Section 80CCD(1B) Deduction: National Pension Scheme (NPS) tax credits

The income tax law prescribes various forms of deductions that help reduce your tax liability. There are a number of prescribed investments and expenses that you pay from your income that are allowed as investments or deductible expenses. Since these investments and expenses are deducted from your income, your taxable income is reduced. As your taxable income decreases, you pay less taxes.

What is Section 80 CCD(1B)?

In terms of deductions, some of the most popular deductions are found in Chapter VIA of the Income Tax Act. This chapter contains Section 80 deductions. Section 80C is a very popular section that allows you to deduct up to INR 1.5 Lakh for various types of investments and expenses. There is another section, Section 80 CCD (1B), which allows an additional deduction of INR 50,000 in addition to the deduction available in Section 80C for INR 1.5 lakh. A deduction under Section 80 CCD (1B) is allowed if you invest in the National Pension Scheme (NPS) offered by the Government of India.

Do you know what NPS investing is? Let's figure it out soon

Download and Prepare at a time 50 Employees Form 16 Part B for the Financial Year 2021-22

What is an NPS scheme?

The National Pension Scheme is a public investment scheme that helps plan for retirement. You can invest in the scheme while you are working, and then the scheme will create housing for your pension. The corpus can then be used to provide a regular income in the form of annuities.

Eligibility to invest in the NPS scheme

The investor must be between 18 and 60 years of age. However, in the case of an NRI, if the NRI's nationality changes after the NRI invests in the scheme, the scheme will be terminated.

Invest in NPS

Investments in NPS can be made through a financial institution acting as a Point of Presence (POP). Almost all banks and non-bank financial companies are authorized to act as POPs. POP has specialized agencies that collect NPS deposits from investors. These agencies are called Point of Presence Service Providers or POP-SPs. The POP-SP list can be found online at the scheme's official website https://www.npscra.nsdl.co.in/pop-sp.php - no application form, ID, or proof of age. and proof of residence.

Section 80 CCD(IB) Deductions

Section 80CCD(1B) Deduction: National Pension Scheme (NPS) tax credits

The income tax law prescribes various forms of deductions that help reduce your tax liability. There are a number of prescribed investments and expenses that you pay from your income that are allowed as investments or deductible expenses. Since these investments and expenses are deducted from your income, your taxable income is reduced. As your taxable income decreases, you pay less taxes.

Download and Prepare at a time 50 Employees Form 16 Part A&B for the Financial Year 2021-22

What is Section 80 CCD(1B)?

In terms of deductions, some of the most popular deductions are found in Chapter VIA of the Income Tax Act. This chapter contains Section 80 deductions. Section 80C is a very popular section that allows you to deduct up to INR 1.5 million for various types of investments and expenses. There is another section, Section 80 CCD (1B), which allows an additional deduction of INR 50,000 in addition to the deduction available in Section 80C for INR 1.5 lakh. A deduction under Section 80 CCD (1B) is allowed if you invest in the National Pension Scheme (NPS) offered by the Government of India.

Do you know what NPS investing is? Let's figure it out soon

What is an NPS scheme?

The National Pension Scheme is a public investment scheme that helps plan for retirement. You can invest in the scheme while you are working, and then the scheme will create housing for your pension. The corpus can then be used to provide a regular income in the form of annuities.

Eligibility to invest in the NPS scheme

The investor must be between 18 and 60 years of age. However, in the case of an NRI, if the NRI's nationality changes after the NRI invests in the scheme, the scheme will be terminated.

Invest in NPS

Investments in NPS can be made through a financial institution acting as a Point of Presence (POP). Almost all banks and non-bank financial companies are authorized to act as POPs. POP has specialized agencies that collect NPS deposits from investors. These agencies are called Point of Presence Service Providers or POP-SPs. The POP-SP list can be found online at the scheme's official website https://www.npscra.nsdl.co.in/pop-sp.php - no application form, ID, or proof of age. and proof of residence.

Download and Prepare at a time 100 Employees Form 16 Part B for the Financial Year 2021-22

NPS account type

When you invest in the National Pension Scheme, you will have two accounts to choose from. These accounts are:

Level I account

A Tier I account is a mandatory account that you would have to invest in if you were to invest in the National Pension Scheme. The minimum investment required for this account is INR 500 at one time and INR 1000 for one year.

Tier II account

A Tier II Account is a voluntary account that you can invest in after you invest in a Tier I Account. The minimum investment amount for a Tier II Account is INR 250 at any given time. No minimum investment per year is required. A minimum deposit of INR 1,000 is required to open an account.

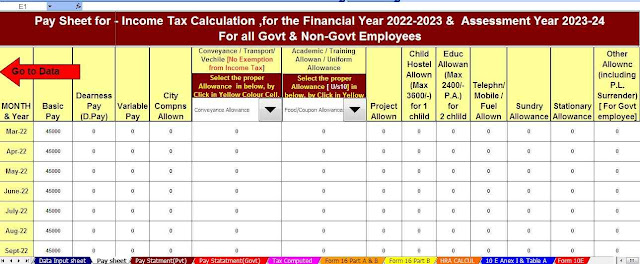

Feature of this Excel Utility:-

1) This Excel utility prepares and calculates your income tax as per the New Section 115 BAC (New and Old Tax Regime)

2) This Excel Utility has an option where you can choose your option as New or Old Tax Regime

3) This Excel Utility has a unique Salary Structure for Government and Non-Government employees Salary Structure.

4) Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the F.Y.2000-01 to F.Y.2022-23 (Update Version)

5) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2022-23

6) Automated Income Tax Revised Form 16 Part B for the F.Y.2022-23

0 Comments