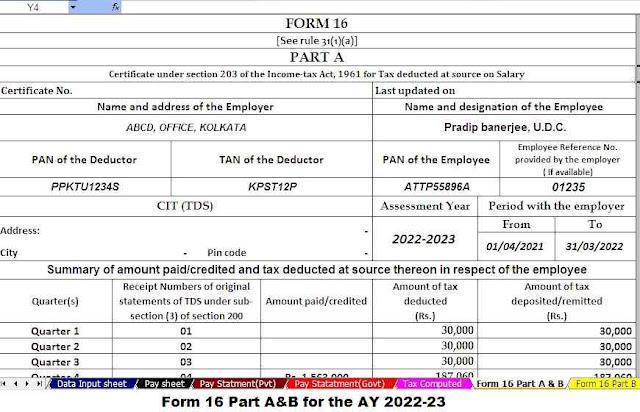

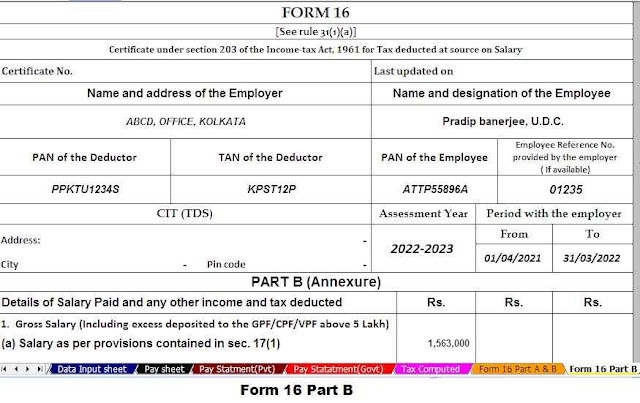

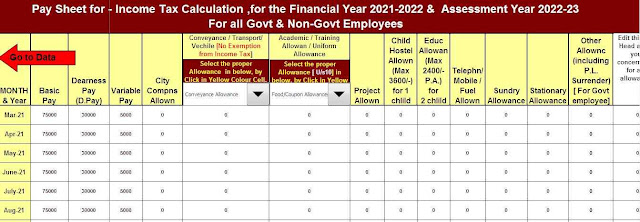

Download Form 16 for 50 or 100 employees at a time, Part A and B or Part B for Financial Year 2021-

22 | In the financial year 2019-20, the CBDT (First Board of Direct Taxes) amended Form 16

rule entitled "Payment of TDS authentication". A unit paid separately to the representative exhausts the

tax benefit of that area unit declared by the taxpayer.

The validity date of the TDS of pay is

indicated and processed immediately. The CBDT has announced that the revamp of

module 16 will have a long-term effect from April 2019.

Is the core offering built into the

new organization of the statement?

The new form 16 regime provides

full details of settlement such as house rent premium u/s 10 (13A), traveling

grant, or assistance under section 10(5).

It is learned that the new

fiscal plan for 2020, has introduced a new section 115 BAC, and a new annual

tax estimation system based on the new and old tax regime has been introduced

in this section. At this time, is it important to know what the new and old tax

regime is?

1) Under the new tax regime, you

are not eligible for annual industry tax benefits other than NPR benefits. And

apart from that, only before the new tax regime was a profit the new tax

regime.

2) Under the old tax system, you

enjoy all the benefits of the tax component, but starting in the 2019-2020

fiscal year, the tax component will be the old tax component. In this

expenditure plan, it is obvious you have given a choice based on your decision,

that is the new and old tax regime in the No. 1 supported structure. 10-IE.

At present, for the required annual tax form 16 Excel Based Fully Automatic Programming according to

new and old tax regime u/s 115 BAC from below -.

Or

Or

Or

Or

Or

0 Comments