How to save income tax for F.Y 2021-22. We all want to save as much money as possible if it is legally

correct. How to save income tax when saving money for taxpayers is probably one of the most

searched phrases.

Here are some top options every taxpayer should explore to save income tax:

Get the maximum benefit of 80C: If you are planning to save income tax, you must get a maximum benefit under 80C (Rs. 1.5 lakh per annum till now).

One can freely choose the savings instruments of their choice, such as those willing to take financial risk, go for 5-year tax saver FD, life insurance policy or other investment products offering fixed returns.

Those who are not ashamed to take risks can invest in mutual funds under ELSS. There is no difference between the performance of ELSS and a general mutual fund except that the ELSS category fund has a lock-in period of 3 years.

Never ignore the 80CCD: Consider using the maximum limit under the 80CCD

You can compare the performance of all the funds under this section and choose the fund of your choice. 50% of your funds are invested in these market-linked products and 50% in debt instruments such as government bonds.

This ratio is changed each year by the fund manager and 100% of your funds are parked in the debt market until retirement. As an assessor, you are already saving 15,000 tax so what you are earning is actually earning 35,000, so if you save under this category then your actual income is much higher.

However, products under 80CCD are only pension funds, so there are some restrictions on raising funds, you must consider this before investing.

Triple Home Benefits: Owning a home offers three times the benefits of home rent savings, long-term property valuation and tax benefits. If you live in a rental property, your rental costs continue to rise every year, where your EMI is almost constant (unless interest rates change).

Finance Minister Nirmala Sitharaman in her 2021 budget has extended the deadline for additional tax benefits of Rs 1.5 lakh under section 80EEA.

In the 'Housing for All', the government is offering tax exemption of up to Rupees Three Lakh and Fifty Thousand (Rs 2 lakh under section 24(b)), which cannot be ignored.

In addition, if you purchase a residential property, you can save tax under multiple categories according to the following schedule: -

Section Maximum Tax Benefits Tax Saving Component Conditions Section 24 Rs.

80EEA Rs.1,50,000 interest on home loan "- Property stamp duty value should be up to Rs. The amount is under 80EE.

80C Rs.1,50,000 Home Loan Principal - Property should not be sold within 5 years of occupation.

So if you claim all taxes on all the above components, you can claim a maximum income tax exemption of Rs. 5 lakhs In addition, let's take a look at a summary of other income tax protection options: -

In addition, let's look at a summary of other income tax protection options:

Department Details Annual Deduction Limit (in Rupees)

80C comes with the following instruments

150,000 under it

80CCD investment in the national pension system

(NPS), Atal Pension Yojana (APY). 50000

80D "premium for Medical insurance

Yourself, spouse and children. 25,000 (50k if over 60)

80E Interest paid on education loan for oneself, wife or children. Deposit interest

For 8 years only. Unlimited

80EE interest for first-time homeowners.

The price of the house should be 50000

80G grants to various governments. Authorized Charities,

Social and government organizations (can be up to 50% amount

Will be claimed for some companies) Maximum 10% of total revenue

80GG house rented, not private

HRA found and does not own any property.

Rent minus 10% of total income, 25%

Total income or 5000 / month whichever is less.

Feature of this Excel Utility:-

1) This Excel Utility Prepare Your Income Tax as per your option U/s 115BAC perfectly.

2) This Excel Utility has all amended Income Tax Section as per Budget 2021

3) Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the F.Y.2000-01 to F.Y.2020-22 (Updated Version)

4) Automated Calculation Income Tax House Rent Exemption U/s 10(13A)

5) Individual Salary Structure as per the Govt and Private Concern’s Salary Pattern

6) Individual Salary Sheet

7) Individual Tax Computed Sheet

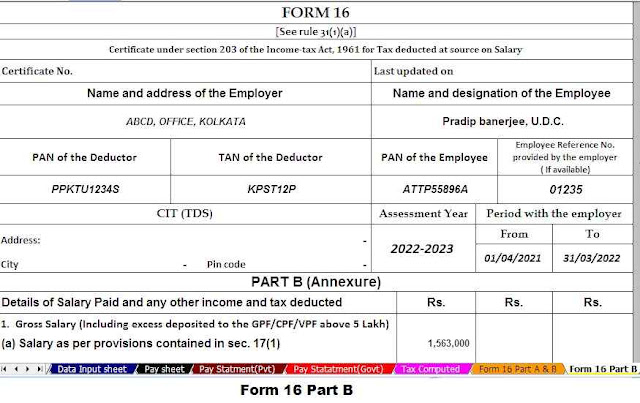

8) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2020-21

9) Automated Income Tax Revised Form 16 Part B for the F.Y.2020-22

10) Automatic Convert the amount in to the in-words without any Excel Formula

0 Comments