Tax Savings tips for the F.Y.2022-23 | How to save tax or rather how to plan your investment is a

question that bothers each one of us. While tax planning is crucial, taxes saving schemes are also

essential. You can save tax and earn returns with the best tax-saving schemes in

plan for tax-saving investments is the beginning of the financial year. This will ensure you don’t pay

more taxes and save taxes in

While we all aim to save taxes in

While planning on how to save tax in

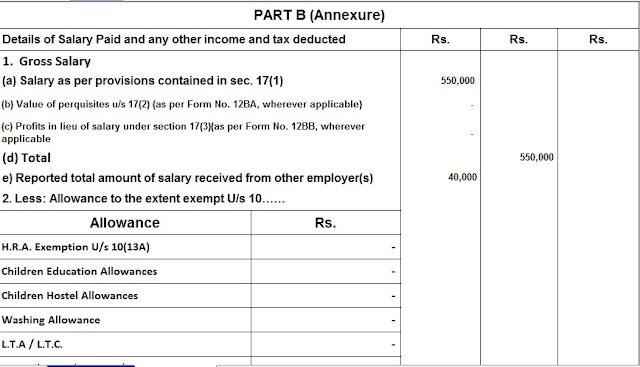

You may also like- Automated Income Tax Form 16 Part B One by One Preparation software in Excel for the F.Y.2021-22

1. Unit Linked Insurance Plan (ULIP)

ULIP Life Insurance Plan is one of the most important investment plans in

Under section 80C of the income tax act 1961, the premium paid towards the purchase of a life insurance policy qualifies for deduction up to Rs. 1.5 lakh. Furthermore, as per section10(10D) income on the maturity of the policy is tax-free. The income is tax-free if the premium is not more than 10% of the sum assured. In the case wherein the money goes to the nominee of the person insured, the same remains as a tax exemption in the hands of the nominee.

In terms of the deduction under section 80C 1961, the taxpayer can claim 20% of a tax deduction on the premium paid. The following conditions also apply:

1. The taxpayer purchases a life insurance policy on or before 31st March 2012

2. The policy is in his own name or in the name of their spouse or child

If the life insurance policy is purchased after 1st April 2012, then the premium paid is eligible for tax deduction up to 10% of the sum assured.

2. ELSS Mutual Funds

Equity Linked Savings Schemes are mutual fund investment schemes that invest a large percentage of their portfolio in equity. Furthermore, the fund has a mandatory lock-in period of 3 years which is the shortest among all the investment products.

Investment in ELSS funds qualifies for deduction under section 80C of the income tax act up to a maximum of Rs. 1.5 lakh. Both lump sum investment and the amount invested through a systematic investment plan (SIP) qualify for the deduction. Since ELSS funds invest a large amount in equity, there is always some inherent risk.

ELSS funds provide the dual benefit of capital appreciation and tax savings. This makes it one of the most popular tax-saving schemes amongst investors.

You may also like- Automated Income Tax Form 16 Part A&B One by One Preparation software in Excel for the F.Y.2021-22

In general, taxpayers who want to claim tax deductions of up to Rs 1.5 lakh under Section 80C provisions and are willing to take some risk should consider investing in ELSS. These mutual funds are equity-oriented, and they invest a minimum of 60% of their portfolio in equity and equity-linked instruments. This makes it crucial to be invested in the funds for a long period of time in order to reap the benefit of the returns.

Learn: How to Save Tax by Investing in Mutual Funds

3. Public Provident Fund (PPF)

The Public Provident Fund has always been a popular tax-saving scheme among the taxpayer. One of the major reasons for this popularity is the fact that PPF falls under the category of exempt tax status. You can open your PPF accounts with a bank or post office.

Taxpayers can claim a deduction under section 80C of the income tax act for the amount invested by them during the financial year. The maximum amount eligible for deduction is Rs. 1.5 lakhs. Since PPF falls under the exempt category, the interest and maturity amount are exempt from tax.

PPF account comes with a lock-in period of 15 years and it allows the investors the below options at the end of the maturity period:

Download Automated Excel Based Income Tax Salary Arrears Relief Calculator U/s 89(1)with Form 10E from the Financial Year 2000-01 to the Financial Year 2022-23 (Updated Version)

.jpg)

0 Comments