In the Budget 2020 has introduced a simple personal tax system to reduce the tendency of income tax income of individuals. This new regime provides an option for individuals to pay taxes at a reduced rate subject to certain discounts and rebates.

The following is a quick comparison of tax rates.

As the new financial year begins, many individual taxpayers are in the process of analyzing whether they will continue to pay taxes under the existing old regime or opt for a simplified personal tax system. Individuals can consider the following to decide which system will work best for them. Under simplification, it is not possible to claim specific exemptions and rebates. There are discounts and rebates widely used by the people listed below and which will not be available under the new tax regime.

In addition to the above for the tax regime. The loss under the heading ‘Income from House Property’ (probably due to interest from a home property) cannot be set against the income under the other head, but it appears to have been set up.

For those who have business income, deductions, investments in new plants and equipment, tea, coffee, rubber development, certain businesses, agricultural extension projects and scientific research expenses cannot be taken under the new tax system. Application of this option for persons who do not have business / professional income during the year.

Although this option can be used by individuals when filing returns, it was not clear until recently whether they could decide on new measures for employers to deduct taxes. The lack of activation of amendments to the tax exemption provisions in the Finance Act 2020 has created confusion among employers as to whether they can apply the new tax system at the time of tax exemption.

Subsequently, the Central Board of Direct Taxes (CBDT) issued a clarification on April 13, 2020, to avoid inconvenience to individual the taxpayers wishing to adopt the new tax option.

According to the specification, an employer can apply the tax at the rates fixed under the new tax rate while withholding tax from the salary. However, the employer must be notified if the employee chooses to opt for the new rules.

If no investigation is arranged, the employer will be able to withhold the tax under the old system. In addition, the employee may notify the employer only once per financial year and the information may be provided at any time during the financial year.

For people with business / professional income: People with business income can use this option before the due date for filing the tax return. If a person with a business / professional income prays for a new tax, he will have to continue with the new government for all his subsequent years. He can withdraw the used option and return to the old regime only once. Once withdrawn, he will be ineligible to use the new government option for any future year, unless his business / professional income ceases. Can employees change the regime while filing tax returns?

It can happen that the person can opt for the new year and notify the employer at the beginning of the financial year. However, as the year went on he realized that the old regime could work better for him because of the projected income and discounts/discounts. In such cases, it is not necessary for the employee to continue with the elected and declared regime with his employer.

According to the provisions of the law, he has the right to change his option while filing the income tax return. Things to keep in mind when choosing a government The individual taxpayer needs to make an informed decision about whether to choose the new personal tax condition, as it can help in tax optimization. In addition, although it is possible to change from one scheme to another at the time of filing the tax return, it may happen that the additional taxes are deposited by the employer as the government-appointed at the beginning of the financial year.

These additional taxes have to be claimed as refunds from the tax authorities which can lead to cash flow problems for the individual. Although the individual will be aware of his or her salary income, the following factors should be considered for the administration to administer fairness: - Income other than salary income (e.g., interest income, dividend / mutual fund income, etc.) – Unexpected increase in the year and bonus money year with being acceptable for-expectations for the fiscal year-for estimating the appropriate home rent allowance in the case of rent payable for the year

The year in which he expects the travel plan to claim a leave travel allowance is a welcome amendment to simplify the new tax system.

However, thoughtful analysis is required to select the appropriate measures for the individual.

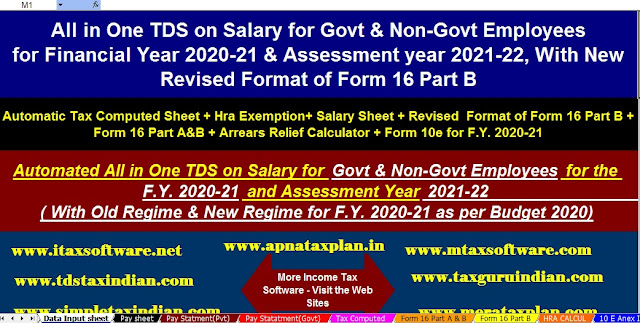

Feature of this Excel Utility:-

1) Automated calculate your Tax in Tax Computed Sheet as per the New Section 115BAC ( New Tax and Old Tax Regime)

2) This Excel Utility can prepare at a time your Tax Computed Sheet

3) Automatic Income Tax House Rent Exemption Calculation U/s 10(13A)

4) Automated Income Tax Revised Form 16 Part A&B and Form 16 Part B

5) This Excel Utility can prepare Automated Income Tax Arrears Relief Calculation U/s 89(1) With Form 10E from the F.Y.2000-01 to the F.Y.2020-21( Updated Version)

6) Easy to install and easy to generate, just like as an Excel File.

7) All in the amended Income Tax Section have in this Excel Utility as per Budget of 2020.

0 Comments