Section 80E deduction of study loan interest | Section 80E gives you a tax deduction on an "interest

item" charged on a loan taken out for the higher education of an individual valued. Educational credits

earned for higher studies in

What is Section 80E of Income Tax?

Section 80E is an income tax exemption that applies to the deduction of an "interest item" paid by higher education borrowers to notified financial or charitable organisations. Interest paid on student loans taken out for higher education from yourself, a spouse or children (including for which you are a legal guardian) can be claimed as a deduction from taxable income.

Who can claim taxes on interest paid on student loans?

This student loan repayment deduction can be claimed by an individual for themselves, spouse, children and anyone who is a legal guardian for them. Whoever repays the loan for the above-mentioned individuals can avail of the 80E exemption.

If your parents share the EMI payments, the extent to which the parents pay part of the EMI interest can be charged to them and the rest to you.

What is the deductible amount u/s 80E?

There is no maximum or minimum exemption limit specified in Section 80E. The amount of the deduction from the deduction of interest payments is not affected by the interest rate charged by the financial institution or charity, the amount of the loan or any other factor. In this section, you will find the deduction from the interest actually paid during the financial year.

To avail of the benefit u/s 80E, where should I apply for a loan?

If you want to claim the 80E benefit, you must borrow from:

The financial institution, or

A charitable institution.

Which financial institutions are notified under section 80E?

Section 80E states that interest paid on a student loan must be collected from a charitable organization or a recognized financial institution. Any other organization from which the loan was collected is not entitled to the deduction. These parameters can be determined as follows:

Financial Institution - Under the Banking Regulation Act, of 1949, a financial institution is defined as any bank operating under the rules specified in the Banking Regulation Act.

Charity - A charity may be defined as an authoritative body as defined in Section 23C of the Act.

What are the supporting documents required to claim an exemption under Section 80E?

Exemption under section 80E is required while filing income tax returns and supporting documents need not be attached. The documents below should still be kept safe, if they need to be forwarded to the Department of Financial Taxation in case of future investigation.

Loan penalty documents.

Return documents of a financial institution or charitable organization. Such statements must include a clear breakdown of the amount of principal and interest paid.

What is the term/s for claiming the deduction?

Exemption under Section 80E can be claimed for less than 8 years of assessment. But if you take out a loan account first, the income tax deduction will be available for the relatively short period that the loan was active.

For example,

You took a student loan in A.Y 2019-20 and started paying interest in that same year.

In this case, you can claim a deduction u/s 80E for A.Y 2019-20 to A.Y 2026-27 (8 tax years).

Now imagine another situation where you pay off the entire loan in just 5 years.

In this case, you can claim an 80E deduction for A.Y 2019-20 to A.Y 2023-24 (i.e. till the time you complete the loan)

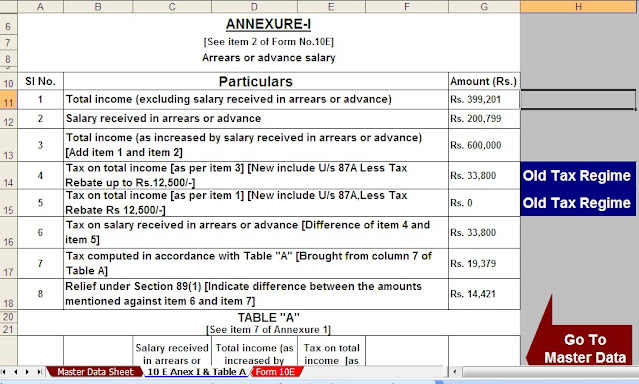

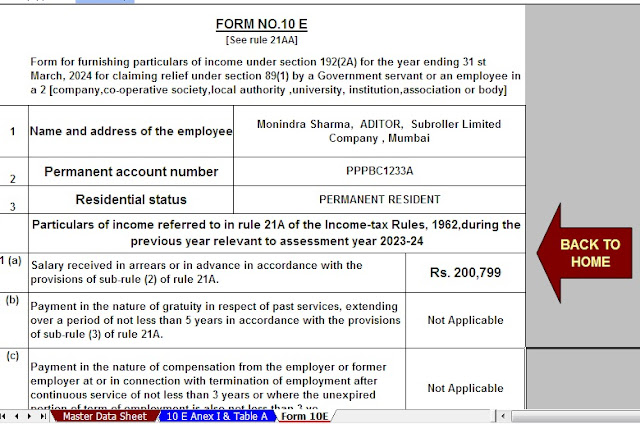

Download Automated Excel Based Income Tax Salary Arrears Relief Calculator U/s 89(1)with Form 10E from the Financial Year 2000-01 to the Financial Year 2022-23 (Updated Version)

0 Comments