In the midst of the progressing helpful and economic steps to address the effect of COVID-19, the government has also taken a a large number of measures to guarantee that individuals from various strolls of society doesn't feel the touch of the lockdown forced because of the pandemic.

The government isn't just attempting to 'level the bend' of coronavirus contamination, however, is all the while attempting to help people and organizations to adapt to the money related effect of COVID-19 by presenting a blend of monetary and tax relief measures.

Against the above setting, from a singular tax point of view, the government has found a way to give relief; it brought the Taxation and different Laws (Unwinding of Specific Arrangements) Law, 2020 [the Ordinance] on Walk 31, 2020, which, bury Alia, extended different time cutoff points of tax compliances.

So as to give further relief to taxpayers, the government gave a Notice on June 21, 2020, wherein as far as possible for recording singular personal tax return for the F.Y. 2019-20 & Assessment Year 2020-21 has been extended from July 31, 2020, to November 30, 2020. Further, the date of outfitting of review report under any arrangements of the Personal Tax Act, 1961 has been extended to October 31, 2020. Download Notification no. S.O. 2033(E) dated 24June 2020

Besides, so as to give relief to taxpayers, the date for the instalment of self-assessment tax on account of a taxpayer whose self-assessment tax risk is up to Rs 1 lakh, has also been extended to November 30, 2020.

Be that as it may, it has been explained that there will be no augmentation of date for the instalment of self-assessment tax for taxpayers having self-assessment tax risk surpassing Rs 1 lakh.

For this situation, the self-assessment tax will be payable by the due date indicated in the Annual tax Act, 1961 (IT Act), for example by July 31, 2020, and deferred instalment would draw in enthusiasm under section 234A of the IT Demonstration, which is material at the pace of 1% every month.

In addition, the government has loosened up the courses of events for ventures/instalments for asserting reasoning under Part VI-An of the IT Demonstration canvassed in Section 80C (LIC, PPF, NSC, and so forth.), 80D (Mediclaim), 80G (Gifts), and so forth, which has been additionally extended to July 31, 2020. Subsequently, the speculation/instalment can be made up to July 31, 2020, for asserting reasoning under these sections for FY 2019-20.

Proceeding with this relief measure, the date for making speculation/development/buy to guarantee rollover advantage/derivation in regard to capital increases under Sections 54 to 54GB of the IT Demonstration, has also been extended to September 30, 2020. In this manner, any venture/development/buy made up to September 30, 2020, will be qualified for guaranteeing to find from capital increases.

What's more, the date of outfitting of the Tax Deducted at Source ('TDS')/Tax Gathered at Source ('TCS') proclamations and issuance of TDS/TCS declarations, being essential for empowering taxpayers to set up their arrival of pay, for FY 2019-20, has been extended to July 31, 2020, and August 15, 2020, individually.

Moreover, the course of events for linkage of Perpetual Record Number (Dish) with Aadhaar has also been extended from July 31, 2020, to Walk 31, 2021.

The augmentation of courses of events for recording tax returns and other related tax compliances is an all-around considered measure, as because of lockdown it is hard for singular taxpayers to acquire fundamental documentation required for arrangement of tax returns and record their profits on schedule. This definitely comes as a major relief to a singular taxpayers who are away from this much-needed development.

Feature of this Excel Utility:-

1) This Excel utility prepares and calculates your income tax as per the New Section 115 BAC (New and Old Tax Regime)

2) This Excel Utility has an option where you can choose your option as New or Old Tax Regime

3) This Excel Utility has a unique Salary Structure for Government and Non-Government Employee’s Salary Structure.

4) Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the F.Y.2000-01 to F.Y.2020-21 (Update Version)

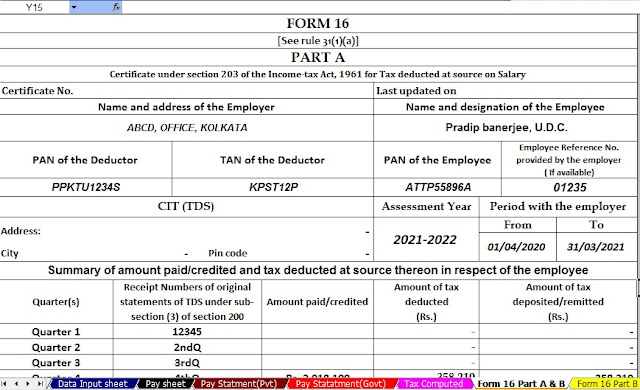

5) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2020-21

6) Automated Income Tax Revised Form 16 Part B for the F.Y.2020-21

0 Comments