Deductions Income Tax Section 80 | A tax deduction is a provision by which you can save the amount

of tax payable to the government. These deductions are based on several factors and depend on the

various investments and expenses made by the taxpayer during the year. These deductions are provided

to encourage people to invest in various schemes and thus help grow the economy on a larger scale.

Section 80 deductions are among the most popular tax deductions available to a taxpayer. Chapter VI A of the Income Tax Act contains various deductions under section 80. These deductions are as follows:

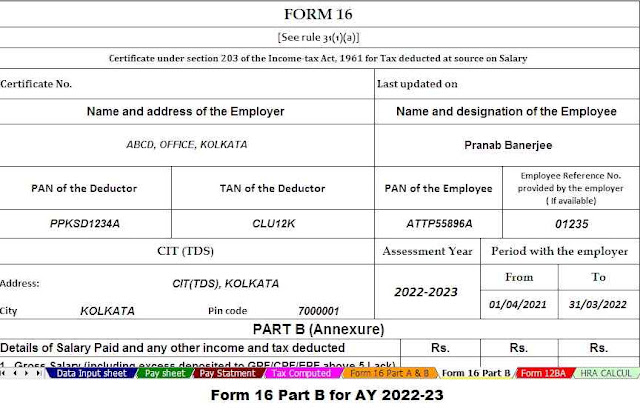

Download and Prepare One by One Income Tax Form 16 Part A&B and Part B for the F.Y.2021-22

Section 80C: Investments

Section 80C investment deductions are available to individuals and a single Hindu family. All taxpayers can apply for a tax deduction in this section of up to Rs 1.5 lakh per year. Tax deductions are available for a variety of investments and expenses, some of which are listed below:

• Life insurance policies for spouses, children or yourself

• Contributions to a savings fund

• Registration fee for up to two children

• Repayment of principal on mortgage loans

• Investments in term deposits for a minimum term of 5 years

• Invest in savings programs for the elderly

• Investments in equity-linked savings plans, etc.

Section 80CCC: Award

Section 80CCC of the Income Tax Act provides tax credits to individuals for investments in LIC annuity plans or any section 10 pension plan (23AAB). However, all pensions received by the fund, interest or bonuses are taxable.

Section 80 CCD (1): Contribution to a retirement account

In this section, a worker can claim a maximum deduction of 10% of his salary (for employees) and 20% of gross income (for self-employed taxpayers) or an amount of 1.5 lakh, whichever is less.

The total deduction available in sections 80C, 80CCC and 80 CCD (1) is limited to INR 1.5 lakh.

Download and Prepare One by One Income Tax Form 16 Part B for the F.Y.2021-22

This section authorizes the taxpayer for a deduction of up to Rs 50,000 on the amount invested in the NPS account, including the Atal Pension Yojana. This deduction is available in excess of the deduction available in the previous sections.

All employers contributing to their employees' pension schemes are granted an additional deduction of up to 14% of their salary with no cap on the maximum salary in case the employer is the central government and in the case of other employers. Work. withheld up to 10% of the amount of the salary without limiting the maximum amount of the salary.

Section 80 TTA: Interest of the Savings Bank

Individuals and HUF are entitled to this tax deduction under section 80TTA up to a maximum of Rs 10,000 relating to interest income from savings account at a bank, cooperative or post office. This deduction does not apply to interest income on term deposits, regular deposits or corporate bonds.

Download and Prepare at a time 50 Employees Income Tax Form 16 Part A&B for the F.Y.2021-22

Section 80GG: Payment of the rent of the accommodation

This deduction is available for people who do not receive any HRA from their employers and live in rented accommodation, subject to payment of 25% of the total adjusted income either Rupees Five thousand per month, whichever is less.

Section 80E: Interest Paid on Student Loans

This section provides for deductions for loans contracted by the taxpayer to himself, his spouse or student children for the continuation of higher studies. This deduction is valid for a maximum period of 8 years or until the full interest has been paid, whichever comes first. There is no limit to the amount of the deduction and all interest paid will be allowed as a deduction.

