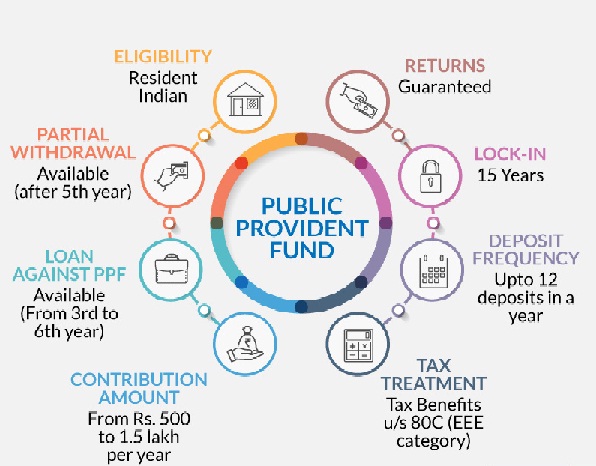

Income Tax Deduction PPF U/s 80C |PPF is one of the best long-term investment options with

attractive interest rates and investment returns for people with low-risk appetites. It can also be called a

savings and tax savings investment option to save on taxes and get a guaranteed return. PPF is a

government-backed scheme that allows you to build up a retirement corpus in one lump sum. Because

the return is fixed, it is also used as a diversification tool for an investor’s portfolio, along with tax-

saving benefits.

PPF BUSINESS REQUIREMENTS: Minimum 15 years of experience.

INTEREST: 7.1% compounded annually

DEPOSIT LIMIT: Minimum investment of Rs.500 and maximum of Rs.1.5 lakh for each financial year

METHOD OF DEPOSIT: Can be done by cash, cheque, DD or online wire transfer

DEPOSIT FREQUENCY: At least once a year for 15 years.

RISK PROFILE: Minimum risk factor applicable to risk-free returns.

TAX REDUCTION BENEFITS: Up to Rs. 1.5 Lakh under Section 80C

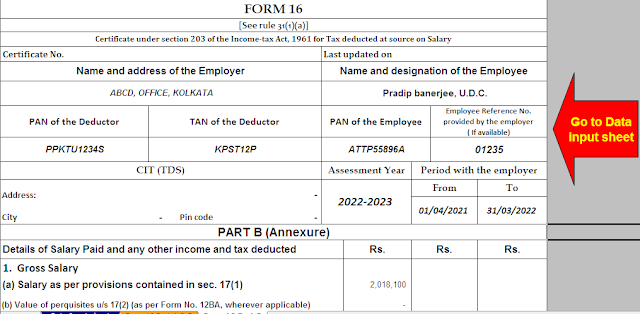

Download and Prepare at a time 50 Employees Form 16 Part B for the F.Y.2022-23 in Excel

PPF: ACCOUNT EXTENSION RULES CHANGED:

After the due date, Form 4 must be submitted for renewal. The extension can be done in blocks of 5 years. The PPF account can also be maintained after maturity without depositing more funds and interest can be earned on the balance amount at the respective rate. Renewal requests must be made within one year of the expiration date of your original or renewed account.

EARLY CLOSING OF ACCOUNT: Apart from early closure in special cases requiring funds, a PPF account can now be closed earlier if your residential status changes from resident to non-resident. This requires documents such as passports, visas or income tax returns to be provided.

Download and Prepare at a time 50 Employees Form 16 Part A&B for the

F.Y.2022-23 in Excel

ACCOUNT FAILURES: Currently there is no limit on the number of deposits. You can deposit in multiples of Rs. 50 but the minimum should be Rs. 500 and the maximum value may exceed Rs. 1 50,000 per annum.

INTEREST ON LOANS AGAINST PPF: The government has reduced the interest rate from 2% to 1% (above the existing interest rate on PPF), reducing the cost of borrowing from PPF.

PAYMENT TERMS: The loan must be repaid within 36 months. In case of default (partial or full), penal interest of 6% per annum will be charged. A second loan can also be obtained right after the first loan. Under the amended rules, PPF is also still available as a tax-saving investment opportunity. It was started in order to mobilize small savings in the form of investments along with its returns. So anyone looking for a safe investment option to save tax and get guaranteed returns can definitely go for PPF.

Download And Prepare at a time 100 Employees Form 16 Part B for the F.Y.2022-23 In Excel

0 Comments