8 Useful Income Tax Deductions for F.Y. 2022-23| The Income Tax Act sets out several income tax

deductions that can be claimed when filing income tax returns. The total taxable income (after reducing

any income tax deductions that have been claimed) would be taxed at the individual's income tax rates.

The Income Tax Department of India encourages its citizens to make use of the various Income Tax Deductions, Income Tax Exemptions and Income Tax Refunds allowed by the Income Tax Act. Incomes that help taxpayers to lower their taxes in

8 Useful income tax deductions to save taxes

There are several income tax deductions that an individual/HUF can claim. The most useful income tax deductions that can be claimed easily and are helpful in reducing the tax burden are explained below.

1. Investment Income Tax Deduction specified in Section 80C

The most popular income tax deduction is the Section 80C deduction, which is allowed for investments in certain specific instruments. There are many instruments in which investments can be made and the cumulative total of deductions allowed under this Section is Rs. Rs 1.5 lakh per year Some examples of specific instruments are

PPF account

Mutual Tax Savings Fund

Fixed tax savings deposit

National Savings Certificate

Repayment of the home loan principal

Life insurance policy premium

Equity Oriented Mutual Funds

Employee Pension Fund Contribution

2. Deductions for Contribution to Pension Funds under section 80CCC & 80CCD

Deductions under Section 80CCC and Sec. 80CCD are income tax deductions allowable for the payment of any amount to initiate or continue any annuity plan of any insurance company to receive any pension from the person a deduction from the amount paid Under Section 80CCC.

And if the person has contributed to the notified Central Government pension plan, ie the National Pension Scheme (NPS), a deduction would be allowed Under Section 80CCD.

From the 2015-16 F.Y., an additional deduction of Rs. An investment of 50,000 is allowed in the NPS U/s 80CCD(1B) account. This additional deduction of Rs. 50,000 is above the deduction allowed in Section 80C and Section 80CCC. In other words, the cumulative total of these must not exceed Rs. 2,00,000.

3. Income Tax Deduction Under Section 80TTA for Interest on Savings Accounts

A deduction of Rs. It is also permissible to claim 10,000 under Section 80TTA (specified in Chapter VI-A) of interest earned on the Bank Savings Account. Such interest income is first added under the heading "Income from other sources" and then the deduction of such income is permitted under Section 80TTA subject to a maximum of Rs. 10,000 per year

4. Housing Loan Interest Income Tax Deduction pursuant to Section 24

If a taxpayer has taken out a home loan, they can claim a deduction of the interest charged on that loan. It should be noted that this deduction under Section 24 is for interest charged and not interest paid.

The principal amount of the Mortgage Loan repaid is permitted as a deduction under Section 80C and Interest charged is permitted as a deduction under Section 24.

5. Section 80D: Deduction for Payment of the Medical Insurance Premium and Health Examination

If an individual/HUF has made any health insurance premium payments for himself, his spouse or dependent children, he may claim an income tax deduction for the same. The deduction allowed in this section varies depending on whether the insured is an elderly or non-elderly person.

If any amount was paid for preventive health examinations, deduction of such payments would also be allowed.

6. Section 80DD and Section 80U: Disability Income Tax Deduction

If the individual himself is disabled, he will be entitled to a deduction under Section 80DD, and in the event that any dependent family member of the individual is disabled, he will be entitled to a deduction under Section 80U.

The disabilities for which deductions are allowed in Section 80DD and Section 80U are also defined in the income tax law.

7. Section 80E: Income Tax Deduction for Interest on Education Loans

A person is allowed a Section 80E income tax deduction for repayment of interest on mortgage loans taken for the higher education of himself or his spouse or dependent children.

It should be noted that this deduction is only for the repayment of interest on the education loan and not for the repayment of the principal amount of the education loan. The nice thing about this income tax deduction is that there is no upper limit to the amount of deduction that can be claimed.

This deduction is not only allowed for education in

8. Income Tax Deduction for Income under Section 80GG

If a person has paid rent on the home and has not claimed income tax deductions for rent paid under other sections of the income tax law, he or she may claim a deduction under Section 80GG.

In other words, a salaried employee who has not benefited from the HRA Waiver or any other person who has not claimed rental expenses paid under any other section of the Income Tax Act may make a deduction under this section, subject to the limits prescribed in Section 80GG.

Feature of this Excel Utility:-

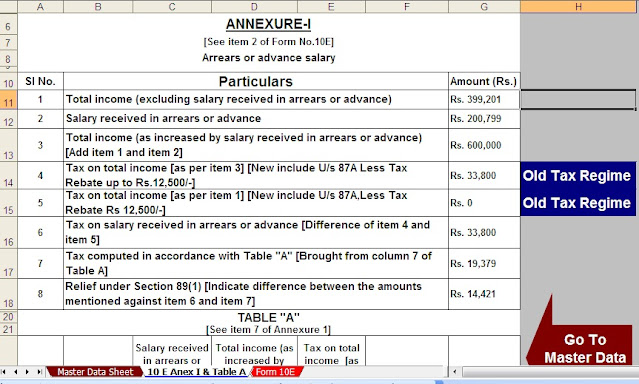

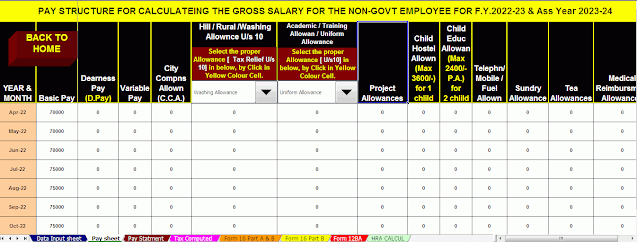

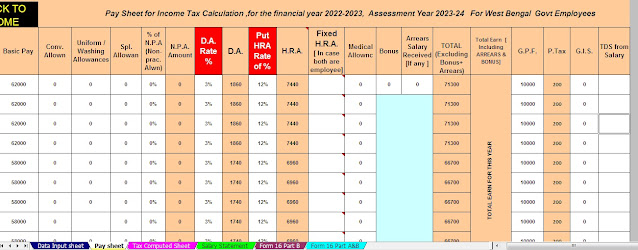

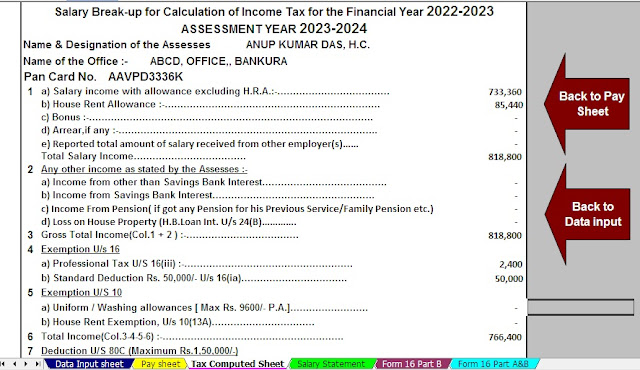

1) This Excel utility prepares and calculates your income tax as per the New Section 115 BAC (New and Old Tax Regime)

2) This Excel Utility has an option where you can choose your option as New or Old Tax Regime

3) This Excel Utility has a unique Salary Structure for

4) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2022-23

6) Automated Income Tax Revised Form 16 Part B for the F.Y.2022-23

7) Individual Salary Sheet

0 Comments