The new corrections are in accordance with the adjustments in personal expense rules and new ITR frames as of late informed by CBDT for AY 2019-20

• The changes will come into power from 12 May 2019 and all businesses issuing Form 16 after that the date should stick to the new principles

In one more endeavor to expand straightforwardness and limit tax avoidance, the Central Board of Direct Taxes (CBDT) has told different changes in the configurations of Form 16. The new revisions are in accordance with the adjustments in annual expense rules and new personal government form (ITR) frames as of late informed by CBDT for appraisal year (AY) 2019-20.

Structure 16: It is a declaration issued by a business to its workers for each monetary year, under Section 203 of the Income-charge Act, 1961. It has two segments—section An and B.

Download Automated Income Tax Form 16 Part B in the new format of Form 16 Part B for the F.Y. 2018-19 [ This Excel Utility can prepare at a time 50 Employees Form 16 Part B ]

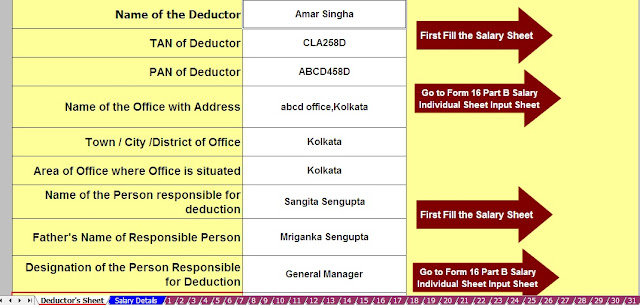

Section A contains the worker's close to home subtleties, for example, name and address, the business' name and address, the Permanent Account Numbers (PAN) of both and the business' Tax Deduction Account Number (TAN). It likewise contains subtleties of the time of work with your present manager and subtleties of duty deducted at source (TDS) on your salary.

Part B has subtleties of salary earned amid your work with the business, complete findings and assessable pay. This part additionally gives subtleties of the assessment payable or refundable.

Starting at now, Form 16 contains the total measure of pay and find, however, will presently need to incorporate subtleties of pay parts and reasonings. "The sort and measure of remittances which have been professed to be excluded should now be accounted for independently in Form 16. For instance, house lease recompense, leave voyaging remittance and other absolved segments should be accounted for as a different detail

The progressions will come into power from 12 May 2019 and all businesses issuing Form 16 after that date should hold fast to the new guidelines. The last date to issue Form 16 is 15 June of every evaluation year.

0 Comments