Leave Travel Allowance [Sec. 10(5) AND RULE 2B] | LTA is compensation paid by an employer for

an employee’s domestic travel while on family or personal holiday.

LTA waiver can be claimed when the employer grants LTA to the employees for leave to any place in

Such deductions are limited to the amount of travel expenses actually incurred by the employee. Total holiday costs are not covered, only travel costs are covered.

Required to travel within

For example, if the employer offers an MJA of Rs.25,000, but the employee spends only Rs 20,000 on travel expenses, the deduction is limited to Rs 20,000.

For the purposes of the exemption, ‘family’ is understood as spouse and children and parents, brothers and sisters who are wholly or substantially related to you.

The exemption does not apply to more than two children of a person born after October 1, 1998. In the case of a second birth after the birth of one child, this limitation also does not apply to this restriction.

The tax rules only provide an exemption for two trips in a block of four calendar years. This block is scheduled for the current calendar year 2018-21.

The exemption is allowed only if the person claiming the deduction is also traveling. If the family is traveling alone, deduction is not allowed.

Assignment of Unclaimed MJA: If an employee did not claim an MJA in the current last block or claimed it only once, it may request one more MJA in the next block of calendar years under the employee’s eligible allocation concession rules and request an MJA -reduction to 3 trips made in the current block of years. However, in order to avail of the transfer concession scheme, one LTA exemption must be applied in respect of travel in the first calendar year of the following block.

Travel to multiple destinations: If an employee travels to multiple destinations during the same leave, the deduction can be granted only for eligible travel expenses from the point of origin to the remote destination of the holiday by the shortest possible route.

Number removed:

Travel undertaken by Air - Economy Short-haul domestic carrier airfare or amount incurred, whichever is less, shall be exempt

Travel by Rail - First Class Train Travel by A.C. by a shortcut or the amount incurred, whichever is less, is not free.

Point of origin and destination Position of travel connected by rail, but traveled by other modes of transport - A.C. First class rail fare according to the shortest route or the cost incurred, whichever is less.

The origin and destination are not connected (partially/full) by rail, but are connected by another recognized public transport system - First class or luxury class fare depending on the route or shortest fare used, which is small.

Place of origin and destination not connected (partial/complete) by train or other recognized public transport system - AC first class rail fare by the shortest route (because the journey was made by train) or the actual cost, whichever is less.

Feature of this Excel Utility:-

1) This Excel utility prepares and calculates your income tax as per the New Section 115 BAC (New and Old Tax Regime)

2) This Excel Utility has an option where you can choose your option as a New or Old Tax Regime

3) This Excel Utility has a unique Salary Structure for Government and Non-Government Employees Salary Structure.

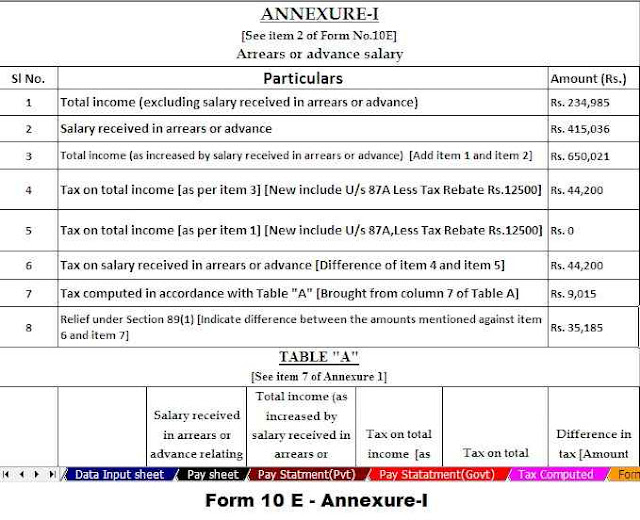

4) Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the F.Y.2000-01 to F.Y.2022-23 (Update Version)

5) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2022-23

6) Automated Income Tax Revised Form 16 Part B for the F.Y.2022-23

![Salary Structure Leave Travel Allowance [Sec. 10(5) AND RULE 2B]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhL7rbGKbgKWteQtIAf6uHRxwlkPdZg3jtX4liKnUXN6fqX1QtD-MSlsSiZral4PSU2bWR3eR38PNy1rZh-VLkmhXjeDWw-YEbSffSUuZGh_XHU3xNUYQ6O6PuEk94VdzeMvRTldSCrHNYHK-MThlzXc60HvvD72e2WnQsMgYs8a3SqzlRjQ3dmYzZE/w640-h222/Salary%20Structure.jpg)

![Tax Computed Sheet Leave Travel Allowance [Sec. 10(5) AND RULE 2B]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEgj1hxNaz_GfzGl_I3gBXSxdIMpzqPr4Q16-CuJ4VGiUuxQ8dwVhEnK4-8NjvQf4Va_lZ4rj5pMx-XF47bM0TtFJXKiM5SxV6D90no5GWy0zIHeONz6bSCdpsiKIcH74NOLuV6jRWyZ-5B9DM2rjhASe8na1JSbeMP9_n-FHBp7kdDuAyBY-i4HmAvI/w640-h548/Tax%20Computed%20Sheet.jpg)

![Form 16 Leave Travel Allowance [Sec. 10(5) AND RULE 2B]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEio5m6-CTZKP6fO5-TOaaj3AVsBCUt32no822pF1iuCNFjQ4qwrWe-uagw2kBOT8GCjixyNR66lcINIqm3a6PwwVXnldWZyGPSZ_5bCtDxaKd2sdRp8njMvtDDaPbjuw_9E1wcHJXqKdhZ1tqyXRTMAZ6I9AQxWNXeiKUdpzypw21dKr4PDa46MMKax/w640-h412/Form%2016%20Part%20A%20and%20B.jpg)

0 Comments