Income Tax Exemption Under ChapterVI A for Tax Saving for the F.Y.2021-22. Budget 2021: Significant income tax exemptions and rebates

What is the income tax exemption according to the income tax law?

An exemption from an income tax perspective is an investment/expense that helps reduce the tax payable. As a result of income tax deduction, your total income decreases (which means you have to pay tax on what you have to earn). This will reduce the tax on your total income.

Eligible assessors can claim these exemptions under the Income Tax Act. Eligible access is specified under each category for which a waiver is being claimed. In some cases, it is unique in some organizations or HUF, etc.

You need to claim an income tax deduction when you file your income tax return and you should not be required to disclose separately. To reach the taxable amount, the number of exemptions from the total income has to be reduced.

You may also, like-Automated Income Tax All in One Value of Perquisite Calculator U/s 17(2)

Let's see how the income tax deduction reduces your tax liability:

Section 80C: Exemption for Life Insurance Premium, Contribution to PF, Children's Tuition Fee, PPF, etc.

This is the most popular income tax exemption. The exemption under this section is individual and the maximum amount that can be claimed under HUF approved to 80C is Rs.1,50,000. The various investment and payment options eligible for discounts under this category are:

Paying life insurance premiums

Annual plan of LIC or any other notified insurer (lifestyle, life sustainability, etc.)

UTI's Unit Linked Insurance Plan (ULIP) or ULS 10 (23D) contribution of LIC Mutual Fund

PPF (Public Provident Fund) contribution

Payment for non-transport pending annuity plans

The amount deducted from the salaries of government employees for the purpose of protecting them from deferred anniversaries

SRF / RPF contribution

Pay tuition fees

Repayment of housing loan

Contribute to higher funds

Senior Citizen Scheme Investment

PPF investment

5 years FD investment

Sukanya Samriddhi Yojana investment

Mutual fund (equity-linked savings scheme) investment

Public sector housing finance companies in cities, towns, and villages, and subscription to the notified deposit scheme of the Housing Development Authority

Section 80CC: Income tax exemption for contributions to the pension fund

Income tax exemptions maybe claimed for contributions made to certain pension plans under section 80CC. The cost of duty exemption can be claimed by individuals (residential or non-resident) and must be clubbed under 80CC at an overall ceiling of Rs 1.5 lakh.

You may also, like-Automated Income Tax House Rent Exemption Calculator U/s 10(13A)

Section 80CCD (1): In the case of eligible NPS, an income tax exemption tax for contribution by an individual

Contributions made to eligible NPSaccounts are tax-deductible up to Rs 1.5 lakh under 80CCD (1). This tax benefit is within the overall ceiling of Section 80C.

Section 80 CCD (1B): Additional Income Tax Exemption for Contribution by Individual in case of Eligible NPS

Section 80 CCD (1B) gives you additional tax savings of up to Rs 50,000 for contribution to the NPS account. This is beyond the scope of Section 80C and this is why Section 80CCD has attracted so much attention.

Section 80CCD (2): An Income Tax Exemption for Employer's Contribution to Eligible NPS

The amount that the employer contributes to the NPS account of an employee is also tax-deductible under section 80CCD (2). The maximum discount limit is Rs. 1,50,000.

You may also, like-Automated New Pan Card Application Form 49A in Excel

Section 80D: Income tax benefits for medical insurance premiums

Section 80D is one of the most popular tax-saving options. Benefits are acceptable under this tax

Medical insurance

Expenditure on preventive health examination Exp

Other medical expenses

The facility under this section can be availed for self and family up to a maximum of Rs.1,00,000 overall.

Section 80 DD: Income tax for treatment of persons with disabilities

Section 80 DD provides income tax benefits of Rs. 0005,000 and Rs. 1,25,000 in case of severe disability respectively. The benefit can be taken to cover the medical expenses for disabled-dependent relatives. For covered disease

Section 80EE: Income Tax Exemption for Homeowners

An additional discount of up to Rs 50,000 under Section 80EE is available on interest payments on home loans.

You may also, like-Automated Income Tax Challan ITNS 280 in Excel

Section 80EEA: Income Tax Exemption for First Time Home Buyers

It is proposed to insert a new section in the case of omission of Chapter VI under Article 70. This section contains section 80EEA which allows taxpayers to make additional concessions to repay the interest on the loan taken. Section 24 allows interest rebates on home loans up to Rs 2 lakh, this section allows homebuyers who take home loans and pay interest on the loans at an additional rebate of Rs 1.5 lakh.

Section 80 GG: An income tax deduction for payment of house rent

In cases where HRA (house rent allowance) or RFA (free rental arrangement) income tax benefit has not been availed. A discount of Rs 60,000 per month can be given for discounted housing.

Section 80U: Income Tax Exemption for Persons with Disabilities

A person who is certified by the medical authority or a government physician can claim a rebate of Rs75,000 for being a disabled person. 1,25,000 under this section.

Section 80 TTA: Discount on interest on deposits in savings accounts Maximum Rs.10,000/-

The department allows discounts on interest income on deposits in 60 TTA banks, co-operative banks, or post office savings bank accounts.

Section 80 TTB: Discount on interest from deposits by senior citizens Maximum Limit Rs.50,000/- in case of interest income from deposits for resident senior citizens (60 years and above), Noted that no exemption will be allowed under Section 80TTA.

Feature of this Excel Utility:-

1) This Excel utility prepares and calculates your income tax as per the New Section 115 BAC (New and Old Tax Regime)

2) This Excel Utility has an option where you can choose your option as New or Old Tax Regime

3) This Excel Utility has a unique Salary Structure for Government and Non-Government Employee’s Salary Structure.

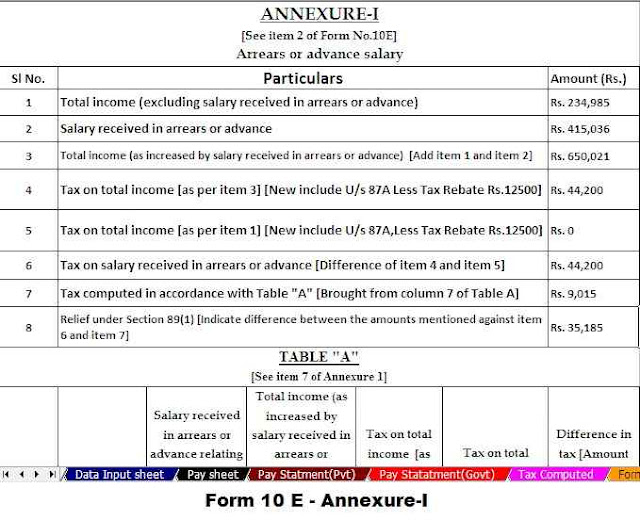

4) Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the F.Y.2000-01 to F.Y.2021-22 (Update Version)

5) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2021-22

6) Automated Income Tax Revised Form 16 Part B for the F.Y.2021-22

0 Comments