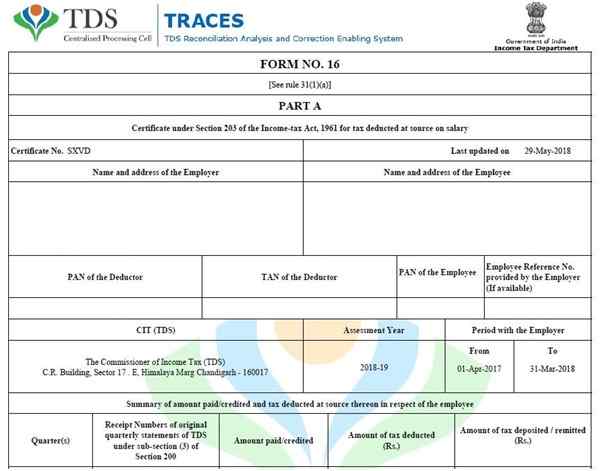

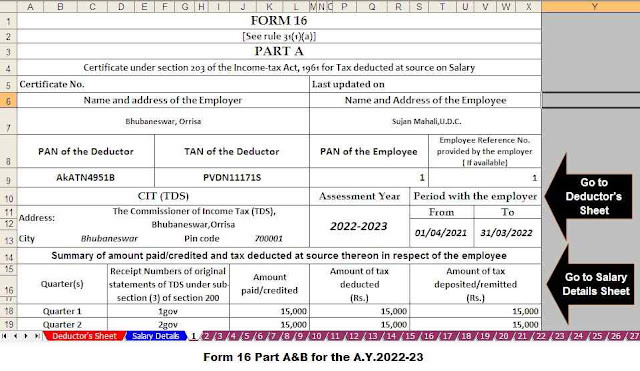

Download at a time 50 or 100 Employees Form 16 Part A and B or Part B for the F.Y.2021-22 |In the financial year 2019-20, the CBDT (Focal Leading Body of Direct Taxes) corrected the provision of Form 16 which is "Pay TDS Authentication". The unit paid to the representative and separately, completes the tax advantage of that area unit declared by the taxpayers.

The payment TDS authentication date is indicated and once performed. The CBDT informed that the new organization of module 16 has a long-term effect as of April 2019.

Is the core offering built within the new tax return organization?

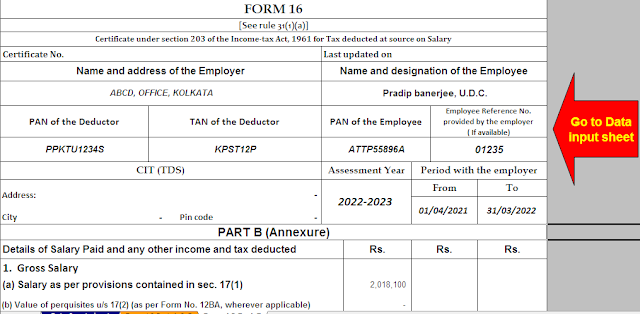

The new Form 16 regime provides full settlement details, such as the u / s 10 home rental premium (13A), travel grant or assistance under section 10 (5).

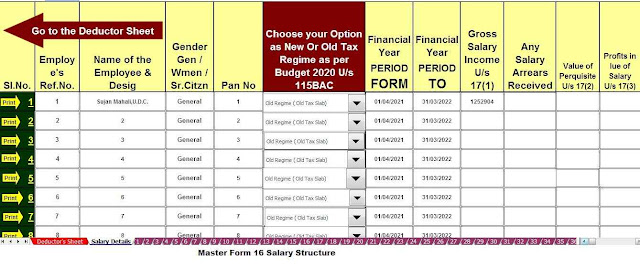

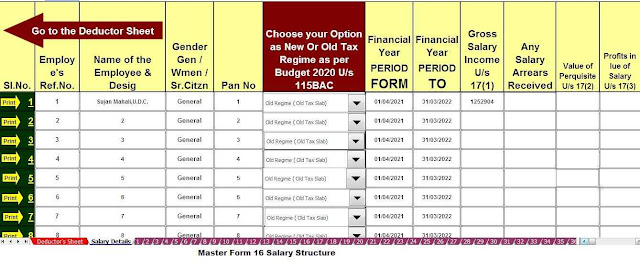

It is noted that as per the new 2020 financial plan, introduced a new section 115 BAC, as well as in this part a new annual tax estimation system based on the new and old tax regime has been introduced. At the moment it is important to know what is the new and the old tax regime?

1) Under the new tax regime, you are not eligible for any annual sector tax benefits except NPS benefits. And apart from that, only for the new tax regime, there was profit in the new tax regime.

2) In the old tax regime, you can enjoy all the benefits of the tax segment, however the tax section will be the old tax part starting from the 2019-20 financial year. In this spending plan, of course, you will provide a choice according to your decision, which is the new and the old tax regime in supported structure no. 10-IE.

At the moment, choose the required annual tax form 16 Excel Based Fully automatic programming according to the new and old tax regime u / s 115 BAC from below -

Or on the other hand

Or on the other hand

Or

0 Comments