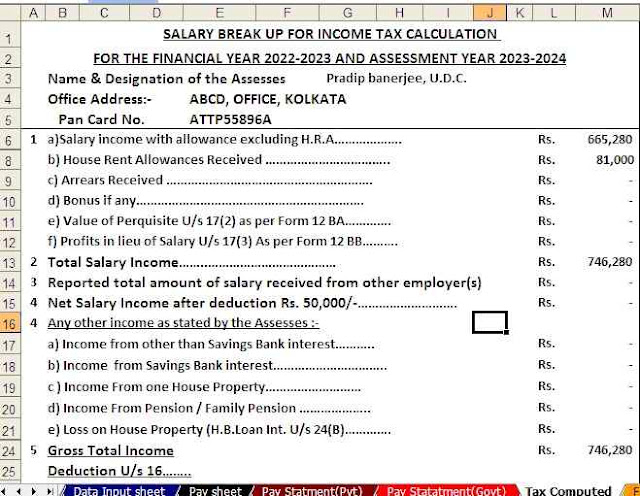

Income Tax Preparation Excel-Based Software All in One for the Govt and Non-Govt Employees for

the F.Y.2022-23

Income tax deductions U/S 80D

Persons under the age of 60 can claim a deduction of up to Rs 25,000 from insurance premiums paid to themselves, spouses and their dependent children. The deduction increases to Rs 50,000 if any of the family members are over 60 years of age. An additional deduction of Rs 50,000 is available for the premium paid for health insurance for dependent parents over 60 years of age. As such, individuals may qualify for a maximum tax deduction of up to Rs 1 lakh under section.

Income tax deduction U/S 80DDB

A tax deduction of Rs 40,000 is available for expenses incurred in the treatment of specific illnesses of one's own family members or dependents. For the elderly (over 60 years old), the limit is increased to 1,00,000 rupees (1 lakh).

This deduction is only available in the case of certain diseases such as cancer, kidney failure, AIDS, haemophilia, dementia, neurological disorder, etc.

Income tax deductions U/S 80E

The deduction is also available on student credit for higher education (undergraduate or graduate) in medicine, engineering, business, or science. The deduction is available from the 1st year and then for the next 7 years. The deduction available on the EMI is paid as interest on the loan.

Income tax deduction U/S 24

Deductions up to Rs 2,00,000/- (Rs 2 lakh) are available on interest paid on a loan used to buy/build your own home. However, the purchase and construction of this house must be completed within 5 years from the end of the year in which the Home Loan was taken. The amount must have been borrowed on or after 04/01/1999 to be eligible for the deduction.

Income tax deduction U/S 80EEA (does not apply to the 2022-23 tax year)

Additional deduction of Rs 1,50,000 for affordable housing up to 45 lakhs. The deduction applies to loans taken between April 1, 2020, and March 31, 2022. However, the exemption has not been extended to FY 2022-23.

Income tax deduction U/S 80EEB

The deduction is only available to individuals through an electric car loan. The interest payable on such a loan is deductible, but not more than Rs 1,50,000/-. The loan must be used between 04/01/2019 and 03/31/2023. The loan must be authorized by a financial institution and must only be used to purchase an electric vehicle.

Only the interest paid is allowed as a deduction.

Income tax deduction U/S 80EE

A tax deduction of Rs 50,000/- on interest paid on a mortgage loan is available to first buyers for loans up to 35 lacs, provided that the value of the property does not exceed 50 lacs. This deduction is more than Rs 2,000,000 from the interest paid on the loan. The deduction is granted for the financial year until the period of full repayment of the loan.

The loan must be approved by a financial institution or housing finance society. In addition, the Credit must be authorized between 04/01/2016 and 03/31/2017 to be eligible for the deduction.

U/S 80G Income tax deductions

Deductions also apply to donations made to notified NGOs, charities are eligible for a 50% or 100% deduction as required by law. However, in institutions where the “cap” clause applies, the maximum allowable deduction is 50% or 100% (as applicable) of 10% of total adjusted gross income after other deductions have been declared. The deposit must be made through a digital platform or check in order to claim a deduction.

Some of the scheduled funds where 100% deduction is available without qualifying limit;

#National Defense Fund

#PMCares Foundation

#Prime Minister Relief Fund

#Swatch Bharat Kosh

#National Foundation for the Relief of the Sick

#National Children's Fund

# Clean denim background

(Incomplete list)

Income tax deductions U/S 80GG

The available deduction from the paid rent of the house, whichever of the following:

• The rent is less than 10% of the total rent.

• 5000/- per month. (Maximum allowable deduction 60,000/-)

• 25% of total income provided that;

The Assessor, their spouse, or minor child must not have housing at their place of work or other location where the Assessor lives, and should not receive a rental allowance.

In addition, the deduction is available as long as the individual does not receive any U/S 10 (13A) rental deductions.

Income tax deductions U/S 80TTA

Deduction from total gross income up to a maximum amount of Rs. 10,000/- is allowed on interest earned on deposits in a savings account (non-term deposits) at a bank, cooperative or post office.

Interest earned on savings and term deposits is deductible for pensioners. The deduction limit has been increased to Rs 50,000 in accordance with section 80 of the TTB.

U/S 80DD and U Income tax deductions

A deduction of Rs 75,000 U/S 80DD is available to cover expenses and treatment of dependents with disabilities. In case of severe disability (more than 80%), the deduction limit increases to Rs 1,25,000/-.

A deduction of Rs 75,000 U/S 80U is available to cover the costs and treatment of any disability suffered by a resident individual (car). In case of severe disability (more than 80%), the deduction limit is Rs 1,25,000/-.

Feature of this Excel Utility:-

1) This Excel utility prepares and calculates your income tax as per the New Section 115 BAC (New and Old Tax Regime)

2) This Excel Utility has an option where you can choose your option as New or Old Tax Regime

3) This Excel Utility has a unique Salary Structure for Government and Non-Government employees Salary Structure.

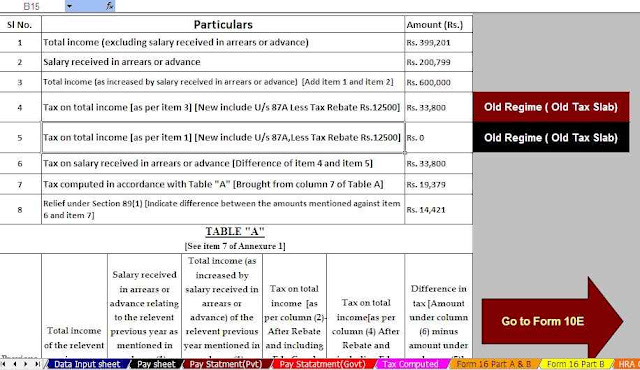

4) Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the F.Y.2000-01 to F.Y.2022-23 (Update Version)

5) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2022-23

6) Automated Income Tax Revised Form 16 Part B for the F.Y.2022-23

0 Comments