Tax Benefit on NPS Tier one and/or 2?

NPS has 2 Tiers – one and a couple of.

NPS Tier one is that the future investment, that has restricted withdrawals and meant primarily for retirement designing. On maturity, you'll be able to withdraw most of the hour of the corpus as a lump sum and rest has got to be used for rente purchase.

NPS Tier a pair of is for managing short to medium term investment. you'll be able to invest and withdraw anytime as per your want. this is often AN optional feature and you're asked if you wish Tier a pair of account whereas gap NPS.

All the tax break associated with NPS is obtainable to investment in NPS Tier one account solely.

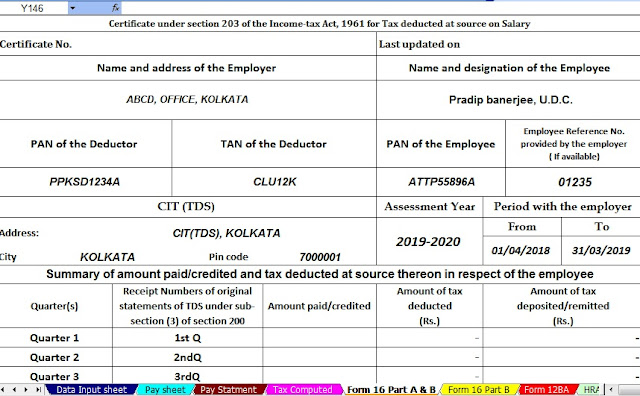

Download automatic Income Tax Preparation Excel Based software All in One for only Non-Govt Employees for F.Y. 2018-19 [ This Excel Utility can prepare at a time Income Tax Computed Sheet + Automated Salary Sheet + Automated H.R.A. Exemption Calculation U/s 10(13A) + Automated For 12 BA + Automated Income Tax Form 16 Part A&B and Form 16 Part B for F.Y.2018-19 ]

NPS Tax Benefits:

NPS tax advantages are on the market through three sections – 80CCD(1), 80CCD(2) and 80CCD(1B). we tend to discuss every below:

1. Section 80CCD(1)

Employee contribution up to 100 percent of basic regular payment and costliness allowance (DA) up to one.5 hundred thousand is eligible for deduction. [This contribution in conjunction with Sec 80C has one.5 hundred thousand investment limit for tax deduction]. Self-utilized can even claim this tax break. but the limit is 100 percent of their annual financial gain up to most of Rs one.5 Lakhs.

2. Section 80CCD(1B)

Additional exemption up to Rs 50,000 in NPS is eligible for tax deduction. This was introduced in Budget 2015.

3. Section 80CCD(2)

Employer’s contribution up to 100 percent of basic and DA is eligible for deduction below this section higher than the Rs one.5 hundred thousand limits in Sec 80CCD(1). this {can be} conjointly helpful for leader because it can claim the tax break for its contribution by showing it as an expense within the profit and loss account. Self-utilized cannot claim this tax break.

Below is that the illustration on however introducing NPS will assist you to save tax below Section 80CCD(2).

Tax Benefit for Compulsory NPS deduction:

The earlier pension structure was replaced by NPS in most central and state government jobs since 2004. So anyone who joined after that has a compulsory deduction for NPS. The deduction is 10% of basic salary and dearness allowance (DA) and the employer to contributes the matching amount. The confusion for most employees is how they take tax benefit on their compulsory NPS deduction?

Here is an example:

Mr.A is a government employee and his employer deducts Rs 62,000 per annum (which is 10% of basic + DA) from salary as employee’s contribution in NPS. It also deposits Rs 62,000 per annum as employer’s contribution in NPS. How and under which section should he claim tax benefit on NPS?

Download: Automated Income Tax Form 16 Part A&B and Part B for F.Y.2018-19 ( One by One Preparation Form 16 Part A&B and Part B for FY 2018-19)

Let’s take the easy part first. Employee’s contribution in NPS would be eligible for tax deduction u/s 80CCD(1).

The employee has a choice as to which section [80CCD(1) or 80CCD(1B)] he wants to show his contribution. Ideally he should show Rs 50,000 investment in NPS u/s 80CCD(1B). The tax deduction on rest Rs 12,000 can be claimed u/s 80CCD(1). The section 80CCD(1) along with Section 80C has investment limit eligible for tax deduction as Rs 1.5 lakhs. So he should make an additional investment of Rs 1,38,000 in Section 80C to save maximum tax. In all, he can save Rs 2 lakhs tax u/s 80C and 80CCD(1B).

0 Comments