Section 80U - Check Eligibility, Amount of Deduction, How to Claim, Documents, Definitions, For

F.Y 2022-23 (AY 2023-24), Diagnosed Disease

Section 80U Exclusion of Disability

Section 80U of income tax is deductible for those who are unable to work. This section provides a lump sum exemption for a person with a disability based on the severity of the disability, regardless of the amount of the income.

The criteria for entitled this deduction are -.

Taxpayers must be residents.

Must be at least 40% disabled for work.

The disability must also be verified by recognized medical authorities.

Exemption of tax under section 80U?

This category is allowed to be deleted

Severely handicapped person* one hundred and twenty-five thousand rupees ie. Rs. 1,25,000/-

Disabled person** seventy-five thousand rupees ie. Rs. 75,000/-

*"severely disabled person" means—

(i) a person with eighty per cent or more of one or more disabilities, as defined in clause (4) of section 56 of the Persons with Disabilities (Equal Opportunities, Protection of Rights and Full Participation) Act; 1995 (1 of 1996); either

(ii) a person with a severe disability referred to in clause (o) of section 2 of the National Autism, Cerebral Palsy, Mental Retardation and Multiple Disabilities Welfare Trust Act, 1999 (44 of 1999).

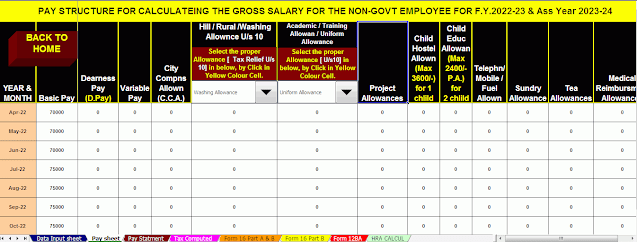

You May Also Like: Automated Income Tax Preparation Excel-Based Software for the Non-Govt Employees for the F.Y.2022-23

80U Eligible - Who can claim this deduction?

Residents who have been certified as a Disabled/Scanned Person by the Medical Authority at any time during the fiscal year will only claim this exemption for themselves. Your living situation determines whether you can qualify for this deduction. NRAs are not eligible for this deduction.

The available amount of exemption available u/s 80U?

As mentioned earlier, the amount of the deductible depends on the severity of the condition. So taxpayers with less than 80% handicap get a deduction of Rs.75,000 and highly handicapped taxpayers who are 80% or more get a deduction of Rs. 1, 25,000 in cash. A deduction is a set amount that can be deducted from taxable income.

What disabilities are covered under Section 80U?

Section 80U has the following disabilities:

Locomotor disability: - This refers to a disability in the muscles or bones of the joints leading to severe restriction of limb movement.

Visual Impairment: - Persons with visual impairment that cannot be fully corrected by surgery or standard refractive correction. People with this disability are still able to use their eyes using other devices.

Blindness: - Blindness means complete loss of vision or where the field of view is limited to an angle of 20 degrees or worse, or vision of less than 6160 accelerates after corrective lenses.

Curing leprosy: - Persons cured of leprosy but still suffering from disability in which they have lost feeling in their legs or arms and paresis in the eyelids and eyes. It also includes the elderly or those with severe disabilities that prevent them from doing vital work.

Mental Retardation: Individuals with incomplete or stunted development of mental abilities, resulting in subnormal levels of intelligence.

Hearing loss:- Hearing loss of at least 60 decibels

Autism:- Autism spectrum disorder is associated with brain development that affects how a person perceives and interacts with others causing difficulties in social interaction and communication.

Cerebral Palsy: - CP is a group of movement disorders that occur in early childhood. Signs and symptoms vary between individuals and over time but include poor alignment, tight muscles, weak muscles, and tremors. Problems can include emotions, vision, hearing and speech.

Mental Illness: - This applies to other mental disorders

A taxpayer is considered to be not severely disabled if he or she has a disability of 40% or more but less than 80%. However, if the taxpayer has a disability of 80% or more, it is called a severe disability. The limit of the deduction varies depending on the severity of the disability suffered.

How do you claim deduction under section 80U?

The person claiming the deduction is liable to submit along with the ITR a copy of the certificate issued by the medical authority in the prescribed form. Practically no document needs to be attached to the ITR, it is advisable to keep the document handy.

Please note that a medical certificate stating the diagnosed disability must be submitted. A certificate with recognized medical authority should be prepared in the prescribed format contained in Form 10 -IA Form can be downloaded from the Income India website -.

0 Comments