available up to eight years. For instance, if your loan tenure exceeds eight years, you cannot claim for deductions beyond eight years.

Section 80G

Donations paid to specified institutions qualify for tax deduction under section 80G but is subject to certain ceiling limits.

For claiming deduction under Section 80G, a receipt issued by the recipient trust must contain the name, address & PAN of the Trust, the name of the donor and the amount donated.

Donation may be eligible to 100% deduction or 50% subject to qualifying or without qualifying limit. No deduction is allowable if the donation in excess of Rs. 10,000 paid in cash.

Section 80 TTA

Deduction U/S 80TTA is applicable to individual taxpayers and HUF only. Interest earned up to Rs. 10,000 from saving bank accounts is allowed to deduct from gross total income. This deduction is not applicable to the interest you received on your fixed deposit

Section 80U

An assessee who is suffering from any disability, not less than 40% is eligible for the deduction to the extent of Rs. 75,000/- and in the case of severe disability allowable deduction is Rs. 1,25,000.

Section 87A:- Tax Rebate Rs. 5000/- who’s taxable Income below Rs.5 Lakhs.

0 Comments