Difference between Old and New Tax Regime | ITR filing season has started. This is the first year when you can choose between the old tax system with deductions and discounts and the new tax system without deductions and deductions when you file your ITR. Taxpayers are confused about which one to choose. Let us discuss in detail the features of both regimes.

What the new tax system provides

The new tax system option is available to all individuals and HUFs. This is optional. Under the new tax system, income up to Rs 50,000 is taxable at a lower slab rate. 15 lakh compared to the old regime. Under the new arrangement, tax slab rates of 5%, 10%, 15%, 20% and 25% are applicable on each incremental increase. Starting with a basic discount of Rs 2.50 lakh. Total income is 2.5 lakh to 15 lakh rupees.

If you choose the new tax system, you will have to give up the various tax exemptions and rebates available under the old regime. Under the new tax system, salaried employees will not be able to receive items such as standard deduction, house rent allowance (HRA), vacation travel assistance (LTA) and even certain allowances for duty.

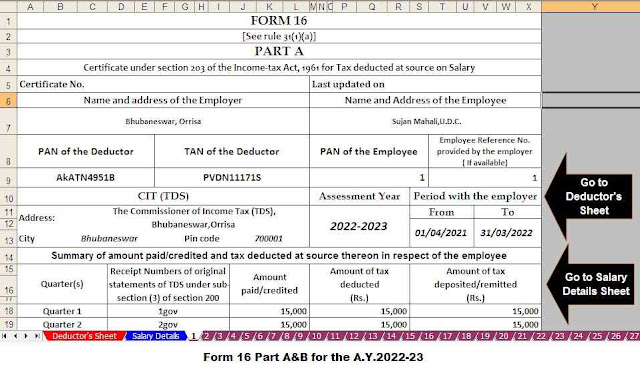

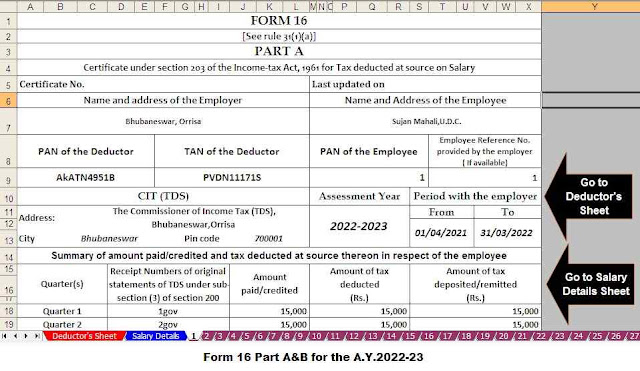

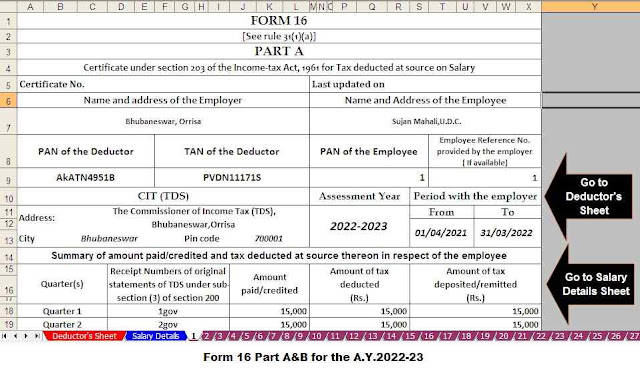

You may also, like- Automatic Income Tax Form 16 Part A&B and Part B for the F.Y.2021-22[This Excel Utility prepare One by One Form 16]

Various under Section 80C (including various items like EPF, LIP, School Fee, PPF, NSC, ELSS, Home Loan Repayment etc.), 80D (for Health Insurance Premium), 80CCD (1) and 80CCD (1B) (for). Discount available NPS) will not be available to both categories of taxpayers such as salaried and self-employed. You also forfeit the home loan interest claim to set off or bear the loss in the case of self-acquired property as well as abandoned property. Also you will not be able to adjust any of the losses incurred against the current income under the new scheme.

Similarly, retired senior citizens cannot claim standard deduction in respect of their previous employment pension. Deductions up to Rs 50,000 under section 80TTB will also not be available for senior citizens for interest from post offices and banks.

How the plan works

Since one can claim different exemptions and deductions and the combination of these tax benefits varies greatly from person to person, a comparative calculation chart cannot be given which shows which system is beneficial. However, considering the tax benefits that most taxpayers have to give up, the benefits available under the current regime are more than the benefits of lower tax rates by shifting to the new system. Let's try to understand its effect with examples.

First of all, let's talk about a salaried person. Since most salaried people either claim the benefit of HRA for the rent paid or probably bought a house with a home loan. Assuming that he has bought a house with a home loan, he will have to repay the principal of Rs. 2 lakh for home loan interest for self-acquired home property.

Considering the fact that he has to give up the standard deduction of Rs 50,000 / -, he has to go to spend money. 4,00,000 / - resulting in tax effect Rs. 80,000 if he is in the 20% tax slab whose income is between Rs 5 million to 10 10 million. Previous Net Tax Profit Tax Liability Rs. More than that. 62,500 under the new project. For those living in the 30% tax slab, the tax effect of 30% of the Missed Benefit will result in tax savings of Rs 1.20 lakh. Earned 37,500 by selecting the new system.

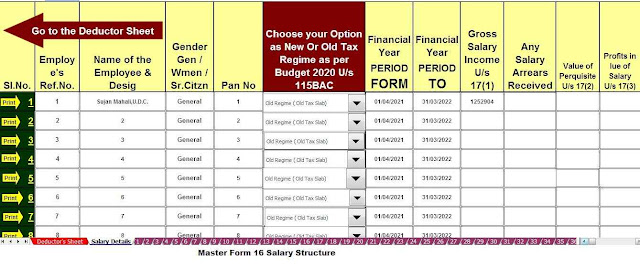

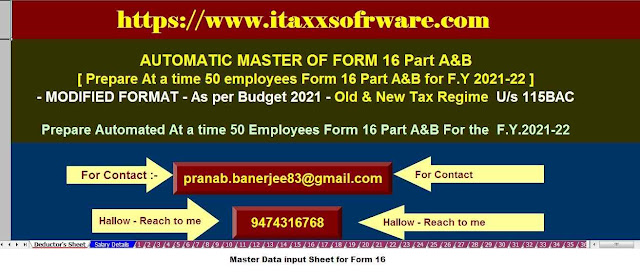

You may also, like- Automatic Income Tax Master of Form 16 Part A&B for the F.Y.2021-22[This Excel Utility prepare at a time 50 Employees Form 16 Part A&B]

However, if he is able to claim the money discount. From the above 2 lakhs he will be able to reduce his total income to 5 lakhs on which he will not have to pay any tax through discount. 12,500 available under section 87A. One can save money by investing two lakh rupees. 32,500 tax under the old system.

Since the salaried will have to give up various benefits like standard deduction, HRA, LTA and will have many essential items like employee future fund contribution, life insurance premium, school fees, home loan principal payments, most of the salaried means staying with the old system. Even for self-employed taxpayers who have an ongoing home loan, there is no point in switching to the new system.

As per above circumstances, the new tax system is only allow for those who have liquidity problems and are not able to take full advantage of under Chapter VI A including 80C, and who have no health insurance and no ongoing home loan. The new arrangement may only be suitable for a few self-employed or HUFs for which no exemption is available under section 87A.

Download and Prepare at a time 100 Employees Automatic Income Tax Master of Form 16 Part A&B for the F.Y.2021-22[This Excel Utility prepare at a time 100 Employees Form 16 Part A&B]

0 Comments