Changes to EPF and ULIP tax rules from the F.Y.2021 |The Union Budget 2021 is hailed as the best budget in recent history. And for a good reason. With its focus on growth and a clear roadmap on how this growth will be achieved and financed, the government seems to have enacted a well-balanced law.

The budget sighed for the taxpayers as there was no risk with the tax slab or tax rate. However, there was a change in the tax situation. Although the finance minister did not mention this in his speech, there is a budget proposal that will change the tax status of two very famous investment options - EPF and ULIP.

You may also, like- AutomatedIncome Tax Revised Form 16 Part B for the F.Y.2020-21 which can prepare at a time 50 Employees Form 16 Part B for the F.Y.2020-21

In this article, we tell you what these changes are and how they can affect you.

Changes to PF Tax Rules: Cap on Interest-Free Returns

In the last budget, the government reduced the amount of tax exemptions on employer contributions in the case of PF, NPS, and support funds. 5.5 lakhs. Since April 1, 2020, Spiritual Employees have earned Rs. For EFF contribution (EPF + VPF). Two and a half lakh will be added to the taxable income and tax will be collected according to the income tax rate of the person. This will not apply to employer contributions.

In other words, if your total annual contribution to the Provident Fund exceeds Rs. 2.5 lakh, interest income has exceeded Rs. 2,000. Two and a half lakhs will be taxable. This margin means less than or equal to your monthly contribution to the PF. 20,833, your returns will be tax-free.

This change in the rules has changed the tax status of PF from EEE (discount-discount-discount) to E-T-E (discount-taxable-discount). This is the second attempt by the government to pay taxes to the PF (the first was in 2016, but the proposal was withdrawn after a huge slogan). This change, as a government, will affect less than 1% of PF customers.

You may also, like- Automated Income Tax Revised Form 16 Part A&B for the F.Y.2020-21 which can prepare at a time 50 Employees Form 16 Part A&B for the F.Y.2020-21

However, as soon as the new Wage Code Bill comes into force, many people will see their contribution to the PF. This is because, from April 2021, the basic salary must be at least 50% of the total salary. So the actual effect of this change in the PF rule will only be known at a later date.

Ulips: Tax equivalent with equity mutual funds

Despite being a market-linked product, the unit has levied favourable taxes compared to other investment opportunities such as Linked In plans (ULIPs), mutual funds. Under the current rules, under Section 10 (10D), Premiums from insurance policies, including ULIPs, are tax-free if they are 10 times the premium.

As per budget 2021 for ULIPs whose premium is above Rs. 2.5 lakh a year. For these ULIPs, the amount of maturity will be taxed equal to the equity mutual fund. This change will take effect on February 1, 2020, and only applies to new ULIP purchases.

Conclusion:

The purpose of this rule change is to plug specific loopholes used by HNIs to obtain tax-free returns. ULIPs are in terms of points. ULIPs became opaque when spent and despite this had a tax advantage over other investment products. So HNIs used to buy ULIPs with big premiums to earn tax-free returns. With the new rules, if someone invests more than Rs 10,000, this tax benefit will no longer exist. 20 thousand per month. More importantly, however, we believe this is just the beginning and that this limit will be further reduced for ULIPs in the future.

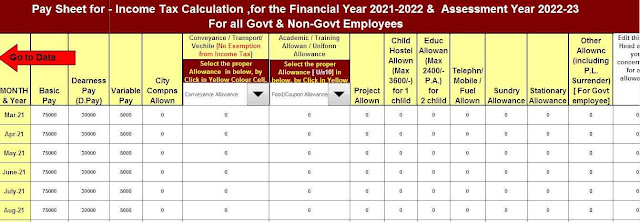

Main feature of this Excel Utility are:-

1) Auto fills your Income Tax Computed sheet as per your option New or Old tax regime U/s 115 BAC

2) Salary Structure for the Government and Private Employees Salary Pattern

3) Automated Income Tax House Rent Exemption Calculation U/s 10(13A)

4) Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10 E for the F.Y.2021-22

5) Automated Income Tax Form 16 Part A&B for the F.Y.2021-22

6) Automated Income Tax Form 15 Part B for the F.Y.2021-22

0 Comments