The basic principles of taxation are nearly as old as the human society—the history of taxes stretches thousands of years into the past. Several ancient civilizations, including the Greeks and Romans, levied taxes on their citizens to pay for military expenses and other public services. Taxation evolved significantly as empires expanded and civilizations become more structured.

Tax saving process or the inclination to evade taxes also had the same history, that may the reason Jesus said, “Give to Caesar what is Caesar’s, and to God what is God’s”. Our governments also recognized the payments to God or to the contribution to his works and allowed tax benefit on such payment under section 80G!!. So, let us start planning our taxation from the beginning of the financial year and check the due amounts.

Many of us start thinking about tax-saving plans only at the end of the financial year and often end up investing in the wrong products. Tax planning at the beginning of the financial year will help you avoid making hasty decisions at the end of the year.

As a primary step, assess your taxable income for the financial year and understand and plan the various options to save taxes. This will help you to plan your taxes effectively, manage your cash flow throughout the year and build your assets wisely, or to avoid excess investments for tax saving purpose.

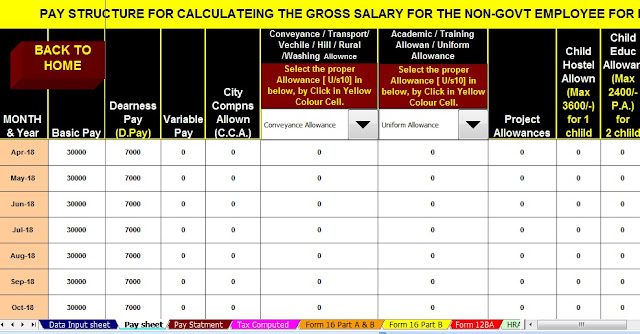

Download Automated All in One TDS on Salary for the Non-Govt Employees( Private) for the Financial Year 2018-19

Salient features of the Tax calculator.

1. Useful for the salaried employees of government and private sector, with all heads of Income including agricultural income.

2. Private sector employees can use to do their Flexi allocation and tax planning.

3. Tax and rebate calculation of agriculture income, to arrive the annual tax liability.

4. Marginal relief on surcharges where income crosses 50L and 1Cr.

5. Individual Form 16 Part B generation, useful for the small size firms.

6. Automated HRA exemption/Sec 80GG deduction calculation based on the salary and rent payments.

7. Validate and highlights the limits Chapter VI A deduction, Housing loan interest set off, and surcharge impacts.

Following are the changes in the tax rules from 2018-19, which is impacting the tax computation of the salaried employees.

1. Standard Deduction from taxable salary. Salaried individuals will get a standard deduction of Rs.40,000/- on income in place of the present exemption allowed for transport allowance and medical expenses.

2. Cessation of tax benefit on Conveyance Allowance and Medical reimbursements. The tax benefit on conveyance allowance Rs.19,200/- pa and medical reimbursement bills Rs.15,000 pa, will no longer be valid.

3. Cess on the Income Tax has been increased to from 3% to 4%

4. Deduction towards Medical Insurance for Dependents who are Senior citizens increased from Rs. 30,000/- to Rs.50,000/-

0 Comments