NPS income tax benefit F.Y.2021-22 as per old and new tax regime | Effective from the fiscal year 2020-21, separate tax assessors will have the option to avail new tax slab rates by retaining existing income tax exemptions and exemptions such as HRA, Section 80C, home loan tax etc.

Thus, in order to take the new tariff measures below the new tax, the taxpayers will have to waive the income tax exemption.

Is there any confusion as to whether popular investment options like NPS (National Pension System) will have any income tax benefits?

The Government of India has launched the National Pension Scheme (NPS) for all citizens from May 1, 2009 and from December 2011 for the corporate sector.

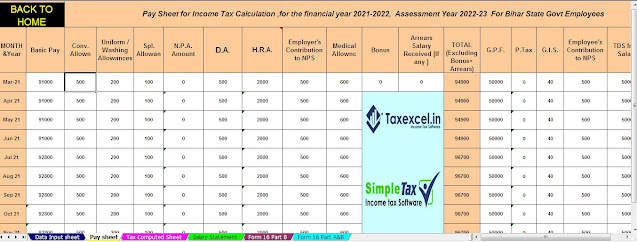

You may also, like:-Automated Income Tax Calculator All in One for the Bihar State Employees for the F.Y.2021-22 & A.Y.2022-23 as per Budget 2021

Feature of this Excel Utility:-

1) This Excel utility prepares and calculates your income tax as per the New Section 115 BAC (New and Old Tax Regime)

2) This Excel Utility has an option where you can choose your option as New or Old Tax Regime

3) This Excel Utility has a unique Salary Structure for

5) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2021-22

6) Automated Income Tax Revised Form 16 Part B for the F.Y.2021-22

It is estimated that government employees contribute about 75% of the rupee. 2.3 lakh (35 Lakh) overseen by the NPS (National Pension System), which began in 2004 and has since been open to all citizens for voluntary contributions.

Most of my blog readers have chosen NPS for two main reasons - i) for tax saving & ii) for most government employees no option other than investment has been made mandatory as a contribution to NPS.

If you are investing in an NPS scheme or planning to invest in NPS, you need to be aware of the latest NPS income tax benefits available under your old tax regime and new tax regime (Budget 2021).

In this post, let’s discuss - what are the NPS income tax benefits for F.Y 2021-22 or A.Y 2022-23? Can you claim income tax exemption on NPS investments under the new tax regime? Is there any tax exemption under NPS Tier-2 account? Under which section of IT law can NPS investment be claimed as tax deduction? What is the proof of investment for availing tax benefits under NPS?

Latest NPS Income Tax Benefit 2021-22 / A,Y 2022-23 under old and new tariffs

Below are the various income tax departments under which an NPS investor can claim income tax exemption for the financial year 2019-20 / A.Y 2019-21.

Section 80CCD (1)

Section 80CCD (2)

Income tax benefit under NPS Tier-1 account for A.Y 2022-23

Tax exemption under 80 CCD (1) on NPS investments of salaried persons (excluding Central Government employees)

An employee can contribute to government notified pension schemes (like National Pension Scheme - NPS). Contributions can be up to 10% of salary (salaried person).

Tax exemption can be claimed as the maximum amount is 1.5 lakh U / s 80 CCD (1).

Old tax system: If you are opting for the old tax discipline, you can continue to claim income tax exemption as listed in the above two points.

You may also, like:-Automated Income Tax Calculator All in One for the Jharkhand State Employees for the F.Y.2021-22 & A.Y.2022-23 as per Budget 2021

1) This Excel utility prepares and calculates your income tax as per the New Section 115 BAC (New and Old Tax Regime)

2) This Excel Utility has an option where you can choose your option as New or Old Tax Regime

3) This Excel Utility has a unique Salary Structure for

5) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2021-22

6) Automated Income Tax Revised Form 16 Part B for the F.Y.2021-22

New Tariff Arrangement: If you proceed with the new tax regime, you will not be able to claim an income tax benefits u / s 80CCD (1).

Tax exemption under 80 CCD (1) on NPS investments by self-employed persons:

Self-employed (persons other than salaried class) can contribute 20% of their total income and it can be deducted from the taxable income under Section 80CCD (1) of the Income-tax Act, 1961.

As a tax deduction, it can be claimed that the maximum amount is 1.5 Lakhs U / S80 CCD (1).

Under the Old Tax Regime: If you choose the old tax rate, you can continue to claim an income tax deduction as listed in the above two points.

New Tariff Arrangement: If you proceed with the new tax regime, you will not be able to claim an income tax benefits u / s 80CCD (1).

