Income Tax exemption to the disabled person Section 80U is given tax deductions for

those who have at least 40% disability under the law. There are several criteria for this and a specific

set of procedures for claiming this deduction under section 80U.

Section 80U deals with tax deductions for residents of

Definition of disability

Disability is defined as a disability of at least 40% in a person, confirmed by the competent medicalauthorities. Persons with disabilities are defined under the Persons with Disabilities (Equal Opportunity, Protection of Rights and Full Participation) Act, 1995, enacted by the government. Disability is mainly divided into 7 categories:

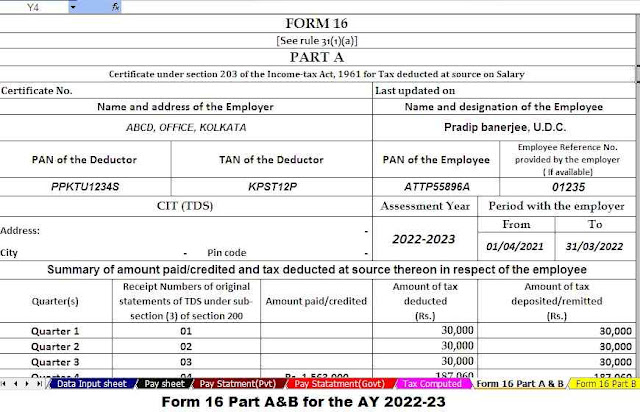

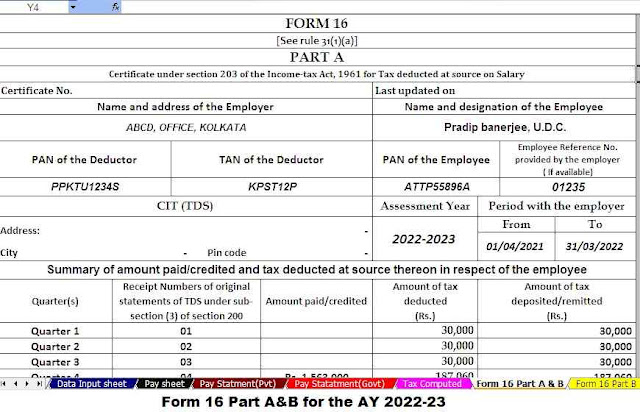

Download and prepare One by One Form 16 Part A&B for the F.Y.2021-22

Poor vision: Poor vision refers to people with visual impairments that cannot be corrected with surgery but can still use their vision with other devices.

Blindness: Blindness is defined as total loss of vision or limited field of vision to an angle of 20 degrees or worse, or visual acuity of less than 6160 after corrective lenses.

Hearing impairment: hearing loss of at least 60 decibels.

Cured of leprosy: People who have been cured of leprosy but have lost sensation in their legs or arms and paresis of the eyelids and eyes. Even the elderly or people with extreme deformities prevent them from engaging in any useful activity.

Mental retardation: people with incomplete or delayed development of mental abilities, resulting in a subnormal level of intelligence.

Musculoskeletal Disability: People with severely limited movement of the limbs due to a disability in the articular muscles or bones.

Mental illness: other mental disorders not associated with mental retardation.

The law also defines severe disability in addition to disability. Severe disability refers to a condition in which a person suffers from 80% or more of the disability in the categories mentioned above. Severe disability also began to include multiple disabilities, cerebral palsy and autism.

Download and prepare One by One Form 16 Part B for the F.Y.2021-22

These Section 80U Exemptions are allowed at Rs 1.25 lakh for severely disabled persons and Rs 75,000 for persons with disabilities.

How can I claim Section 80U benefits?

There are no documentationrequirements other than a certificate from a recognized medical institution confirming the disability. There is no need to submit bills or other itemsincurred as the cost of treatment or any other expenses.

Section 80U gives tax Exemptions for those who have at least 40% disability under the law. There are various criteria for this and a specific set of procedures for obtaining this deduction under Section 80U.

