How to save taxesin the F.Y. 2021-22. Taxpayers are generally aware of general tax deductions (such as Section 80C of the Income Tax Act, 191 which can be taken during any financial year. However, there are other exemptions available under various sections of the Income Tax Act that can help a person to lower their tax liability further.

Keep in mind that until F.Y 2021-22, a person can continue with the old tax system with existing deduction and tax rebate benefits. It also has the option of paying taxes under the new, exempt tax levy which denies most existing exemptions and tax exemptions.

In both tax systems, a deduction is available if your taxable income does not exceed five lacks in a financial year. Effectively, this means that if your net taxable income does not exceed Rs 5 lacks, there will be no tax liability.

Here's a look at how you can save tax by using the various exemptions allowed under the Income Tax Act.

This is the most used category where a person can invest a maximum of Rs 1.5 lakh U/s 80 C in a given year / at a given time in a financial year or save tax through tax.

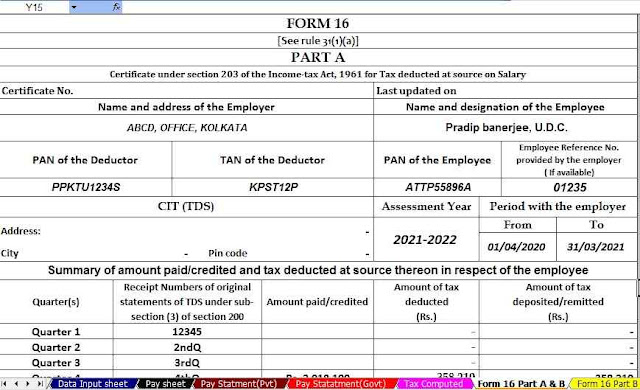

You may also, like-Download and Prepare One by One Automatic Income Tax Form 16 Part A&B and Part B in Excel for the F.Y.2020-21 as per new and old tax regime.

You can save more tax by investing an additional Rs 50,000 in NPS. Note that this discount is available on and above the tax benefit available under Section 80C. In this way, you can save tax by investing up to Rs 1.5 lakh under Section 80C and Rs 50,000 under Section 80CCD (1B) up to Rs 2 lakh in a financial year.

This deduction is available for employer contributions to an employee's Tier-2 NPS account. A maximum contribution of 10% of the basic salary allowance (where applicable) of the basic salary is allowed under this section.

Note that effective from the financial year 2010-2011, the employer's contribution to the retirement fund - EPF, surplus fund, NPS - more than Rs. 5.5 lakhs in the financial year will be taxable to the employee.

When availing of tax benefits under this section, ensure that the employer's contribution and EPF's contribution with your NPS account will not exceed Rs.5.5 lakh in any financial year.

Also, keep in mind that under both the old and new tax systems this is the only exemption

The premium paid for the health insurance policy for a self, spouse, and dependent children up to Rs 25,000/-. In addition to these, premiums paid for parental health insurance can provide additional tax breaks of up to Rs 25,000. If your parents are senior citizens (60 years of age or older), this duty break will go up to a maximum of Rs 30,000.

You may also, like-Download and prepare One by One Automatic Income Tax Form 16 Part B in Excel for the F.Y.2020-21 as per new and old tax regime

If you are a person with a disability of 40% or more, you can claim a duty break under 80U. However, waiver claims under sections 80U and 80DD cannot be claimed simultaneously. The claim for a waiver under section 80U is claimed by the disabled person whereas the waiver of the waiver under section 80DD is claimed to have borne the cost for the treatment of the disabled person. The amount of exemption under section 80U for disability and severe disability is the same as in section 80DD

In addition to the tax benefits available on the repayment of the principal of a home loan under section 80C, a tax benefit of up to a maximum of Rs 2 lakh on interest payable in a financial year can also be claimed.

If you have taken a home loan to buy a house under the Affordable Housing Department in the financial year 2010-2011, you can claim additional tax breaks on interest up to a maximum of Rs 1.5 lakh. This deduction is available in Section 24 (mentioned above) where you will get a tax benefit up to Rs 2 lakh. However, you must meet certain conditions before claiming tax benefits under Section 80EEA.

You may also, like-Download and prepare at a time 50 Employees Automatic Income Tax Form 16 Part B in Excel for the F.Y.2020-21 as per new and old tax regime

Exemption from Interest in savings accounts in banks or post offices up to Rs 10,000 from these sources in financial sources can be claimed as a deduction from the total income under section 80TTA. However, senior citizens cannot claim this discount.

Senior citizens (60 years and above) can claim a maximum rebate of Rs. 50,000 from the total income under this section.

0 Comments