Income Tax Exemption under 80 CCD(2) on NPS Investment for Central-Private Government Employees: • An employer can also contribute to the NPS scheme.

The amount of contribution made by the employer can be claimed as tax deduction U/s 80CCD (2), subject to at least its threshold limit below; 10% Ross Total Income of Basic Salary + DA (or) paid by an employer

• This is an additional discount that

• Self-employed persons cannot claim NPS tax exemption of UPS 80 CCD (2)

Under the old and new tax system: If you opt for a new tax system on your income tax return, there will now be a limit of U/s 80CCD (2) effective from the fiscal year 2021-22. Your employer can contribute to your NPS account as described in the points above.

However, under Sec 80 CCD (2), if your employer's contributions are more than Rs. 50,000 per annum (including EPF and Supervision), the contributions above that result in taxable income in the hands of the employee. .5.5 lakh plus interest is also taxable

Income tax exemption under 80 CCD (2) on NPS investment for Central Government employees:

The amount of contribution made by the employer (in this case the Central Government) can be claimed as tax exemption U / s 80CCD (2), subject to the lower limit of the lower part; Amount paid by an employer

14% of Basic Salary + DA (or)

Total income

The center will now contribute 14% of private salaries to the pension corpus of government employees, increasing from 10%. This is w.e.f April 2019.

This is an additional discount that

You may also, like:-Automated Income Tax Calculator All in One for the Andhra Pradesh State Employees for the F.Y.2021-22 & A.Y.2022-23 as per Budget 2021

1) This Excel utility prepares and calculates your income tax as per the New Section 115 BAC (New and Old Tax Regime)

2) This Excel Utility has an option where you can choose your option as New or Old Tax Regime

3) This Excel Utility has a unique Salary Structure for

5) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2021-22

6) Automated Income Tax Revised Form 16 Part B for the F.Y.2021-22

Under the old and new tax system: If you opt for a new tax system on your income tax return, there will now be a limit u / s 80CCD (2) effective from the fiscal year 2020-21. Your employer can contribute to your NPS account as described in the points above.

However, under Sec 60 CCD (2), if your employer's contributions are more than Rs. 50,000 per annum (including EPF and Supervision), such additional contribution is taxable income in the hands of the employee. .5.5 lakh plus interest is also taxable

80 CCD (1B) of NPS Additional Tax Exemption

Salary or self-employed persons can claim u / s 80CCD (1b) for additional tax benefit of Rs. 50,000 / -.

Please note that the total exemption under Sections 80C, 80CCC, and 80CCD (1) may not exceed Rs.1,50,000 for FY 2020-21. 50,000 / - Excess tax exemption of 80 CCD (1B) has exceeded the limit of Rs. 1.5 lakhs.

Under the old tax regime: If you opt for the old tax, you can continue to claim an income tax deduction of Rs. 50,000 U/s 80CCD (1b).

New tax regime: If you proceed with the new tax regime, you cannot claim an additional income tax deduction of 50,000 U/s 80CDD (1b).

Financial Income Benefit under NPS Tier-2 Account for 2020-21

The Tier II National Pension Scheme account is just like a savings account and customers are free to withdraw their money whenever they need it.

Tax exemption below 80c for NPS Tier-2 investment

The contribution of government employees (only) under Tier-2 of NPS will be brought under section 80C for exemption up to Rs 1.5 lakh for income tax including a lock-in period of three years. This is w.e.f April 2019.

For other NPS customers, there is no tax benefit on NPS investments in Tier-2 accounts.

Under the old tariff: If you opt for the old tax discipline, you can continue to claim income tax exemptions in the 80s.

Rules for Acquisition and Withdrawal of NPS Maturity in FY 2012-2012

Below are the general rules that apply under the old and new tax systems related to the acquisition and withdrawal of NPS maturity;

Achieving NPS Tier-1 Maturity in case of Retirement

Upon reaching the age of 60 years, you will be allowed to withdraw 60% of the total corpus and at least 40% of the assets deposited in the NPS account need to be used to purchase annuity / pension plans.

You may also, like:-Automated Income Tax Calculator All in One for the Non-Govt(Private) Employees for the F.Y.2021-22 & A.Y.2022-23 as per Budget 2021

1) This Excel utility prepares and calculates your income tax as per the New Section 115 BAC (New and Old Tax Regime)

2) This Excel Utility has an option where you can choose your option as New or Old Tax Regime

3) This Excel Utility has a unique Salary Structure for Non-Govt (Private) Employee’s Salary Structure.

5) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2021-22

6) Automated Income Tax Revised Form 16 Part B for the F.Y.2021-22

With effect from 1st 1st April 2019, 60% NPS withdrawal full tax-exemption.

The total corpus in the account is Rs. As per the date of retirement (public sector) 2 lakh / 60 years old (private sector) receiving customers (excluding self-reliant customers) can take the option of full withdrawal, however, 60% of this withdrawal will be duty-free and 40% taxable.

NPS Tier-1 account and partial withdrawal

The Tier 1 account cannot be withdrawn until you reach the age of 60. However, in certain cases, partial withdrawal is allowed earlier.

Rule In the latest rule change (Budget 2017), PFRDA (Pension Fund Regulatory and Development Authority) relaxed the withdrawal policies so that customers can now withdraw 25% contribution starting from the third year of opening NPS.

Please note that such partial withdrawals are tax-exempt. (NPS partial withdrawals made before 1.04.2017 are taxable)

The center will now contribute 14% of private salaries to the pension corpus of government employees, increasing from 10%. This is w.e.f April 2019.

This is an additional discount that

Under the old and new tax system: If you opt for a new tax system on your income tax return, there will now be a limit of U/s 80CCD (2) effective from the fiscal year 2020-21. Your employer can contribute to your NPS account as described in the points above.

However, under Sec 60 CCD (2), if your employer's contributions are more than Rs. 50,000 per annum (including EPF and Supervision), such additional contribution is taxable income in the hands of the employee. 5.5 lakh plus interest is also taxable

80 CCD (1B) of NPS Additional Tax Exemption

Salary or self-employed persons can claim u / s 80CCD (1b) for additional tax benefit of Rs. 50,000 / -.

Please note that the total exemption under Sections 80C, 80CCC, and 80CCD (1) may not exceed Rs.1,50,000 for FY 2020-21. 50,000 / - Excess tax exemption of 80 CCD (1B) has exceeded the limit of Rs. 1.5 lakhs.

Under the old tax regime: If you opt for the old tax, you can continue to claim an income tax deduction of Rs. 50,000 U/s 80CCD (1b).

New tax regime: If you proceed with the new tax regime, you cannot claim an additional income tax deduction of 50,000 U/s 80CCD (1b).

Financial Income Benefit under NPS Tier-2 Account for 2020-21

The Tier II National Pension Scheme account is just like a savings account and customers are free to withdraw their money whenever they need it.

Tax exemption below 80c for NPS Tier-2 investment

The contribution of government employees (only) under Tier-2 of NPS will be brought under section 80C for exemption up to Rs 1.5 lakh for income tax including a lock-in period of three years. This is w.e.f April 2019.

For other NPS customers, there is no tax benefit on NPS investments in Tier-2 accounts.

Under the old tariff: If you opt for the old tax discipline, you can continue to claim income tax exemptions in the 80s.

Rules for Acquisition and Withdrawal of NPS Maturity in FY 2012-2012

Below are the general rules that apply under the old and new tax systems related to the acquisition and withdrawal of NPS maturity;

Achieving NPS Tier-1 Maturity in case of Retirement

Upon reaching the age of 60 years, you will be allowed to withdraw 60% of the total corpus and at least 40% of the assets deposited in the NPS account need to be used to purchase annuity/pension plans.

With effect from 1st 1st April 2019, 60% NPS withdrawal full tax-exemption

The total corpus in the account is Rs. As per the date of retirement (public sector), 2 lakh / 60 years old (private sector) receiving customers (excluding self-reliant customers) can take the option of full withdrawal, however, 60% of this withdrawal will be duty-free and 40% taxable.

NPS Tier-1 account and partial withdrawal

The Tier 1 account cannot be withdrawn until you reach the age of 60. However, in certain cases, partial withdrawal is allowed earlier.

Rule In the latest rule change (Budget 2017), PFRDA (Pension Fund Regulatory and Development Authority) relaxed the withdrawal policies so that customers can now withdraw 25% contribution starting from the third year of opening NPS.

Please note that such partial withdrawals are tax-exempt. (NPS partial withdrawals made before 1.04.2017 are taxable)

Feature of this Excel Utility:-

1) This Excel utility prepares and calculates your income tax as per the New Section 115 BAC (New and Old Tax Regime)

2) This Excel Utility has an option where you can choose your option as New or Old Tax Regime

3) This Excel Utility has a unique Salary Structure for Government and Non-Government Employee’s Salary Structure.

4) Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the F.Y.2000-01 to F.Y.2021-22 (Update Version)

5) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2021-22

6) Automated Income Tax Revised Form 16 Part B for the F.Y.2021-22

0 Comments