Which are the simplest Tax Saving choices for 2018-19? What are the simplest Tax Saving choices for Salaried for 2018-19? Financial Year 2018-19 already started. However, several folks sadly rise at the top to appear for best tax saving choices. Instead, it's invariably best to start out tax designing for the primary day of the monetary year. Hence, allow us to check out the choices out there.

Tax designing or Tax Saving isn't a nasty conception. however, the unhealthy conception is to take a position only for SAVING TAX. Instead, you have got to 1st determine your monetary goals. supported the time horizon of the goal, do the quality allocation between debt and equity. at intervals debt or equity, whereas finally finance, you'll opt for the merchandise that conjointly offers you Associate in the Nursing choice to save tax.

However, several of doing the reverse. we tend to bushed the asleep mode for the entire year. we tend to rise throughout the monetary year-end. during a hurry to avoid wasting tax, we tend to invest in an unhealthy product that in no manner might facilitate the USA to achieve our monetary goals.

Download & Prepare at a time 50 employees Form 16 Part B for the Financial Year 2018-19 [ This Excel Utility can prepare at a time 50 employees Form 16 Part B for F.Y.2018-19 as per the new amended Standards Deduction Rs.40,000/- for F.Y.2018-19 ]

Tax designing or Tax Saving should begin from the primary day of the monetary year. this may provide you with the advantage to arrange well and save tax.

What is the distinction between Exemption and deduction?

If Associate in Nursing financial gain is exempt from tax, then it's not enclosed within the computation of financial gain. However, the deduction is given from financial gain guilty to tax. Exempt financial gain can ne'er exceed the quantity of financial gain. However, the deduct is also but or up to or over the quantity of financial gain.

Allowances out there to avoid wasting tax for 2018-19

# customary Deduction of Rs.40,000

Actually, I even have to place this beneath Deductions. However, this customary deduction replaced the prevailing allowances. Hence, I placed it here for higher understanding.

Earlier you wont to claim Rs.15,000 beneath Medical Allowance and allowance. However, with impact from FY 2018-19, you'll be able to claim the direct Rs.40,000 deduction rather than these 2 allowances.

This deduction clearly for salaried and pensioners. this is often regardless of the quantity of dutiable wage you'll be receiving to urge a deduction of Rs.40,000 or dutiable wage, whichever is a smaller amount.

Hence, allow us to assume for FY 2018-19, you worked just for a few days. Your wage is dutiable wage is Rs.50,000. In such a situation, you'll be able to directly claim the deduction of Rs.40,000. However, if your wage is a smaller amount than Rs.40,000 (say Rs.20,000), then you have got to say solely Rs.20,000 however not Rs.40,000.

# Mobile/Telephone compensation

If your leader providing you the mobile/telephone association or web association which needs for work, then you'll be able to claim 100 percent of such price. However, you have got to provide the bill. solely the paid connections are allowed for compensation.

# Leave allowance

The bills for your travel against LTA will be claimed for exemption. it's allowed to be claimed doubly during a block of 4 years. this block is 2014 to 2017. you'll be able to shift your unwanted LTA to successive year. you'll be able to request your leader to not deduct tax thereon and permit you to say it next year.

# diversion Allowances

You may be obtaining this allowance. However, the exemption is offered just for Government workers. the quantity of exemption is least of the subsequent.

a) Rs 5,000

b) 1/5th of wage (excluding any allowance, advantages or different perquisites)

c) Actual diversion allowance received

# House Rent Allowance (HRA)

This is the notable exemption that is employed by several salaried people. However, the incorrect belief is that regardless of the rent they pay is really exempted from their financial gain. the fact is completely different. the quantity of exemption is least of the subsequent.

a) Actual HRA Received

b) four-hundredth of wage (50%, if house placed in Bombay, Calcutta, urban center or Madras)

c) Rent paid minus 100 percent of wage

(Salary= Basic + public prosecutor (if a part of retirement benefit) + Turnover primarily based Commission)

Download Automated H.R.A. Exemption Calculator U/s 10(13A)

Download Automated H.R.A. Exemption Calculator U/s 10(13A)

# kids Education Allowance

If your leader providing this allowance, then you'll be able to take exemption up to Rs.100 per month per kid (maximum of up to two children). Therefore, monthly you'll be able to save Rs.200 from this allowance. The exemption might look therefore low. however why to pay the tax?

# Hostel Expenditure Allowance-If your leader providing this allowance, then you'll be able to take exemption Up to Rs. three hundred per month per kid up to a most of two kids is exempt. Therefore, you'll be able to save around most of Rs.600 from this allowance.

