80GG – deduction on rent paid | 80GG is a deduction under Chapter VI-A of the Income-tax Act, 1961. It was introduced to accommodate persons who do not receive housing assistance, but who pay rent for their accommodation. For example, a person can claim a rent deduction, even if they have not received a mortgage.

A person wishing to claim deductions under this section must be a self-employed person or employee. 80GG allows people to claim a deduction relating to rent paid. The rent paid is for personal occupancy.

Exclusion under Section 80GG

To request an exemption under this section, the following conditions must be met:

The person cannot receive housing benefits from their employer.

The person has filed a petition in Form no. 10BA.

The assessee or his spouse or minor or a member of HUF cannot own a house in the place where he usually resides or performs his office functions or carries on his business or profession.

The assessee cannot own a flat in his own profession, or in any other place, the value of which is to be ascertained in accordance with Sec 23(2)(a) or Sec 23(4)(a).

In other words, if Mr A is claiming on his income tax return an exemption for personal use and he pays rent for a place where he ordinarily lives, but does not own, he cannot claim an exemption under section 80GG :

The quantum of the deduction is the least of the following:

Rent actually paid less than 10% of the adjusted total income.

5,000/- per month.

25% of the total adjusted cost.

Exceptions under Article 80GG:

- An individual cannot claim a rental deduction if the premises is the place where he works or carries on business.

An individual cannot claim a deduction of rent by claiming payment of landlord-owned property as landlord-occupied property elsewhere. If the person lives in one city and owns a home in another city or town, they are considered tenants.

If a person lives in a household with his father and mother, he can apply for eviction under Article 80GG. She will have to sign a lease with her parents to get the rent deduction. However, the mother and father, who own the property, will have to report the rent as income on their tax return. If the house is jointly owned by a son/daughter, they cannot claim rent deduction from their taxable income.

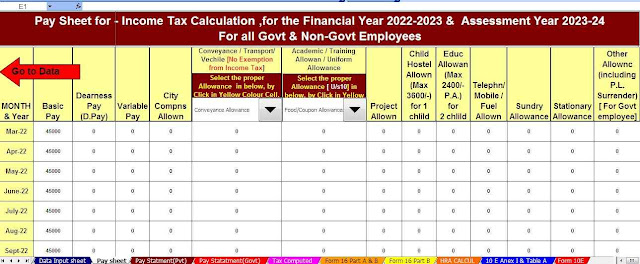

Feature of this Excel Utility:-

1) This Excel Utility Prepare Your Income Tax as per your option U/s 115BAC perfectly.

2) This Excel Utility has the all amended Income Tax Section as per Budget 2022

3) Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the F.Y.2000-01 to F.Y.2022-23 (Updated Version)

4) Automated Calculation Income Tax House Rent Exemption U/s 10(13A)

5) Individual Salary Structure as per the Govt and Private Concern Salary Pattern

6) Individual Salary Sheet

7) Individual Tax Computed Sheet

8) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2022-23

9) Automated Income Tax Revised Form 16 Part B for the F.Y.2022-23

10) Automatic Convert the amount into the in-words without any Excel Formula

0 Comments