Income Tax benefits from Medical Insurance U/s 80 D | The Income Tax Act, 1961, allows personal

income tax deduction by reducing the amount of tax payable. It is important to know the relevant

sections to make the most of these deductions.

What is section 80D?

Section 80D of the Income Tax Act provides for tax deduction relating to medical insurance premiums paid for you and your family members. You can claim a tax deduction for health insurance premiums paid for yourself, your parents, your children and your spouse.

Additionally, this section also allows Hindu Undivided Families (HUFs) to claim a deduction of 80D. If you want to know how you will benefit from this section, read on to know more about Section 80D deductions and the proposed tax deduction.

Which investment comes under section 80D?

Deduction under section 80D of the Indian Income Tax Act can be claimed on the premium paid for a health insurance policy and the cost of preventive health check-ups.

Individuals can also claim a deduction on the health insurance premiums paid for the policies of their parents. The amount of deduction will depend on the age of the main policyholder.

Critical illness coverage available with life insurance plans like health bikers is also covered under Section 80D of Income Tax.

Deduction under section 80D: Deduction of medical expenses

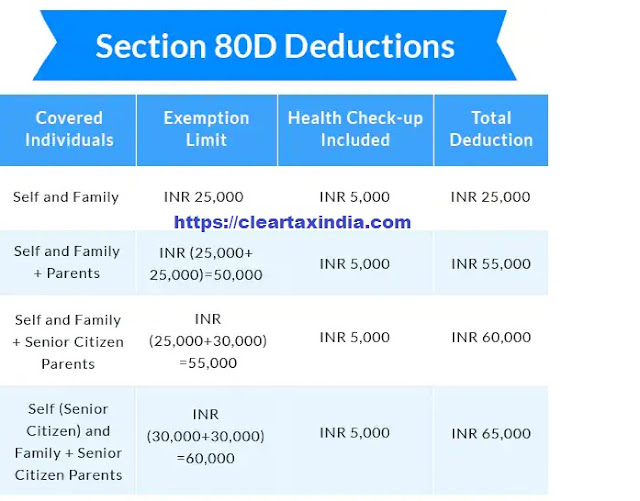

80D deduction pertains to medical insurance policies only. These deductions are shown as follows:

personal and family

If you pay insurance premiums for yourself, your spouse and your children, you can claim a maximum tax allowance of Rs.25,000 per year. In the case of senior citizens, the limit is Rs. 50,000 per annum

If you pay health insurance premiums for your parents, you can claim a maximum tax benefit of Rs 25,000 per year if your parents are below 60 years of age. However, if your parents are elderly, you can apply for tax benefits up to Rs 50,000 per year

Preventive health checkup under section 80D

In 2013-14, the government implemented a preventive health check-up cut to encourage citizens to become more health-conscious. The goal of preventive health check-ups is to detect any disease early and reduce risk factors by consulting a doctor on a regular basis.

Payment for preventive health check-ups under section 80D is deducted at the rate of Rs 5,000. This exemption is limited to Rs 25,000/ Rs 50,000 depending on the situation. Individuals can claim this deduction for themselves, their spouse, their dependent children or their parents. Additionally, cash can be used to pay for preventive health checkups.

80D. additional deduction of

You are eligible to claim an additional 80D income tax deduction of Rs 5,000 for health check-up related expenses. This includes all expenses for the family check-up.

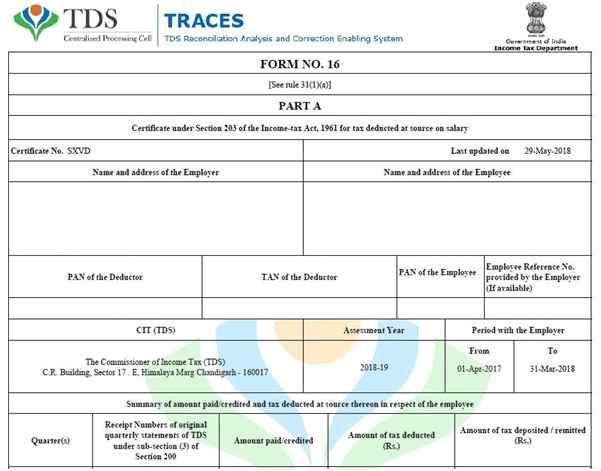

Download and prepare One by One Form 16 Part B for the F.Y.2021-22

What the exclusions are under section 80D?

