Income Tax Arrears ReliefCalculator U/s 89(1) With Form 10E | What if they pay you late? If really,

you may be worried about the tax consequences of it. Do you have to pay taxes on the total tax base?

Shouldn't something be said about last year's tax checks and such? For taxpayers with these requests in

mind here's everything you need to know.

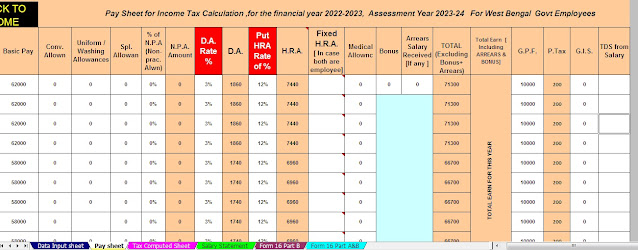

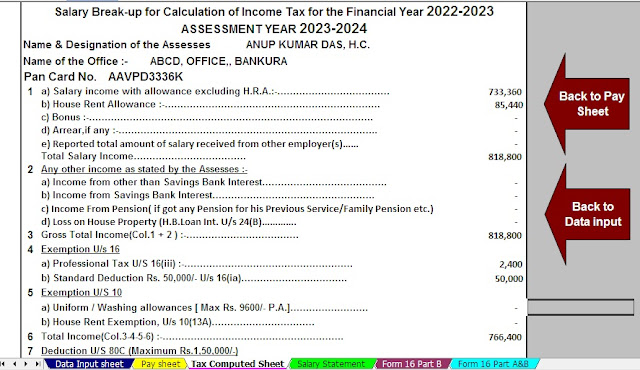

Now, you would have recently resolved that income tax is calculated on a taxpayer's total income for a given year. Income can be a salary or family annuity or various sources of income. Regardless, there may be circumstances where you received back family benefits or future wages during the current tax year. It may happen that a taxpayer receives part of his advantage or salary early or late in any year related to cash, which increases his total income in a similar way by increasing the taxes to be paid. In that case, an application can be filed and the reviewing authority can allow relief to the taxpayer. In short, the Income Tax Law guarantees equity in income tax rates, so that when part of the income obtained is not identified with the current year, a tax exemption is granted with the aim that the taxable income does not increase.

To make sure you are not mistaken for paying additional taxes, the U/s 89(1) Relief is issued by the income tax office. If you receive any annuities or dues from the previous year, you will not pay taxes on the full amount for the current year. Essentially, you're far from paying additional taxes considering the way there was a deferral of the instalment.

To benefit from Section 89(1) preferences, you must file Form 10E. The nuances of Form 10E, how and why to enter the comparable, are detailed below.

What is relief under section 89(1)?

Exactly when the taxpayer receives:

1. Delay in salary payment or

2. Salary in advance or

3. Delay of family annuity

Until then, said amount is taxable in the Monetary Year in which it is obtained.

However, the exemption under section 89(1) is provided to lessen the additional tax burden due to the deferral of receipt of such income.

How to calculate relief under section 89(1)?

Here is how to calculate relief under section 89(1) of the Income Tax Act of 1961:

1. Calculate the tax to be paid on the total overdue income for the year in which it is earned.

2. Calculate the tax to be paid on the total income, except the arrears of the year in which it is accrued.

3. Compute the differentiation somewhere in the range of (1) and (2).

4. Tax to be paid on the total tax base for the year to which the delays refer, including delays.

5. Compute the differentiation somewhere in the range of (4) and (5).

6. The amount of relief will be the amount in excess of (3) more than (6). No relief will be allowed if the value of (6) is greater than the value of (3).

What is Form 10E?

To secure relief under section 89(1) for back wages received, it is necessary to file Form 10E with the Income Tax Division. In the event Form, 10E is not filed and relief is granted, then the taxpayer is on their way to getting a notice from the Income Tax office for not filing Form 10E.

0 Comments