Section115BAC is the newly inserted section in the Income Tax Act, 1961 that deals with the new income tax regime. This section and alternate tax regime was introduced in Union Budget 2020 and are applicable to individuals and Hindu Undivided Families (HUFs) only. A key feature of this new regime is that the income tax slab rates have been significantly reduced. However, the new rates come at the cost of various key income tax exemptions and deductions, which are currently available under the old (existing) income tax regime.

The following table shows the new slab rates as per Section 115BAC.Annual Income | New Income Tax Slab Rate |

Nil to Rs. 2.5 lakh | Exempt |

Above Rs. 2.5 lakh to Rs. 5 lakh | 5% |

Above Rs. 5 lakh to Rs. 7.5 lakh | 10% |

Above Rs. 7.5 lakh to Rs. 10 lakh | 15% |

Above Rs. 10 lakh to Rs. 12.5 lakh | 20% |

Above Rs. 12.5 lakh to Rs. 15 lakh | 25% |

Above Rs. 15 lakh | 30% |

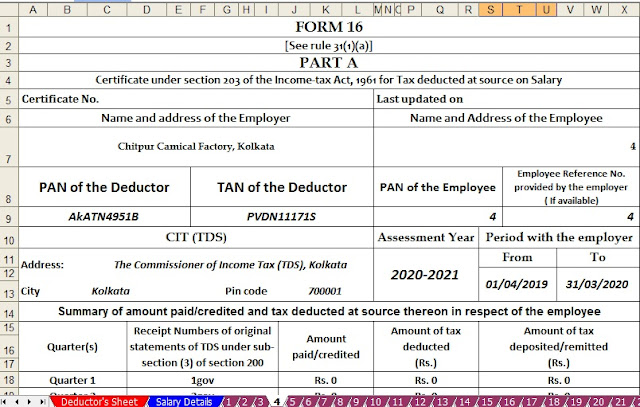

DownloadAutomated Income Tax Revised Form 16 Part B for the Financial Year 2019-20 [This Excel Utility can prepare at a time 50 Employees Form 16 Part B]

What are the eligibility criteria for the new tax regime?

In AY 2021-22, individuals and HUFs will have the option to pay income tax as per the new (reduced) income tax slab rates provided their total income for the relevant FY satisfies the following conditions.

- The declared income does not include any business income.

- It is calculated without any exemptions or deductions provided under the following

- Chapter VI-A except those u/s 80CCD/ 80JJAA,

- Section 24b,

- Clause (5)/(13A)/(14)/(17)/(32) of Section 10/10AA/16,

- Section 32(1)/ 32AD/ 33AB/ 33ABA,

- Section 35/ 35AD/ 35CCC,

- Clause (iia) of Section 57.

- It is calculated without setting off losses from any earlier assessment year (AY) due to the above-mentioned deductions or from house property.

- It is calculated without claiming any depreciation under clause (iia) of Section 32.

- It is calculated without any exemption or deduction with respect to any allowances or perquisites.

Download Automated Income Tax Revised Form 16 Part A&B for the Financial Year2019-20 [This Excel Utility can prepare at a time 50 Employees Form 16 Part A&B]

Deductions and exemptions not allowed under Section 115BAC

The following table shows the major income tax deductions and exemptions that have been disallowed under the new income tax regime. Please note that the new regime is optional in FY 2020-21 and you may opt for the old (existing) regime, where all of the following deductions can be claimed.