The exemption U/s 80D is as follows:

If you are making payments on behalf of your grandparents, siblings or working children, you are not eligible for tax benefits. This applies to any other relative not explicitly covered by your policy.

If you are paying your health insurance premiums in cash, you will not be eligible for health insurance tax benefits. Preventive health benefits can also be used with cash payments.

If the company pays a group health insurance premium on behalf of the employee (non-contributory), it will not be eligible for tax exemption. However, if taxpayers choose to pay additional premiums to improve group (contributory) coverage, they can claim tax benefits on the additional amount paid.

You will not be required to avail of any GST and Cess tax benefits on premium payment.

Who is eligible for tax deduction under section 80D?

You are entitled to claim tax deduction under section 80D for yourself, your spouse, your children and your parents. Also, as mentioned above, HUFs can also apply for deduction in this section. Any member of HUF can claim tax deduction on the amount paid towards the health insurance premiums. This deduction is subject to the upper limit under section 80D of the Income Tax Act.

Who is eligible for tax deduction under section 80D of the Income Tax Act, 1961?

Individuals and Hindu Undivided Families (HUFs) can apply for tax deduction from taxable income under section 80D.

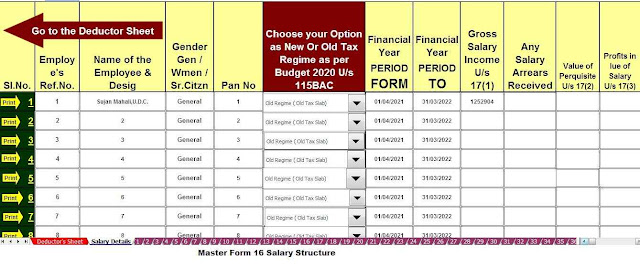

Feature of this Excel Utility:-

1) This Excel utility prepares and calculates your income tax as per the New Section 115 BAC (New and Old Tax Regime)

2) This Excel Utility has an option where you can choose your option as New or Old Tax Regime

3) This Excel Utility has a unique Salary Structure for Government and Non-Government Employee’s Salary Structure.

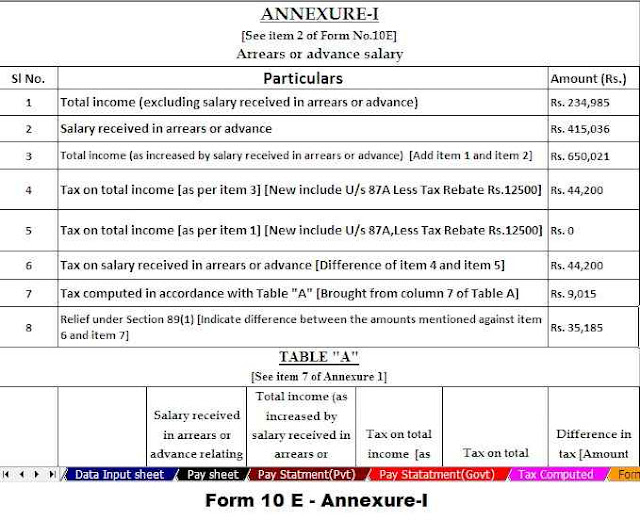

4) Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the F.Y.2000-01 to F.Y.2021-22 (Update Version)

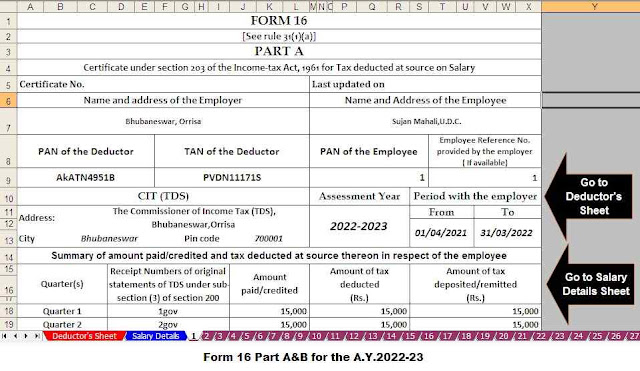

5) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2021-22

6) Automated Income Tax Revised Form 16 Part B for the F.Y.2021-22

0 Comments