Tax Sections Description Maximum Tax Exemption Limit (Rs.)180C/ 80CCC/ 80CCD Investment in EPF, ELSS, PPF, FD, NPS, NSC, Pension Plans, Life Insurance, SCSS, SSA and NPS. Also includes Home Loan Principal repayment, Tuition Fees, Stamp Duty.

Best Tax Saving Investments u/s 80C 150,000/-

80CCD(1B)Investment in NPS : Additional deduction Rs. 50,000/- out of U/s 80C

You can requirement requirement Tax Benefit on both HRA & Home Loan

80E Interest paid on Education Loan. No Limit – Rs 50,000 is just an unsupportable value

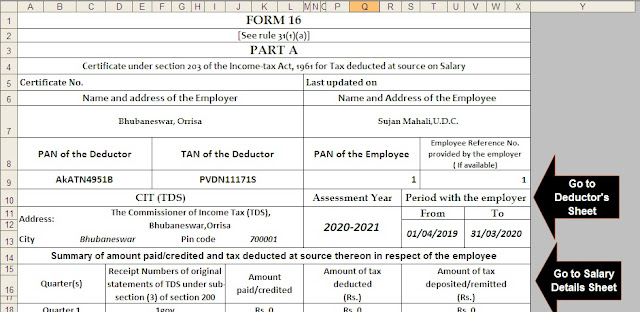

Download All in One TDS on Salary for Govt & Non-Govt Employees for the F.Y. 2019-20With H.R.A. Exemption Calculation U/s 10(13A) + Automated Arrears ReliefCalculator U/s 89(1) with Form 10E + Automated Revised Form 16 Part B and Form16 Part A&B for F.Y. 2019-20

The feature of this Excel Utility is the following:-

1) This Excel Utility can prepare automatic Tax Calculation as per new Finance Budget 2019

2) The Salary Structure as per the Govt and All of Non-Govt(Private) employee’s Salary Pattern

3) Automated Individually Salary Sheet for each Employee

4) Automated Income Tax Salary Sheet for each Employee

5) This Excel Utility calculate your House Rent Exemption Calculation U/s 10(13A)

6) Automated Income Tax Revised Form 16 Part A&B for F.Y. 2019-20 in New Format

7) Automated Income Tax Revised Form 16 Part B for the F.Y. 2019-20 in New Format

8) Automated Arrears Relief Calculator U/s 89(1) with Form 10E from the F.Y. 2000-01 to F.Y. 2019-20

Tax Benefit on Education Loan (Sec 80E)

50,000/-

80D Premium payment for medical insurance for self and parents. Includes Rs 5,000 limit for preventive health checkup

Making Sense of Tax Benefit on Health Insurance u/s 80D

60,000/-

Download All in One TDS on Salary for Non-Govt Employees for the F.Y. 2019-20 With H.R.A. Exemption Calculation U/s 10(13A) +Automated Form 12 BA for F.Y. 2019-20+ Automated Revised Form 16 Part B andForm 16 Part A&B for F.Y. 2019-20

The feature of this Excel Utility is the following:-

1) This Excel Utility can prepare automatic Tax Calculation as per new Finance Budget 2019

2) The Salary Structure as per the All of Non-Govt(Private) employee’s Salary Pattern

3) Automated Individually Salary Sheet for each Employee

4) Automated Income Tax Salary Sheet for each Employee

5) This Excel Utility calculate your House Rent Exemption Calculation U/s 10(13A)

6) Automated Income Tax Revised Form 16 Part A&B for F.Y. 2019-20 in New Format

7) Automated Income Tax Revised Form 16 Part B for the F.Y. 2019-20 in New Format

8) Automated Value of Perquisite Calculator with Form 12 BA

80DDB Treatment of Serious illness for self and dependents for Senior Citizens Rs 40,000 for others)80,000

80U Physically Disabled Tax payer (Rs 75,000 for 40% to 80% powerlessness and Rs 1,25,000 for increasingly than 80%)125,0000

80DDPhysically Disabled Dependent (Rs 75,000 for 40% to 80% powerlessness and Rs 1,25,000 for increasingly than 80%)125,000

80GDonation to tried charitable funds like Prime Minister Relief fund, etc (assumed value)50,000/-

80GGA Donations for scientific research or rural minutiae (assumed value)50,000/-

80GGC Donations to political parties (assumed value)50,000/-

80TTA interest received in Savings Account deduction from the Bank Savings Interest Rs. 40000/-

Maximum Limit Requirement Tax Benefit for Rent Paid u/s 80GG?

60,000/- (Who are not get House Rent Allowances from their employer)

0 Comments