Major Deductions under Chapter VIA (u/s 80C, 80CCC, 80CCD, 80DD, 80DDB, 80E, 80EE, 80EEA, 80G, 80IA, etc) | House Rent Allowance (HRA) u/s 10(13A) | Home Loan Interest u/s 24(b) |

Standard Deduction | Leave Travel Allowance u/s 10(5) | Deduction for Donation or Expenditure on Scientific Research |

Allowances u/s 10(14) | Deduction for Entertainment Allowance and Employment/Professional Tax u/s 16 | Depreciation u/s 32(iia) |

Deductions u/s 32AD, 33AB, 33ABA, 35AD, 35CCC | Exemption for SEZ unit u/s 10AA | Deduction from Family Pension u/s 57(iia) |

Deductions allowed under Section 115BAC

While most of the income tax deductions have been discontinued under the new income tax regime (as mentioned in the earlier section), the following deductions are allowed:

Deduction u/s 80CCD(2) (employer’s contribution to your pension account) | Deduction u/s 80JJAA (additional employee cost) | Transport Allowance for Differently Abled Employees (Divyang) |

Conveyance Allowance for Performance of Office Duties | Any Allowance for the Cost of Travel/ Tour/ Transfer | Daily Allowance given to Employees under Certain Conditions |

Important points to consider about the new tax regime

- Section 115BAC of the Income Tax Act deals with the new income tax slab rates, which are applicable only for individuals and Hindu Undivided Families (HUFs).

- Although the new regime comes with significantly reduced slab rates, it takes away a major chunk of tax deductions and exemptions that could be availed under the old regime.

- The new income tax regime is optional, and you can still opt for the old (existing) regime.

- You cannot opt for the new regime if you have any business income in the applicable FY.

- The rates of surcharge and cess in the new income tax regime are the same as those in the old (existing) regime.

- The option to pay income tax as per the new regime can become invalid for the relevant financial year, if the individual or HUF fails to satisfy any of the conditions mentioned in Section 115BAC.

Download Automated Income Tax Revised Form 16 Part A&B and Part B for the Financial Year 2019-20 [This Excel Utility can prepare One by One Form 16 Part A&B and Part B ]

Old tax regime vs. the new tax regime

The old (existing) tax regime allows for a variety of income tax deductions and exemptions and hence is suitable for most of the taxpayers. However, the new tax regime may prove beneficial to those who have not significantly invested in various tax-saving schemes, such as Employee Provident Fund (EPF), Equity Linked Savings Scheme (ELSS), Life Insurance, National Pension Scheme (NPS), National Savings Certificate (NSC), tax-saving Fixed Deposit (FD), etc. Moreover, the standard deduction of Rs. 50,000 for salaried individuals and HRA allowance also do not apply under the new tax regime.

Let us understand how the total tax payout is affected under the two regimes through the following table. We have considered an income tax deduction of Rs. 1.5 lakh u/s 80C, Rs. 25,000 u/s 80D and Rs. 50,000 as a standard deduction when computing tax using the existing income tax slab rates. Thus, the total deduction amounts to Rs. 2.25 lakh.

Net Income (Rs.) | Taxable Income | Tax Outgo | Difference Between the Total Tax Outgo (Old Regime – New Regime) | ||

Under the Old Regime (Deduction of Rs. 2.25 lakh) | Under the New Regime (No deduction) | Under the Old Regime | Under the New Regime | ||

7 lakh | 4.75 lakh | 7 lakh | 0* | 37,500 | -37,500 |

10 lakh | 7.75 lakh | 10 lakh | 70,200 | 78,000 | -7,800 |

15 lakh | 12.75 lakh | 15 lakh | 2,02,800 | 1,95,000 | +7,800 |

30 lakh | 27.75 lakh | 30 lakh | 670,800 | 6,63,000 | +7,800 |

*After applying income tax rebate up to Rs. 12,500 under Section 87A of Income Tax Act, 1961.

Thus, the new regime u/s 115 BAC may prove beneficial for the high-income group with minimal investment in tax-saving investments. However, the old (existing) regime may be better suited to the low-to-middle income group if they make sufficient investments in various tax-saving schemes. Hence, there is no set formula to decide between the two regimes. One must calculate the total tax outgo as per both the old and new slab rates before deciding whether to adopt Section 115BAC slab rates or not.

0 Comments