Section 80D: Health Insurance

Individuals, as well as HUF, are eligible for a deduction of Rs 25,000 under section 80D for health insurance investments for themselves, their spouse or their dependent children. An additional discount of Rs 25,000 applies to parents under the age of 60, while a deduction of Rs 50,000 applies to parents over the age of 60.

In the event that the taxpayer and parent are over 60, the applicable deduction amount is Rs 1 lakh.

Download and Prepare at a time 50 Employees Income Tax Form16 Part B for the F.Y.2021-22

Section 80U: Physical Disability

All physical handicaps, including blindness and mental retardation, must be taken into account in the tax reduction under this section of Rs 75,000 for the Qualified Person. The amount of the tax credit is further increased to Rs 1.25,000 in case of severe disability.

Section 80G: Donations

Tax deductions of 50% and 100% apply to donations to various social causes in accordance with Section 80G. However, cash donations not exceeding Rs 2,000 are applicable for this discount only. Donations over Rs 2,000 must be made by other means to qualify for a tax deduction.

Here are some of the known donations that are considered 100% tax-deductible:

• The Prime Minister's National Relief Fund

• National fund for municipal consent

• University / recognized educational institution of national importance

• Zila Sakshartha Samiti with the district collector as president

• State Fund for Medical Assistance to the Poor

• National Fund for Patient Care

• National Council for Blood Transfusions

• National Foundation for the Wellbeing of People with Autism, Cerebral Palsy, Mental Retardation and Multiple Disabilities

• National Foundation for Sport

• National Foundation for Culture

• Fund for the development and application of technologies

• National Fund for Children

• Swah Bharat Kosh

• Bottom "Clean

Here are some important donations that can benefit from the 50% deduction:

• Jawaharlal Nehru Memorial Foundation

• Prime Minister's Drought Fund

• Indira Gandhi Memorial Foundation

• Rajiv Gandhi Foundation

Therefore, if a taxpayer contributes to any of these charitable causes, a total contribution of 50% of the contribution will be allowed as a deduction from his taxable income.

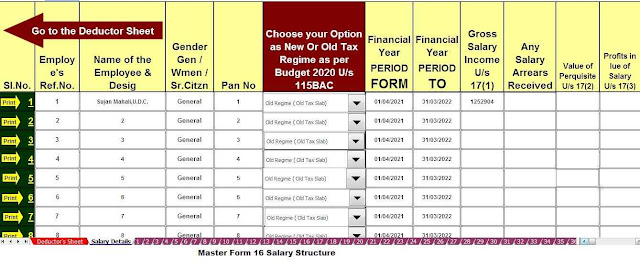

Feature of this Excel Utility:-

1) This Excel utility prepares and calculates your income tax as per the New Section 115 BAC (New and Old Tax Regime)

2) This Excel Utility has an option where you can choose your option as New or Old Tax Regime

3) This Excel Utility has a unique Salary Structure for Government and Non-Government employees Salary Structure.

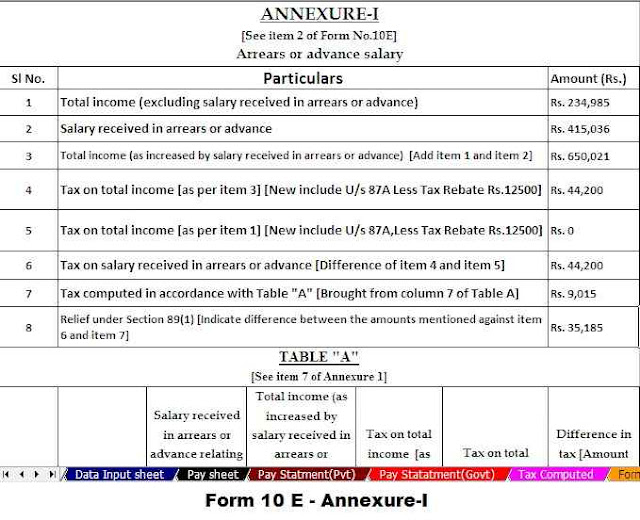

4) Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the F.Y.2000-01 to F.Y.2022-23 (Update Version)

5) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2022-23

6) Automated Income Tax Revised Form 16 Part B for the F.Y.2022-23

0 Comments