# Conveyance Allowance

This is the various allowance than transport allowance. it's the expenditure granted to Associate in a Nursing worker to fulfill the expenses on conveyance inactivity of his workplace duties. there's no limit for this. If such conveyance allowance is Rs.5,000 a month, then the whole allowance is exempt. Hence, you'll this might be exempt to the extent of expenditure incurred for official functions.

# Any Allowance to fulfill the price of travel or on transfer

Here conjointly no limit. the worker will claim exempt to the extent of the expenditure incurred for official functions.

# Allowance to fulfill the price of travel or on transfer

Here conjointly no limit. the worker will claim exempt to the extent of the expenditure incurred for official functions.

# Daily Allowance

If you're not placed in traditional duty place, then your leader might give you such allowance. the worker will claim exempt to the extent of the expenditure incurred for official functions.

These are the main allowances, which might be utilised to avoid wasting tax on wage financial gain. There are few different allowances conjointly to say the exemption. however several of such allowances aren't therefore notable. Hence, I left them to list.

Best Tax Saving choices for 2018-19

Now allow us to discuss the deductions out there for 2018-19. exploitation these deductions you'll be able to save the tax.

# Section 80C

This is the notable section which regularly employed by all of salaried. the most limit for this year is Rs.1,50,000. Therefore, up to Rs.1,50,000, you'll be able to save tax on wage financial gain from this section alone. the various investments you are doing and might even be claimed beneath Sec.80C are listed below.

• Life payment (Paid by a private, spouse, and child. within the case of HUF, on the lifetime of any member of HUF).

• The app-employee contribution will be claimed for deduction.

• Public Provident Fund (Paid by a private, spouse, and child. within the case of HUF, on the lifetime of any member of HUF).

• National Savings Certificate (NSC).

• Sukanya Samriddhi Account

• ELSS or Tax Saving Mutual Funds.

• Senior subject Savings theme.

• 5-Years Post workplace or Bank Deposits.

• The tuition fee for children.

• Principal payment towards home equity loan.

• Stamp duty and registration price of the house.

# Sec.80CCC

Deduction beneath Sec.80CCC is offered just for people. Contribution to Associate in Nursing rente arranges of the LIC of India or the other insurance firm for receiving the pension. Do keep in mind that the quantity ought to be paid or deposited out of financial gain guilty to tax.

The maximum quantity deductible beneath Sec.80CCC is Rs.1.5 lakh. Do keep in mind that this is often conjointly the part of the combined limit of Rs.1.5 hundred thousand out there beneath Sec.80C, Sec.80CCC, and Sec.80CCD(1).

80C image

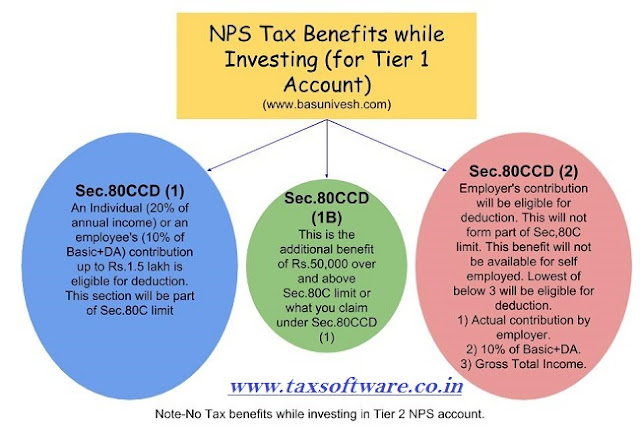

# Sec.80CCD1

• The most profit out there is Rs.1.5 hundred thousand (including Sec.80C limit).

• An individual’s most two-hundred of annual financial gain (Earlier it had been 100 percent however once Budget 2017, it enlarged to 20%) or Associate in Nursing workers (10% of Basic+DA) contribution are going to be eligible for deduction.

• As I aforesaid higher than, this section can type the part of Sec.80C limit.

# Sec.80CCD2

• There may be a thought among many who there's no higher limit for this section. However, the limit is least of three conditions. 1) quantity contributed by Associate in Nursing leader, 2) 100 percent of Basic+DA and 3) Gross Total financial gain.

• This is extra deduction which is able to not type the part of Sec.80C limit.

• The deduction beneath this section won't be eligible for freelance.

NPS Tax advantages beneath Sec.80CCD (1B)

• This is that the extra deduction of up to Rs.50,000 eligible for tax deduction and was introduced within the Budget 2015

• Introduced in Budget 2015. One will avail the good thing about this Sect.80CCD (1B) from FY 2015-16.

• Both freelance and workers are eligible for availing this deduction.

• This is over and higher than Sec.80CCD (1).

Explained all 3 sections of NPS (Sec.80CCD1, Sec.80CCD2 and Sec.80CCD(1B) in below image for your reference.

0 Comments