List of different discounts U/s 80C.

Deduction U/S 80C for life insurance premium, contribution to PF, etc. (Individual / HUF only). Find the list of income tax exemptions under section 80C. Section 80C exempts a person (a); (B) A Hindu undivided family is subject to a maximum of one lakh and fifty thousand rupees for investment in specific assets. In this article, you can get a list of discounts available only to Individuals, a list of discounts available to Individuals and HFF, other special points for seconds. 80C.

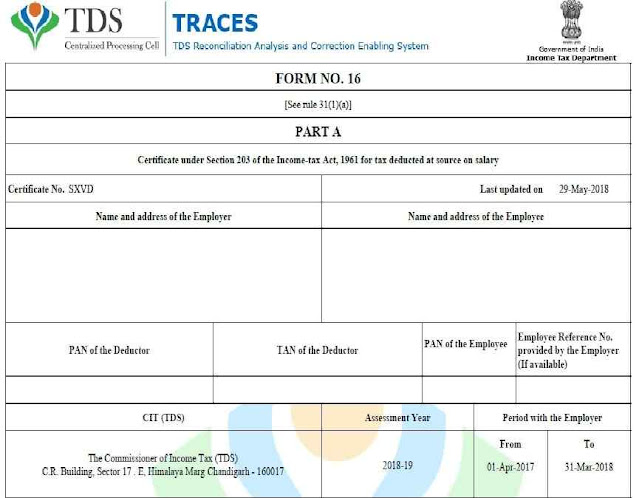

You may also, like- Automated Income Tax Revised Form 16 Part A&B and Part B for the F.Y. 2020-21 [This Excel Utility can prepare One by One Form 16 Part A&B and Part B in a single Excel File]

Now you can scroll down and check the complete list of different subtractions under section 80C

You can claim a waiver under section 80C:

Individual discounts available only:

Any payment made by the individual to keep in effect a non-transportable deferred annuity agreement about the life of the individual, the husband, any child of the individual

Any amount deducted from the salary payable by the government for the purpose of paying the anniversary payable to him. However, the salary should not be without 1 / fifth.

You may also, like- Automated Income Tax Revised Form 16 Part B for the F.Y. 2020-21 [This Excel Utility can prepare One by One Form 16 Part B ]

SPF / RPF contributions.

Contributions to the ApprovedApproval Fund.

National Savings Scheme Subscription.

NSC subscription, even interest in it is eligible for discount

Subscription Unit of Mutual Fund / UTI

Contribution to Mutual Fund / UTI / Pension Fund established by National Housing Bank

Submitted to National Housing Bank, HUDCO

Deposits with a PSU providing long-term financing for the construction or purchase of residential homes in

Deposits with notified housing boards as per law for planning, development and enlistment of towns/cities/ villages.

Tuition fees (maximum 2 children) for full-time education of children in universities, colleges, schools or other educational institutions located in

Accommodation / Expenses

Subscriptions to authorized equity shares or entities of a public company or a government financial institution and the entire proceeds of the issue are used in full and exclusively for power generation or infrastructure facilities companies. (Holding period minimum 3 years)

Term deposit with a scheduled bank for at least 5 years.

Notified NABARD Bond Subscription.

Deposits under the Senior Citizens Savings Scheme.

5-year time deposit in any account under Post Office Deposit Rules.

You may also, like- Automated Income Tax Revised Form 16 Part A&B for the F.Y. 2020-21 [This Excel Utility can prepare at a time 50 Employees Form 16 Part A&B in a single Excel File]

Other points for seconds are 80C

The total limit under this section is 2014-1. Fiscal year/assessment year 2011-16-1 from 1.50 lakh. 2014-1. Before the financial year, the limit was Rs. 1 lakh rupees. Many small savings scheme schemes like NSC, PPF and other pension schemes under this heading are also eligible for exemption under section 80C for payment of life insurance premiums and investments in certain government infrastructure bonds.

If the appraiser transfers the FP, no waiver is claimed, before the expiration of the five-year term of the fiscal year in which the owner of such national property occurs. No concession will be allowed in the house to which the house of PIO is shifted. Approved discounts in previous years will be treated as PY assessment income, where the home is relocated.

If a member participating in the Yule PIP terminates before the 5-year contribution, the same treatment given in point 2 will be given.

The deduction can be given only if the previous year i.e. 31st March or earlier is paid/contributed/invested.

0 Comments