Can anyone claim a rent allowance if he/she live in my parents' home? Salary earners

living in a rented house are entitled to tax exemption under House Rent Allowance

(HRA) under Section 10 (13A) of the Income Tax Act, 1961. This discount while

staying at your father's house?

Provisions under the Income Tax Act relating to HRA Under income tax law, if a person is of the majority age, i.e. 18 years or more, and is not dependent on his or her parents, he or she is considered a separate taxpayer in the eyes of the law. The calculation of income varies from income to income and therefore, the amount of HRA will also vary.

You may also, like- Automated Income Tax House Rent Exemption Calculator U/s 10(13A)

If you live in your parents' home, you will need to meet the HRA tax exemptions

1. The house should be in the name of the parents

The salaried person has to be shown as a tenant in the parents' house. Since the owner of the house has to pay the rent, the parents have to own it. The house may be in the name of one or both parents.

2. Rent payments should be sent directly to a bank account or checked in the name of the guardian

In order to claim HRA exemption in this way, salaried employees must have strong evidence that the parents actually paid the rent. In this case, the money transferred by bank transfer or check plays an important role.

3. You need to make a rental agreement with your parents

In order to claim HRA while living in a parent's home, the salaried person must enter into a rental agreement with his or her parent, who owns the home,

4. Rental income will be included in your parents' total income

The rent paid to the parents is taxable for them under the heading ‘Income from home property.’

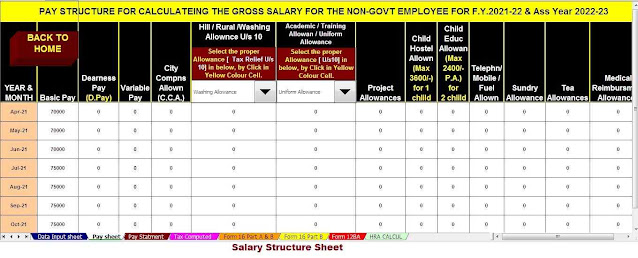

You may also, like- AutomatedIncome Tax Preparation Excel Based Software All in One for the Non-Govt employees for the F.Y.2021-22 as per new and old tax regime U/s 115 BAC [This Excel Utility can prepare at a time your Tax Computed Sheet + Individual Salary Structure as per the all Non-Govt Employees + Automated H.R.A. Exemption Calculation U/s 10(13A) + Automated Form 12 BA + Automated Income Tax Form 16 Part A&B and Form 16 Part B for F.Y.2021-22]

If the parents are in less tax than the salaried person claiming HRA exemption, then the family can save tax completely. If they are over 60 years of age, they will also enjoy a higher minimum income exemption limit (Rs 3 lakh for those over 60 years and Rs 5 lakh for those over 80 years). If they have no taxable income, you will be able to save significant taxes as a family.

How much tax can be saved on house rent?

The amount of HRA that can be claimed as a discount is the lowest of the following:

H Received actual HRA /

Bas 50% for

Paying rent (-) 10% of salary

Documents required claiming a house rent allowance

Rent receipt, if the rent is more than 3000 / month.

The landlord's pan, if the rent exceeds 1 lakh/year.

Important information:

• HRA discounts are available only to salaried persons.

The HRA cannot be claimed if the husband/wife has a home in their name as the husband and wife live together under the Income Tax Act.

Tax HRA is not available under the new tax system

H You can claim discounts on both HRA and home loans. 1.5 lakh as against the original payment and if you are in another city due to a job posting, you will have to pay interest of Rs. 2 lakh.

Even if HRA is not part of your salary, you can claim HRA deduction under section 80GG. This section applies to those who do not receive HRA as part of their salary and self-employed persons

Download Automated Income Tax Salary Arrears Relief Calculator U/s 89(1) with Form 10 E from the F.Y.2000-01 to F.Y.2021-22 [This Excel Utility most handy and easy to generate]

0 Comments