Income tax rebate U/s 87A | The Income Tax Act of 1961 allows for several types of tax credits so that

taxpayers can reduce their taxable income and therefore their tax liability. One such provision under

the Income Tax Act is the tax credit permitted under section 87A of the Act. Let's see what this

discount is about –

What is the u/s 87A tax credit?

A tax deduction is a type of discount offered on your tax liability. If your annual income, net of deductions and exemptions, does not exceed INR 5 lakh, you may claim a tax credit under section 87A on your tax liability. With the tax credit available under Section 87A, your tax liability becomes void if your net annual income does not exceed INR 5 lakh.

You may also like – Automated Income Tax Form 16 Part B for the F.Y.2021-22[This Utility can prepare at a time 50 Employees Form 16 Part B]

Allowable discount amount u/s 87A

The allowable discount amount for u/s 87A will be the lower of the two:

• The amount of tax payable, or

• INR 12,500

By applying the tax credit amount, your tax liability will be zero.

Things to Remember When Applying for an 87A Tax Credit

The tax credit available under section 87A of the Income Tax Act of 1961 gives you the benefit of zero taxation if you have a limited income. However, before you claim a discount, here are a few things you should keep in mind:

• Resident Indian taxpayers may only benefit from the rebate in accordance with Section 87A.

• The rebate will apply to tax liabilities calculated before the end of health care and education.

• Taxpayers under the age of 60 and between the ages of 60 and 80 can claim this discount.

• Taxpayers aged 80 and over, ie the very elderly, are not eligible for the discount.

• You may qualify for a discount under the old or new tax regime.

• If your tax liability is less than the rebate amount, you are not eligible for a refund. In these cases, the discount will be equal to the calculated tax liability.

• Rebate is only available if your taxable income does not exceed INR 5 lakh. If your taxable income is more than INR 5 lakh, you will have to pay tax on your total income without any discount.

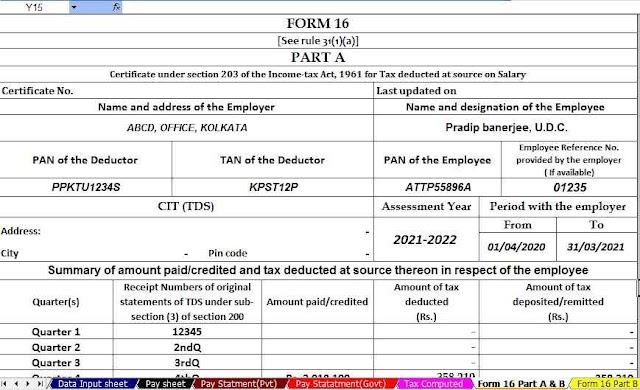

You may also like – Automated Income Tax Form 16 Part A&B for the F.Y. 2021-22[This Utility can prepare at a time 50 Employees Form 16 Part A&B]

How can you get the u/s 87A tax credit on your income?

Here are the detailed steps by which you can claim an available tax credit on your tax liability:

• List all the income you have earned during the financial year and categorize them into the appropriate headings.

• Sum up the total income you have earned from all sources.

• Subtract eligible income deductions and exemptions to find your net taxable income.

• Calculate your tax liability on your net taxable income if it exceeds the INR 2.5 lakh threshold.

• If your net taxable income is INR 5 lakh or less, apply for an estimated tax credit or INR 12,500, whichever is less.

Eligibility Criteria for Section 87A Discount

To qualify for the u/s 87A tax credit, the following eligibility criteria must be met:

• You must be an Indian taxpayer

• Your age must not exceed 80 years

• Your net taxable income, ie income after eligible deductions and exemptions, must be up to INR 5 lakh.

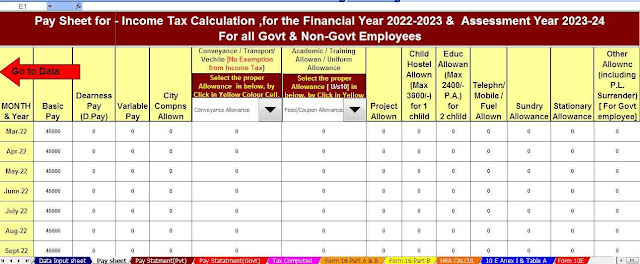

Feature of this Excel Utility:-

1) This Excel utility prepares and calculates your income tax as per the New Section 115 BAC (New and Old Tax Regime)

2) This Excel Utility has an option where you can choose your option as New or Old Tax Regime

3) This Excel Utility has a unique Salary Structure for Government and Non-Government employees Salary Structure.

4) Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the F.Y.2000-01 to F.Y.2022-23 (Update Version)

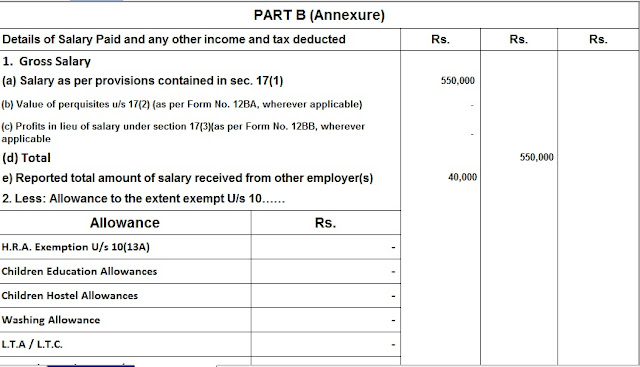

5) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2022-23

6) Automated Income Tax Revised Form 16 Part B for the F.Y.2022-23

0 Comments