Tax benefits of home loan for F.Y2021-22. On February 1, 2021, in the Union Budget 2021, the government extended for another year an additional 1.5 Lakh tax deduction on interest paid on housing loans for the purchase of affordable housing. Thus, sorrow recipients can now avail discounts up to Rs.3/5 Lack for another one lakh, till March 31, 2022.

This exemption is available under section 80EEA which is Rs. 1.5 lakh has been paid on interest on the home loan. These home loan tax benefits are available on existing discounts and above Rs 2 lakh under section 24a (b).

You may also, like-Automated Income Tax Revised Form 16 Part B for the F.Y.2020-21 [This Excel Utility can prepare One by One Form 16 Part B]

You can claim to buy a house with a stamped price of only Rs. 25,000 / - for this home loan duty exemption. 45 lakh.

Homeowners can claim the benefits of the loan on March 31, 2022. Thus, the customers will be able to claim the maximum.

Income tax benefits under Section 80EEA is available for taking home loans under the PMEL CLSS scheme.

Some sections of the Income Tax Act that provide tax relief on home loans:

Sections in IT Act

Section 80C

Section 24

Section 80EE

The nature of home loan waiver in income tax

Tax exemption on original payment

Tax deduction on the amount of interest payable

Additional home loan interest tax benefits for first-time homeowners

The maximum amount of discount

RS. 1.5 lakh

RS. 2 lakh rupees

RS. 50,000

You may also, like-Automated Income Tax Revised Form 16 Part A&B and Part B for the F.Y.2020-21 [This Excel Utility can prepare One by One Form 16 Part A&B and Part B]

Home Tax Duty Details:

To get a home loan, you need to pay a monthly rep as an EMI, which consists of two basic components -

The principal amount and interest payable. The IT Act enables the recipient to enjoy tax benefits on these two components

Individually.

1. Section 80C

The maximum home loan is Rs. 1.5 lakh from your taxable income on basic payment.

This may include stamp duty and registration charges as well, but can be claimed at once.

2. Section 24

Enjoy discounts up to a maximum of Rs 2 Lakh. The amount of interest payable is 2 lakh rupees.

These discounts only apply to properties whose construction is completed within 5 years. If it does not expire within this period, you can only claim up to Rs 2,000. 30,000

3. Section 80EE

First-time homeowners can claim an additional Rs 10,000. 50,000 on interest payable every financial year.

The amount of home Anne must not exceed 35 lakhs.

The value of the property must be in rupees. 50 lakh.

You may also, like-Automated Income Tax Revised Form 16 Part A&B for the F.Y.2020-21 [This Excel Utility can prepare at a time 50 Employees Form 16 Part A&B]

Notice some more conditions:

A. Tax deductions only apply when the construction of the property is complete, or you are ready for a home.

B. Enjoy this tax benefit on home loans every year and save a significant amount.

C. If you sell the property within 5 years of its possession, the claimed benefits will be reversed and added to your income.

d. You can buy the property and rent it out. In that case, no maximum amount is applicable for claiming as home loan tax

Exemption

e. When you take out a home loan, you can claim tax benefits if you are currently renting another home

HRA as well.

What are the tax exemptions for joint homes?

In the case of a joint home loan, each borrower can avail of tax benefit on a joint home loan from his taxable income.

Individually. Anyone can claim a maximum of Rs 500. 2 lakh on interest paid and Rs. 1.5 lakhs in the original amount

Any family member, friend, or even a spouse can be multiple recipients of a joint home from the bank.

The only condition is that each applicant for a housing loan must be the co-owner of that residential property.

Does a second home have a home loan tax benefit?

If you take out a second home loan to buy another property, the tax benefits apply to the interest payable. Here,

You can claim the full amount of interest as no cap is applied here.

At present individuals can only claim one property as self-occupied and pay taxes on the basis of rent based on other considerations.

A proposal has been tabled under

You may also, like-Automated Income Tax Revised Form 16 Part B for the F.Y.2020-21 [This Excel Utility can prepare at a time 50 Employees Form 16 Part B]

How do you claim tax benefits at home?

The process of claiming tax benefits on a home loan are simple and easy.

1. The Property must be in the residential purpose is in your name. In the case of a joint home loan, be sure to co-own the home.

2. The total amount after calculation you can be entitled to a tax deduction.

3. Transfer home loan interest certificate to your employer so that he can adjust the IDS.

4. After failing to follow this step, you will need to file your IT return.

Self-employed sorrow recipients are not required to submit these documents. If any questions arise in the future, they must provide them with this.

How does a home loan help with income tax?

Home loan repayment rescheduling is eligible for tax exemption under the Income Tax Act, 1961.

Loan interest up to Rs. 2 lakhs per annum is tax-deductible for 24-year-olds. Section 80C allows exemption against payment of principal up to Rs. 1.5 lakhs per annum.

Additional discounts u / s 80EE and 80EEA is available.

What is the maximum amount of tax deduction for a home loan?

The maximum tax-exempt income tax for home loans is listed below under certain sections of the Income-tax Act, 1961.

Up to Rs.2 lack U/s 24 (b) for the self-acquired house; Self-occupied homes have no boundaries.

RS.1.5 lakh U / S Home loan principal amount.

80EEA up to Rs 1.5 lakh for first-time home buyers. (Home Loan Interest)

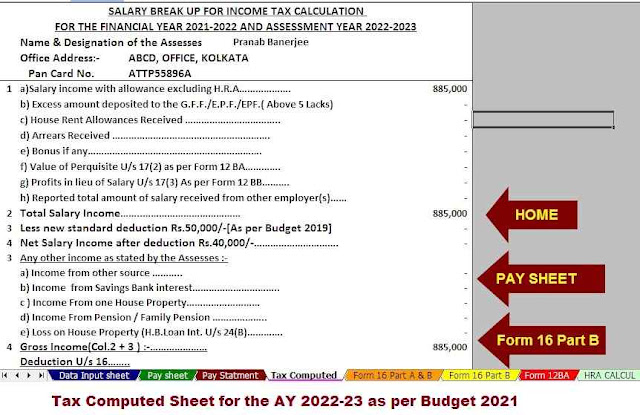

1) This Excel Utility Prepare Your Income Tax as per your option U/s 115BAC perfectly.

2) This Excel Utility has all amended Income Tax Section as per Budget 2021

3) Automated Income Tax Form 12 BA

4) Automated Calculation Income Tax House Rent Exemption U/s 10(13A)

5) Individual Salary Structure as per the Govt and Private Concern’s Salary Pattern

6) Individual Salary Sheet

7) Individual Tax Computed Sheet

8) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2021-22

9) Automated Income Tax Revised Form 16 Part B for the F.Y.2021-22

10) Automatic Convert the amount into the in-words without any Excel Formula

0 Comments