Section 80 TTA - Exemption for Savings Interest | 80TTA Complete Guide: Definitions, Limits,

Eligibility, Exceptions for the Fiscal Year 2022-23 (A..Y 2023-24

A savings bank account is like a digital piggy bank where interest is earned. Most people have savings bank accounts, but most of them are not aware of the taxation of accrued interest on savings accounts. Interest earned from savings accounts is taxed based on income from other sources and interest deduction u/s 80TTA is also allowed.

What is the 80TTA section?

Section 80TTA of the 1961 Income Tax Act provides for the deduction of interest earned from savings accounts in banks, cooperatives or post offices, up to Rs 10,000/-. No FD interest discount available u/s 80TTA. This deduction is allowed for all individuals and HUFs other than super seniors (aged 60 and over) as they have a separate 80TTB Part deduction for themselves.

Section 80TTA was introduced in 2013 as part of the Finance Act which was passed that year and came into effect from the 2012-13 fiscal year onwards and remains in effect.

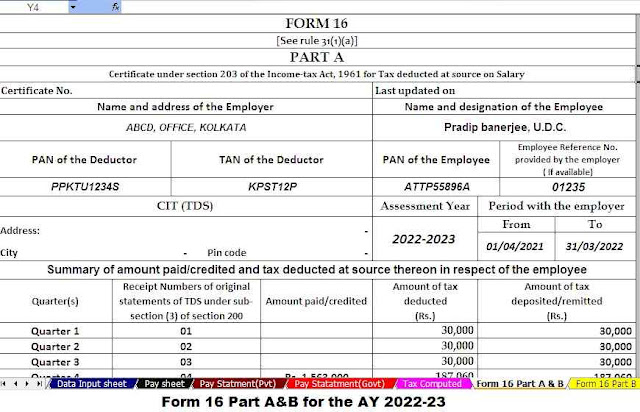

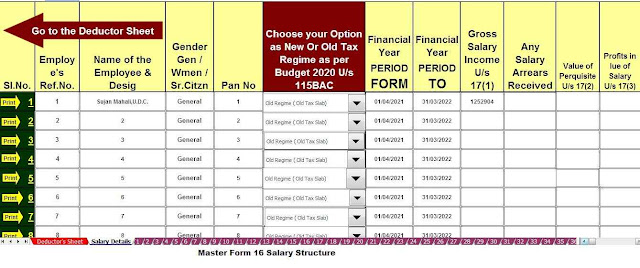

Download and Prepare at a time 50 Employees Form 16 Part A&B for the F.Y. 2021-22 in Excel

Who can take advantage of the discount under the 80TTA section?

Undivided Hindu individuals or households (HUF) can claim a deduction of less than 80 TTA on interest earned on all their bank and postal accounts.

Can an NRI request a deduction of fewer than 80 TTA?

Like Indian residents, non-resident Indians (NRIs) are also eligible for a reduction of up to 80 TTA.

The 80TTA benefit is only available in NRO savings accounts. Please note that no deductions are allowed on NRO time deposits.

How much is the reduction amount of 80TTA u/s?

A deduction of Rs 10,000 u/s 80TTA on interest earned from savings accounts is allowed. If one has several savings accounts with different banks, the maximum deduction that can be claimed for all savings accounts combined is Rs 10,000/-.

The reduction under the 80TTA section is higher than the 1.5 lakh limit of the 80C section.

Download and Prepare at a time 50 Employees Form 16 Part B fort he F.Y. 2021-22 in Excel

What organizational savings accounts does Section 80TTA cover?

Savings accounts with the following institutions fall under Section 80TTA:

Banks: Banking companies established under the provisions of the Banking Regulations Act, 1949. This includes all banks and banking institutions established under Section 51 of the same law.

Post Office: All Indian government post offices that have a savings account.

Cooperatives: Cooperatives that are registered by the government and are eligible to have a savings account as a feature of their banking system.

What are the exceptions to 80TTA?

The exceptions to 80TTA are:

Deposits in non-bank financial companies

Fixed deposit interest (FD)

Interest from Recurring Deposit (RD)

Download and Prepare at a time 100 Employees Form 16 Part B for the F.Y. 2021-22 in Excel

Q- If I have a savings account with the Cooperative, am I entitled to a tax deduction under Section 80TTA?

Yes, you are eligible for tax deductions under Section 80TTA if you have a savings bank account with a registered Cooperative.

Q- My annual income is below the minimum annual tax threshold, do I have to pay tax on interest earned from my savings account?

No, as long as your total annual income is not below the lower tax threshold. You do not have to pay tax on interest earned from your savings account even if it exceeds Rs.10,000/- as there is no taxable income.

Q- If the appraiser has earned capital gains or income from homeownership, etc, can 80 TTA be claimed?

80 TTA can only be requested if the appraiser has earned interest income on the savings account.

Q- Can seniors apply for 80TTA?

No, deductions can be claimed by seniors up to Rs.50,000 under 80 TTB share.

Q- Can 80TTA be claimed by NRI?

Yes, Section 80TTA can be claimed by NRIs like Indian residents.

Q- How many bank accounts can I request for a deduction under the 80TTA section?

In the 80TTA section, the limit is on the interest amount and not on your account amount. Therefore, tax benefits can be claimed for a number of accounts up to an aggregate interest amount of Rs 10,000.

Q- Will TDS be deducted from my interest income?

Ans. No, there is no provision under the Income Tax Act to deduct the TDS on interest income received from savings accounts.

0 Comments