Download Autofill in Current Form10E from F.Y.2000-01 Download Income Tax Salary Arrears Relief Calculator U / S 89 (1)

Form 10E FAQs

Question 1 What is Form 10E?

A. In case of receipt of arrears or any amount of advance in nature of salary, relief may be claimed U/s 89(1).To claim such relief, the assessor has to file Form 10E. The form must be submitted before filing an income return.

Q.2 Can I download and re-submit Form 10E?

A. No, there is no need to download Form 10E can be submitted online after logging in to the e-filing portal.

Q.3 Should I file Form 10E?

A. You need to file Form 10E before filing your income tax return.

Q.4 Is it mandatory to file Form 10E?

A. Yes, it is mandatory to file Form 10E if you want to claim a tax deduction on your arrears/advance income.

Q. 5 I claim 89(1) relief in my ITR even after failing to file Form 10E but what will happen?

A. If you fail to complete Form 10, you claim 89 in your ITR, your ITR will be processed, but you will not be allowed without the claimed relief 89

Q. How do I know that ITD has denied the relief claimed by my ITR?

A. If the relief claimed by you on 89 is not granted, the ITD will have to inform you through U / S 143 (1) after its ITR processing has been completed.

Form 10E User Manual

1. Overview

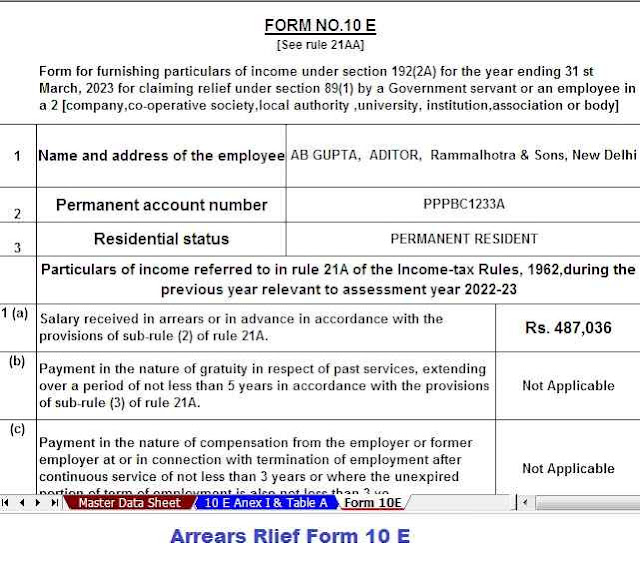

Total income tax liability is calculated from the total income earned during a particular financial year. However, if the nature of the salary includes the payment of advance or arrears within the income of a particular financial year, the Income Tax Act allows relief (u / s 89) for additional understanding of tax liability. Form 10-E needs to be filled in to claim such relief.

Form 10E can only be submitted through online mode.

2. A prerequisite for receiving this service is a valid user ID and password registered with the e-filing portal. About Form

3.1 Objectives Provide relief to an assessor for salary or profit in lieu of advance or arrears of salary or family pension received by an assessor in a financial year under the Income-tax Act, 1999.

This relief is given at a higher rate than the rate of total income value. Such relief can be claimed with details of your income in higher Form 10E.

3.2 Who can use it? All registered users on the e-filing portal can provide details of their income on Form 10E to claim relief under Section 89(1) of the Income Tax Act.

4. At a Glance Form 10E consists of seven parts:

1. Personal information- PAN and contact details

2. Consolidation I (arrears) - arrears of salary/family pension

3. Attachment (Advance) - Salary / Family Pension Advance Receipt 4. Annexure-II and IIA (Gratuity) - Payment in the nature of gratuity for past services

5. Figure III (Compensation) - Payment of fewer than 3 years of IV (Pension) from the employer or previous the employer for termination of employment for more than one year or payment as compensation from the previous employer or unchanged part of the tenure.

6. Declaration

0 Comments