Section 80GG is one among known sections which may be utilized by taxpayers to reduce their tax burden by means of claiming tax exemption for lease paid (in case HRA is not part of earnings). this Section may be used by being both salaried/pensioner or self-hired taxpayers

Conditions for claiming tax advantage u/s.80gg for rent paid

You can claim a tax deduction on hire paid U/s 80gg on the time of filing tax go back best if the following conditions are satisfied:

The deduction is to be had most effective for individuals & HUFs

For a salaried individual to be eligible for tax advantage U/s 80GG, he should now not acquire HRA from his Employer.

Pensioners or self-rent do not have any H.R.A. and on the way to take benefit of 80gg

No person in the circle of relatives together with a partner, minor children, self or HUF he is the member of must very own a residence inside the metropolis you're Rented or carrying your commercial enterprise.

If you own a house in a different town, you cannot show it as self-occupied. you need to recollect it as deemed to let loose – i.e. – you've got to reveal apartment earnings whether or not it’s truly placed on hire.

Moreover, you need to fill shape no 10BA to assert tax advantage U/s 80GG. this form is not to be submitted anywhere however saved with you for statistics to reveal to i-t branch in case of scrutiny.

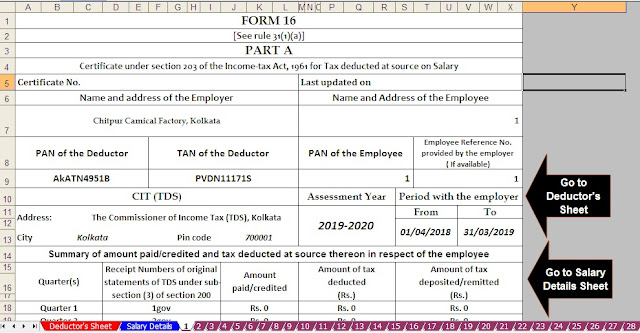

Download and Prepared at a time 100 Employees Form 16 Part B for the Financial Year 2018-19

The deduction allowed U/s 80GG:

The house rent deduction is minimal of the beneath 3 numbers:

1. Rs. 5,000 in keeping with month [increased from Rs 2,000 to Rs 5,000 in Budget 2016]

2. 25% of annual earnings

3. (rent paid – 10% of annual income)

Right here annual income refers to

Gross total earnings

minus

The longtime capital benefit,

Short time period capital benefit of 10% category,

Deductions underneath sections 80c to 80u except for section 80gg and income of a foreign organization

Free Download and Prepare at a time 50 Employees Form 16 Part B for the F.Y. 2018-19

How to Calculation H.R.A. Exemption U/s 80GG

Expect that Mr.A has an annual income of Rs 5 lakhs and he pays rent of Rs 10,000 consistent with a month. here is his tax benefit for lease paid.

1. Rs. 5,000 per month – Rs 60,000

2. 25% of annual earnings –Rs. 1,25,000

3. (Rent paid – 10% of annual income) – Rs 70,000 (1,20,000 – 50,000)

the tax deduction would be minimum of above 3 numbers = Rs 60,000

80gg in earnings tax go back shape

Tax exemption under segment 80gg is part of chapter VI-A and needs to be filled as you do for section 80c in the ITR paperwork.

Free Download Automated One by One Income tax Form 16 Part A&B and Part B for F.Y. 2018-19

Can HRA and 80GG tax gain be claimed together?

If you were salaried receiving HRA for a few parts of the economic year but paid hire for the entire year, you can declare benefit underneath both HRA & U/S 80gg. for the period you acquired HRA, you must claim tax gain on that through your Employer. For rest of the months, you'll get tax benefit U/s.80GG.

0 Comments