Section 80U deals with tax deductions for residents of

Definition of disability

Download and prepare at a time 50 employees Form 16 Part A&B for the F.Y.2021-22

Disability is defined as a disability of at least 40% in a person, confirmed by the competent medical authorities. Persons with disabilities are defined under the Disability (Equal Opportunity, Protection and Full Participation) Act of 1995, issued by the government. Disability is mainly divided into 7 categories:

Poor vision: Poor vision refers to people with visual impairments that cannot be corrected with surgery, but who can still use their vision with other devices.

Blindness: Blindness is defined as total vision loss or visual field restriction of 20 degrees or worse, or visual acuity below 6160 after corrective lenses.

Hearing impairment: hearing loss of at least 60 decibels.

Healed leprosy: People who have recovered from leprosy but have lost sensation in the legs or arms and paresis of the eyelids and eyes. Even elderly people or people with extreme deformities prevent them from carrying out any user activity.

Download and prepare at a time 50 employees Form 16 Part B for theF.Y.2021-22

Mental retardation: People with incomplete or delayed development of mental abilities, resulting in a subnormal level of intelligence.

Musculoskeletal motor insufficiency: People with severely limited limb movement due to impaired functioning of the joint muscles or bones.

Mental Illness: Other mental disorders not associated with mental retardation.

The law also defines severe disability separately from disability. Severe disability refers to a condition where a person suffers 80% or more of the disability in the above categories. Severe disability also began to include multiple disabilities, cerebral palsy, and autism.

Deductions Section 80U

Section 80U deductions are available at Rs 1.25 lakh for severe disability and Rs 75,000 for people with disabilities.

These limits have been increased from the previous limits of Rs 1 lakh for severe disability and Rs 50,000 for disability. The changes take effect from the 2020-21 evaluation year.

Download and prepare at a time100 employees Form 16 Part A&B for the F.Y.2021-22

How do I get Section 80U benefits?

No documents other than a certificate from a recognized medical institution certifying disability are required. It is not necessary to present invoices or other items incurred as a cost of treatment or any other expense.

However, you need to complete various modules for mental illness and other disabilities. Likewise, Form 10-IA for children with cerebral palsy and autism must be completed.

To make an application, you must provide a medical certificate of disability and a Section 139 tax return for the relevant assessment year.

If your disability assessment certificate has expired, you can still request deductions in the year that the certificate expires.

However, starting next year, a new certificate will be required to benefit from Section 80U benefits.

Certifications can be obtained from government-licensed medical bodies, which may include a physician in neurology, paediatrician, urologist, chief medical officer (CMO), or civil surgeon at a government hospital.

It should be mentioned here that Section 80DD also applies if a person has paid a premium to care for a disabled dependent. Dependent means any member of a united Hindu family (HUF) or siblings, parents, spouse or children. As regards the limits to the deduction, they are the same as those referred to in Section 80U.

Download and prepare at a time 100 employees Form 16 Part B for the F.Y.2021-22

Section 80U Frequently Asked Questions

1. Can a person with a proven disability of 44% receive tax deductions under section 80U?

Yes, you can take advantage of the tax deductions provided in section 80U. It should be noted that the percentage of disability established for the deductions referred to in the section is between 40% and 80%.

2. What is the Section 80U deduction?

Deductions of up to Rs 1.25,000 can be claimed. The indicated amount can be requested if the person has an 80% disability. For people whose disability is greater than 40% and less than 80%, the deduction is Rs 75,000.

3. Have the deduction limits for the disabled changed?

Yes, the deduction limits for the disabled have been changed. The new limits take effect from the 2020-21 assessment.

4. How many categories is the disability divided into?

Disability is divided into seven categories. These are vision problems, blindness, hearing problems, leprosy treatments, mental retardation, impaired musculoskeletal system, and mental illness.

5. Are autism, cerebral palsy and multiple disabilities considered severe disabilities?

0 Comments