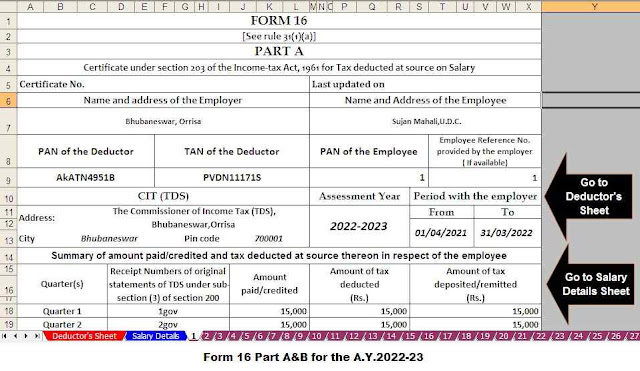

Download Excel Based Automated Income Tax Form 16 for the Financial Year 2021-22|

Pension Fund

This is one of the best investment options to save on taxes. The offered interest rate is 8.5% per annum. The fund cannot be withdrawn for 5 years under certain conditions.

Employers typically contribute 12% of base and DA. The employee's contribution is deducted at the rate of Rs. 1.50.000/- pursuant to section 80C of the Income Tax Act 1961. However, the government has amended the Finance Act 2021 to tax contributions paid in excess of Rs. 2.50.000/-. In addition, the interest on this additional deposit is also taxable. It is also stipulated that the contribution paid by the employer to the pension fund, pension fund and pension fund exceeds Rs. 7.50.000 / - in the year under consideration are also taxed along with interest, dividends, etc. for this excess.

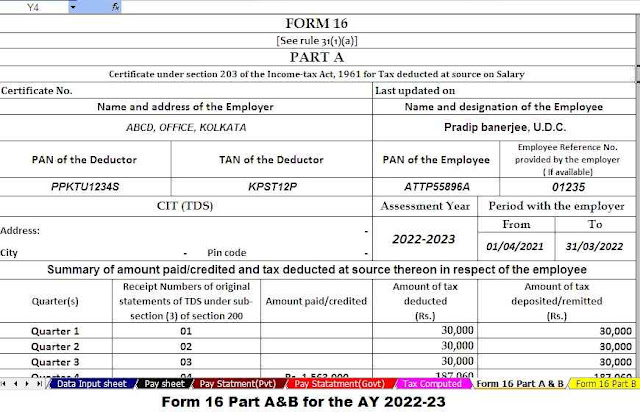

Download and Prepare One by One Income Tax Automated Form 16 Part A&B for the F.Y.2021-22

State Pension Fund

This option is usually available to people who are self-employed or outside of PF's remit. The contribution made is allowed as a deduction under section 80C of the Income Tax Act 1961 at Rs. 1.50.000/-. The offered interest rate is 7.1% per annum. Both the proceeds from the redemption and the interest accrued on the instalment paid are exempt from tax. However, investments are subject to blocking for 15 years and can be partially withdrawn from the 7th year.

Fixed tax deposits

A deduction under section 80C of the Income Tax Act 1961 is also granted for investments made in Tax Saver time deposits of Rs 1,50,000/-. The maturity of these term deposits is 5 years from the date of the investment. Interest earned on these deposits is taxable and TDS must be deducted accordingly.

National Savings Certificate

In favour of the deduction in accordance with Art. 80C also applies to investments made in the National Savings Certificate. As with all other investments, the maximum deduction is Rs. 1.50.000/-. The offered interest rate is 6.8% per annum. Like taxpayer time deposits, interest earned on investments made in a national savings certificate is taxable. However, if the accrued interest is reinvested, it will not be taxed.

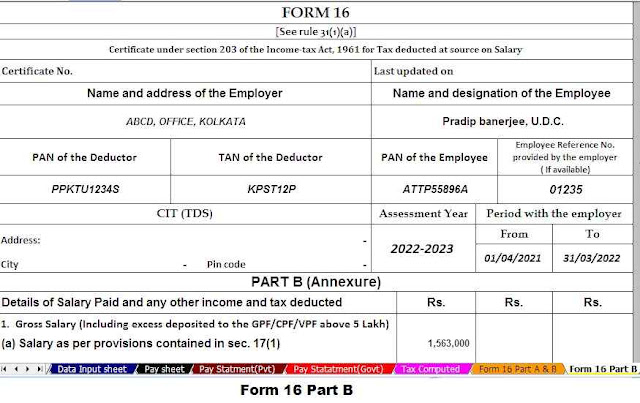

Download and Prepare One by One Income Tax Automated Form 16 Part B for the F.Y.2021-22

Equity-linked savings scheme

This option offers the highest income compared to other available options. At the same time, it also carries a high risk, as investments are made in mutual funds traded on stock markets. The blocking period for investments made is 3 years or 36 months. When mutual funds are redeemed, any capital gains earned are taxed at a rate of 10%. The maximum deduction amount is Rs. 1.50.000 / - according to section 80C

Unit related insurance plans

This is one of the best options available for people who expect a refund along with insurance benefits. It carries less risk than ELSS. Investments may also be deducted under section 80C with a maximum limit of Rs 1,50,000/-. Proceeds payable are also exempt from tax under section 10 (10D). Investments are usually made for a period of 10 years or more.

National Pension Scheme Under this scheme, an additional deduction of Rs. 50,000 is expected to exceed the Rs deduction. 1.50.000 provided Art. 80C. This is a good option for those who are planning to set up a pension fund. Because investments are linked to retirement, the investment freeze period lasts until retirement age.

0 Comments