Income tax allowances, as well as deductions of salaried persons | Salaried persons, constitute a major part of the overall taxpayers of the country and their contribution to tax collection is significant. Income tax deduction provides many opportunities for tax saving for the salaried class. With these discounts and rebates and one can significantly reduce his taxes.

Exemption of allowance

House rent allowance

A salaried person who has rented accommodation can get HRA (house rent allowance) benefit. However, if you do not live in rented accommodation and still get an HRA, it will be taxable. If you cannot submit the rent receipt to your employer as proof of HRA claim,

You can claim one of the following as an HRA waiver.

A. Total HRA received from your employer

B. Rent paid 10% less (basic salary + DA)

C. 40% Salary for Non-Metros (Basic Salary + DA) and 50% Salary (Basic Salary + DA) for Metros

Standard deduction

In Budget 2018, announced a standard discount amounting to Rs. 40,000 for salaried employees. It was in place of transport allowance (Rs. 19,200) and medical compensation (Rs. 15,000). As a result, salaried employees can get an additional income tax exemption of Rs. 5,800 in FY 2018-19.

The exemption limit has been increased to Rs 50,000 in the interim budget of 2019.

Children's allowance

The employer can provide an education allowance for your children as part of your salary. Such allowances received by the employer for the education of children are tax-free.

However, the employee can claim the maximum amount. 100 per month or Rs. 1200 per annum. Discounts are allowed for a maximum of 2 children.

Approved deduction

Sections 80C, 80CCC and 80CCD (1)

Section 80C is the most popular option for reducing the income tax burden. The following are some of the investments which are eligible for rebates up to a maximum of Rs. 1.5 lakhs under Sections 80C, 80CCC and 80CCD (1).

Life insurance premium

Equity Linked Savings Scheme (ELSS)

Employees Provident Fund (EPF)

Annual / Pension Scheme

Payment of home loan principal

Tuition fees for children

Contribute to PPF account

Sukanya Samridhi Account

NSC (National Savings Certificate)

Fixed Deposit (Tax Savings)

Post office time deposit

National Pension Scheme

Medical Expenses and Insurance Premium (Section 80D)

Section 80D is a deduction that you can claim for medical expenses. One can save tax on medical insurance premiums paid for the health of oneself, family and dependent parents.

Section 80D deduction limits are:

25,000 for premium for self/family.

Rs 50,000 for premium for Rupee Senior Citizen Parents.

In addition, health checks up to Rs 5,000 are allowed and are covered within the overall range.

Discounts up to 50,000 are subject to medical expenses incurred by senior citizens (60 years of age or older) or to senior citizen parents if they are not covered by a Mediclaim policy.

A taxpayer can claim a maximum discount of 50,000 including the amount of premium and medical expenses if he is a senior citizen

(60 years or older). In addition, if he has paid the medical bills of his senior citizen parents, he can claim an additional discount of up to Rs. 50,000

Your employer can pay the premium on your behalf and deduct it from your salary. Such premium paid is deductible under section 80D.

Another key tax-saving tool is house building loan interest. Homeowners have the option to claim money 2 lakh discount for home loan interest for the self-acquired property. If the home property is abandoned, you can claim a deduction for the entire interest associated with such a home loan.

In addition to the above, one can claim the principal component of housing loan repayment as a rebate under section 80C up to a maximum of Rs 1.5 lakh.

Deduction for loans for higher studies (Section 80E)

The income tax law provides a deduction for the interest on education loans. Notable conditions attached to claiming such deductions are that the loan should have been taken by the person himself or his wife from a bank or financial institution for higher studies (in

Grants (Section 80G)

Section 80G of the Income-tax Act, 1961 offers an income-tax exemption to an appraiser who donates to charities. This discount varies depending on the recipient organization, which means that anyone can receive a discount with or without a 50% limit on the amount donated.

Deduction on Savings Account Interest (Section 80TTA)

Section 80TTA of the Income-tax Act, 1961 offers a rebate of up to Rs.10,000 on income earned from interest on savings accounts. This discount is available to individuals and HUFs. If the bank's interest income is less than INR 10,000, the full amount will be approved as a deduction.

Home Loan Interest (Section 80EE)

Section 80EE entitled homeowners to claim an additional exemption of Rs. 50,000 (Section 24) for the EMI interest component of a home loan.

Feature of this Excel Utility:-

1) This Excel Utility Prepare Your Income Tax as per your option U/s 115BAC perfectly.

2) This Excel Utility has all amended Income Tax Section as per Budget 2021

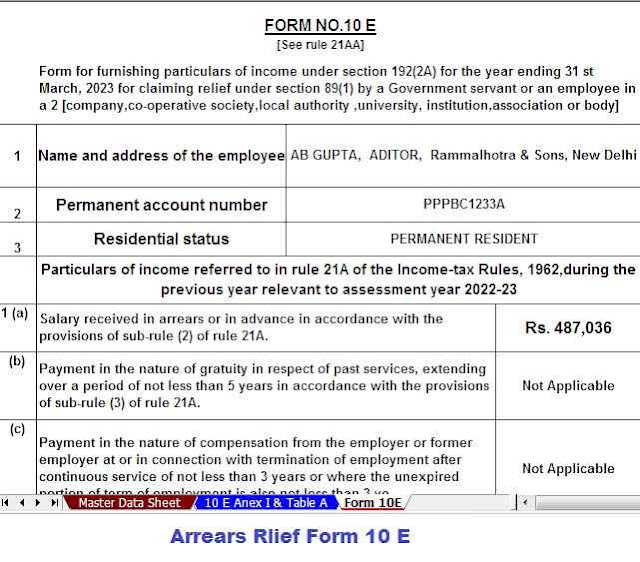

3) Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the F.Y.2000-01 to F.Y.2021-22 (Updated Version)

4) Automated Calculation Income Tax House Rent Exemption U/s 10(13A)

5) Individual Salary Structure as per the Govt and Private Concern’s Salary Pattern

6) Individual Salary Sheet

7) Individual Tax Computed Sheet

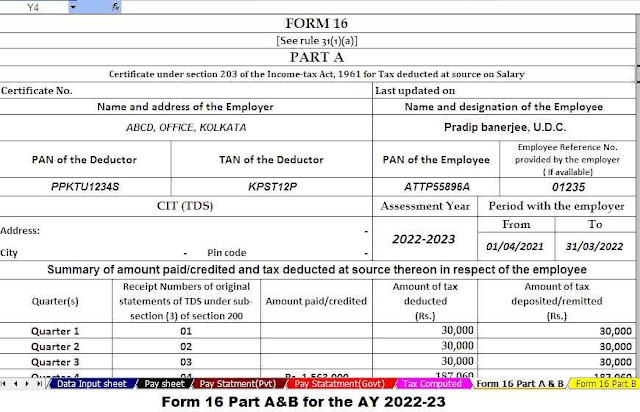

8) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2021-22

9) Automated Income Tax Revised Form 16 Part B for the F.Y.2021-22

10) Automatic Convert the amount in to the in-words without any Excel Formula

0 Comments