The tax season is here and I started getting emails and comments asking “best tax-saving investments”. Unfortunately, there is no direct answer to this. The best investments are different for different people and combine with their return expectations, risk-taking ability, personal situation and alignment with their financial goals in other matters.

You can invest up to Rs 1.5 lakh in instalments (including section 60cc, 80cc) by investing in qualified materials. Unfortunately, the approved U / S80C in terms of investments and expenses is too crowded and makes it difficult for most people to choose.

Your investment/expense list is suitable for U / s 80C deductions.

1.Provident Fund (EPF / VPF)

2. Public Provident Fund (PPF)

3. Sukanya Samridhi Account (SSA)

4. Certificate of National Conservation (NSC)

5. Senior Citizens Protection Scheme (SCSS)

Tax. Fixed tax deposit (for 5 years)

7. Life Insurance Premium

8. Pension plans from mutual funds

9. Pension plan from the insurance company

10. New Pension Scheme (NPS)

11) Tax Protection Mutual Fund (ELSS)

12. Central Government Employees Pension Scheme

13. Main payment for home on

14. Tuition fees for 2 children

15. Stamp duty for home registration

The first step is to check all the expenses that are suitable for tax exemption. Below is the list:

The tuition fee for 1 to 2 children

Expenses for full-time course tuition fees for up to two children are suitable for you 80 / sec discount. However, there is no discount for tuition fees in coaching classes or private tuition. The following expenses are not considered as tuition fees - development fees, transport charges, hostel charges, mess charges, library fees, late fines, etc.

2. Stamp duty for new home registration

Stamp duty and registration charge up to Rs 1.5 can be claimed for U / s 80C discount. The money for which the tax is being paid should have been paid in the same financial year. That means the cut cannot be extended next year. The house should also be in the name of a discount to demand to price.

If you pay stamp duty for a new home, you will probably carry your 80C limit for the year and no further investment is required.

There are some mandatory exemptions which are eligible for the tax benefit of Section 80

C. Check if you have contributed to any of these discounts:

1. Provident Fund (EPF / VPF)

EPF is a mandatory discount for most salaried employees. The basic salary and increment allowance of this discount can be 12% or Rs. 1,800 per month. See your salary statement for how much you have contributed for the year. Only count your contributions. The employer's contribution to tax-saving investments is not eligible. You can also have a contribution through the Voluntary Provident Fund (VPF) which can be up to 100% of the initial salary and DA.

2. National Pension Scheme (NPS)

NPS (Tier 1) is mandatory for most government employees who join after 2004. Check your payslip to check your discount. Again only your contribution is a valid discount. The employer's contribution is not eligible. The good news is that you can use this contribution to claim an additional tax deduction of up to Rs 50,000 under the newly introduced Section 80CCD (1B). We explained this in the last paragraph of the post.

1. The main amount of home loan

Are you paying home? The principal component paid each year is tax-deductible. For this, you can download tax returns from the bank's website. If you do not receive it from the supplier. This will give you an estimate of the principal and interest paid for the financial year.

2. Insurance premium

Have you purchased life insurance products like ULIPs, endowment plans or term insurance where you have to pay premiums for years to come? If you want to continue investing in the same way, you can continue to claim tax benefits.

3. PPF (Public Provident Fund)

If you have a PPF account, you should contribute a minimum of Rs.500 in a financial year. If you don't, you will be fined.

4. Sukanya Samridhi Account (SSA)

You have to keep a minimum deposit every year otherwise you will be fined Rs 50.

5. NPS

Do you have an NPS account? A minimum contribution of one thousand rupees per financial year is required to keep the account active.

New investment for 80C

1. Term life insurance

Are you dependent? Will they survive financially if something happens to you? Do you have adequate life insurance? If not, get term insurance first. It is important to choose security first.

Useful advice:

Term Online Term plans are much cheaper than offline. So it is wise to go for online plans.

Insurance Do not provide incorrect information in the insurance form. Insurance claims may be rejected for incorrect information.

Don't buy anything other than the term plan of the insurance companies. No refunds, endowment plans!

2. ELSS (Equity Linked Savings Scheme)

Tax savings are popular as mutual funds. These are equity-based mutual funds and one of the best investment options for creating long-term wealth while saving taxes. If you can digest the volatility of the stock market, this is the recommended option.

Lock-in period: 3 years

Good:

In Saving Tax Savings Investments, ELSS has a lock-in period of at least 3 years.

ELSS Fund Benefits Tax-Free

Convenient to buy and operate as EELSS can be purchased and redeemed online.

Bad:

Returns can cause considerable volatility and you may receive a negative return at the end of 3 years.

3. PPF (Public Provident Fund)

Another popular tax-saving investment option for PPF under section 80C, especially for any other future fund people

Lock-in period: 15 years. However, partial withdrawal is allowed from the 7th year

Good:

The interest earned on PPF is tax-free

PPF can be invested online every year after opening a PPF account (for some banks)

Maximum protection - government-supported. Of India

Bad:

The lock-in is for 15 years but the wards have partial liquidity from the 7th year.

4. Certificate of National Conservation (NSC)

NSC can be purchased at post offices to save USS 80C tax. It is only available for five years (NSC VIII). The interest rate paid is 7.8%.

Lock-in: 5 years

Good:

Most interest rates are higher than most tax-saving bank fixed deposits.

Certificates can be kept as collateral to get from banks

No tax deduction at source

The interest earned for NSC qualifies for a Sec 80C discount in subsequent years

Highest protection - government-supported. Of India

Bad:

Earned interest earned is taxable

You have to go to your post office to buy and unload NSC units. This can be a problem for people who move frequently.

5. Tax Savings Bank Fixed Deposit

India prefers fixed deposits and FDs which save tax is obviously very popular.

Lock-in: 5 years

Good:

Invest is convenient in investing. Many banks offer online facilities for tax saving FDs

Safety High Security - FD insurance up to Rs 1 lakh has been provided by RBI

Bad:

Interest is taxable. (Permanent Deposit Tax Treatment)

The mat cannot be picked up untimely

The secure loan cannot be committed as security

Main Feature of this Excel utility:-

1) This Excel Based Utility Calculate the Income Tax as per the new system U/s 115BAC ( Old and New Tax Regime) produced by the Budget 2020

2) This Excel Utility have the Salary Structure as per the all Non-Government (Private) Concerns Salary Pattern

3) In this Excel Utility Have Individual Salary Sheet

4) Automated Income Tax Form 12 BA ( For Value of Perquisite)

5) Automated House Rent Exemption Calculation U/s 10(13A)

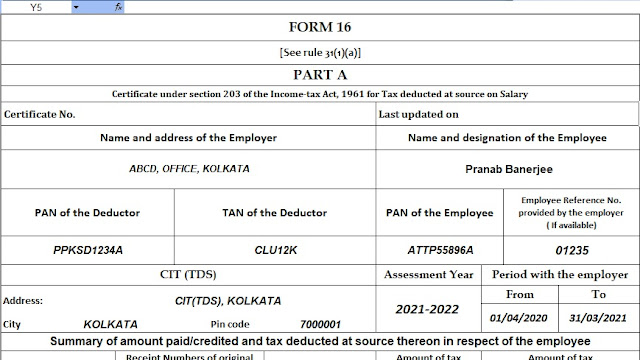

6) Automated Income tax Revised Form 16 Part A&B for F.Y.2020-21

7) Automated Income tax Revised Form 16 Part B for F.Y.2020-21

0 Comments