Tax savings the right way | This is the time of year when you need to invest in a variety of investment products to secure your tax savings in the fiscal year 2021-22. Or after March, regretting not taking advantage of the various deductions available to you.

Nowadays, no one wants to invest just for tax savings, everyone needs investment products that not only help us save on taxes but also meet our long-term investment needs.

Here is a list of 10 such investment products that will help you double-down on tax savings as well as long-term investments.

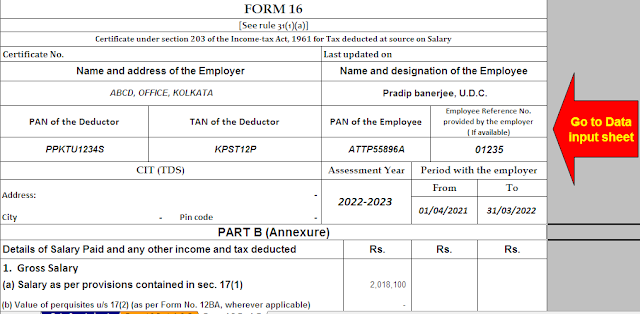

Download and Prepare One by One Form 16 Part B for the F.Y.2021-22

1. Tax Savings Mutual Fund (ELSS) Tax Perspective: - One of the most attractive ways to save on taxes today is to invest in tax saving mutual funds (ELSS). Healthy has a 3-year maturity, which means you cannot sell the fund before the 3-year maturity.

Investment Perspective: -ELSS - Mutual fund with a maturity of 3 years. As we all know, the inherent risk of mutual funds is that they are exposed to market risk. The amount you receive from the sale of the fund will depend on the prevailing market conditions at the time. A mutual fund is commonly known as an average return in terms of risk and average return.

2. National Pension Scheme (NPS) Tax Perspective: - The advantage of investing in NPS is that you get an additional deduction of Rs 50,000/- in addition to the aforementioned deduction for 80C of Rs 1,50,000/-. So this is an attractive option for saving additional fees.

Investment perspective: - The amount invested under the NPS will be repaid in instalments after the person reaches the age of 60, together with interest. The length of time an individual must invest in NPS makes this investment product less attractive to young people. This investment vehicle is one of the best in terms of retirement prospects.

Download and Prepare One by One Form 16 Part A&B for the F.Y.2021-22

3. Real estate investment combined with a real estate loan tax perspective: - Buying a house as an investment has many advantages. First, they are recognized as a deduction in accordance with Art.

Now, if the house is bought on credit, then the person receives a double benefit from the fee paid. The instalment interest amount is allowed as a homeownership deduction, and the installment principal amount is allowed as a deduction under section 80C.

Many people use equity investments and borrow them as a tax planning tool.

Investment Perspective: - Investing in a house is considered to be one of the best investments as its value increases year by year. Also the same can be rented to get a positive cash flow. However, if the same is used as a living room, it is not considered an investment as you will never sell the place where you live.

Download and Prepare at a time 50 Employees Form 16 Part B for the F.Y.2021-22

4. LIP (life insurance premium)

Tax Perspective: - Life insurance premium paid for the year is allowed as a deduction from income received, provided that the total limit is Rs 1,50,000 / - in accordance with section 80C. The redemption value is released under certain conditions

Investment Perspective: The premium is cumulative and the accumulated amount is received along with interest returned at maturity or death, whichever comes first. This investment tool helps protect your family during times of crisis.

5. ULIP (Unit Linked Insurance Plan)

Tax Perspective: - The premium paid ULIP, like LIP, is allowed as a deduction from earned income, provided that the total limit is Rs 1,50,000 / - in accordance with section 80C. The redemption value is released under certain conditions

Investment perspective: – Part of the premium paid is invested in capital market securities, so the maturity depends on market conditions. This investment vehicle helps counter the aspect of inflation that standard LIP payments don't take care of.

Download and Prepare at a time 50 Employees Form 16 Part A&B for the F.Y.2021-22

6. NPF (State Pension Fund)

Tax Perspective: - Paid PPF is allowed as a deduction from earned income, provided that the total limit is Rs 1,50,000 / - in accordance with section 80C. The redemption value is released under certain conditions.

Investment Perspective: -PPF is a win-win in terms of investment. The amount cannot be withdrawn for 12 years unless certain conditions are met. Interest rates vary within 6-7%. The minimum payment amount each year must be Rs 500/- and the maximum Rs 1,50,000/-

7. Term deposits in the mail

Tax Perspective: - The amount invested in the Post Office Time Deposit is allowed as a deduction of u/s 80C subject to a maximum amount of Rs 1.50.000/-. The term of the deposit must be 5 years to be eligible for a tax deduction

Download and Prepare at a time 100 Employees Form 16 Part B for the F.Y.2021-22

8. NSC (National Savings Certificate)

Tax Perspective: - The amount invested under the NSC is allowed as a deduction of u/s 80C subject to a maximum amount of Rs 1,50,000/-.

9. Savings Scheme for seniors

Tax Perspective: - The amount invested under the Senior Savings Scheme is allowed as a deduction u/s 80C up to a maximum of Rs 1,50,000/-

10. Term deposit for tax savings

Tax Perspective: - The amount invested in the fixed tax savings deposit is allowed as a deduction of u/s 80C subject to a maximum amount of Rs 1.50.000/-. These FD tax savings have a validity period of 5 years and cannot be withdrawn before 5 years.

Download and Prepare at a time 100 Employees Form 16 Part A&B for the F.Y.2021-22

0 Comments