Download Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E for the F.Y.2023-24 and

A.Y.2024-25

Salary arrears are understood as unpaid wages of the previous period accrued in the current year. There may be a subsequent revision of the employee’s wages or a disputed wage which is then issued by the employer.

What are wage arrears?

Arrears of payment means all receivables paid in the previous period which are paid back in another assessment year. In addition, the salary may have been adjusted, but the increase may be paid later or the increase may be revised later. Therefore, in such cases, the amount of the difference paid in the subsequent period is called wage arrears. The employer states this separately from the pay slips and part B of form 16.

Salary Arrears Taxes

Wage arrears are treated as wage income in ITR. They are taxed in the year they are earned. However, a taxpayer may be concerned about paying a higher rate due to a higher tax bracket in the year received or due to applicable bracket rate changes. In such a case, the taxpayer may apply for an exemption under Article 89(1).

Exclusion under Article 89(1).

A taxpayer who receives part payment later or earlier or receives a benefit in lieu of payment can claim a deduction under Section 89(1) of the Income Tax Act.

If a taxpayer’s total income including wages paid in the current financial year and the rates of the tax brackets are different in both years, this may lead to higher taxes. For example, the Income Tax Act allows a deduction under section 89(1) to protect the taxpayer from any additional tax liability for delay in the collection of income.

File Form 10E

It is mandatory to file Form 10E for claiming benefits under section 89(1). The taxpayer has to submit this form online at the income tax e-filing portal.

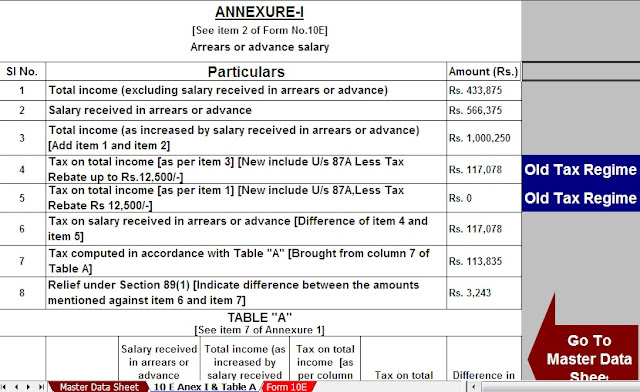

Calculation of tax relief under Article 89(1) for back pay

Income tax return for failure to file Form 10E

From the financial year 2014-15 (the tax year 2015-16), ITD has made it mandatory to file Form 10E if you want to claim an exemption under Section 89(1). Taxpayers who have claimed an exemption under Section 89(1), but have not filed a Form 10E, have received an income tax bill from the IRS.

Frequently asked questions

How to claim tax relief on back pay under Section 89(1)?

Wage arrears or advances are taxable in the year in which they are received. Income Tax

Department

It allows tax relief u/s 89 of the Income Tax Act to save the taxpayer from the above

The tax revenue. Accordingly, the employer computes the exemption u/s 89 and discloses

It is Form 16.

The Employees can claim such exemption in ITR.

How to save taxes on deferred pay?

An employee who earns overtime pay can save tax on that extra money

in the following manner:

* Calculate relief u/s 89(1) .

* Submission of Form 10E for claiming exemption u/s 89(1) .

When should I file Form 10E?

Form 10E is required before filing an income tax return

0 Comments