Form 16 A and B- the two sides you need to know| Attention all salaried employees in India! Are

you ready to discover the mystery behind the Salary? Certificate Form 16? This important document

not only summaries your income but also contains the key to your tax deduction. But wait, did you

know that there are two TDS certificates, Form 16A, and Form 16B? Each section provides unique

information about your finances that you need to learn to accurately prepare your tax returns. So get

ready to dive into the exciting world of Form 16 and check out the exciting features of Form 16 A and

Form 16 B.

Therefore,

What is Form 16A?

In other words, Form 16A is an important document in the Indian income tax system. It works as documents supplied by the employer to the employees as documents of taxes deducted at source (TDS) on payments other than salary, such as rent, professional fees, commissions, interest, and more.

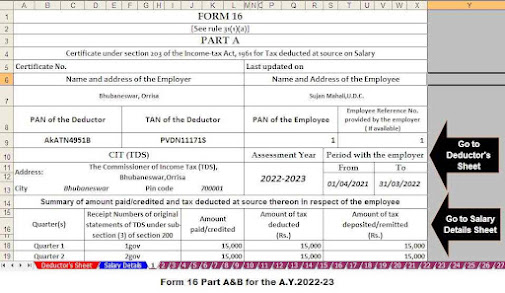

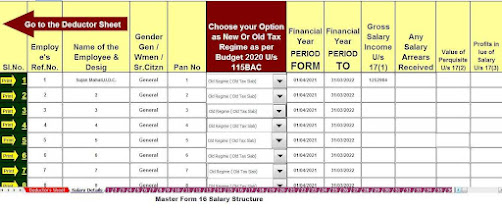

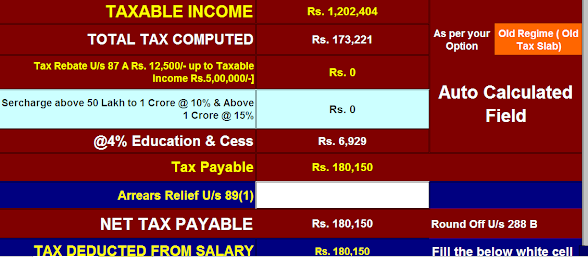

Download and Prepare at a time 100 Employees Form 16 Part B for the Financial Year 2022-23amd Assessment Year 2023-24

However, This certificate contains important information, including the name of the deductor and

drawee and PAN, method of payment, the amount paid, and TDS deducted and deposited with the

government.

Form 16A is very useful as a franchise as it allows you to claim TDS credit while filing your tax

returns. Without this certificate, you could end up paying more tax than you should.

For instance, Who issues form 16A?

Form 16A is not issued to employers but to financial institutions, entities, or individuals who have

deducted tax at source on their non-salary income. For example, if you have received interest income

from fixed deposits, mutual fund appreciation, insurance commission, or self-employment, you may

receive a Form 16A from the deductor.

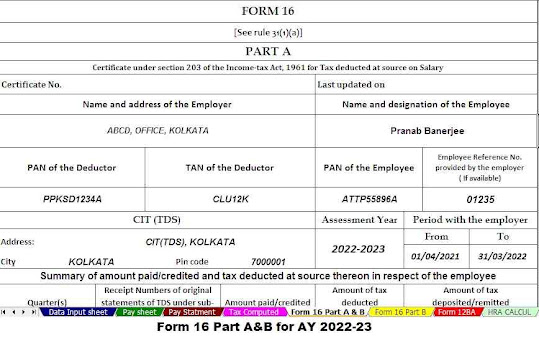

Download and Prepare at a time 100 Employees Form 16 Part A&B for the Financial Year 2022-23amd Assessment Year 2023-24

What are the features of Form 16A?

Above all, Form 16A is the reference document for anyone looking to get a clear picture of their Tax

Deduction at Source (TDS) in India. This TOS statement is an inexhaustible source of information

including the following details:

Name and address of deductor (entity deducting tax at source).

Permanent Account Number (PAN) of Assee

TAN(Tax Deduction Account Number) of the Employee

Name and address of deductible (income tax deductible).

Franchise PAN of the franchise.

Type of payment for which TDS is deducted (for example, rent, commission, interest, etc.).

The amount paid by the franchise

Amount of TDS deducted

Date of deduction of TDS

Date of filing of TDS with the government.

Assessment year for which TDS is deducted.

Download and Prepare at a time 50 Employees Form 16 Part B for the Financial Year 2022-23amd Assessment Year 2023-24

What is Form 16B?

In addition, Form 16B is an important document in the Indian income tax system. It serves as a

certificate issued by the drawer to the drawee as proof of tax deducted at source (TDS) on the sale of

real property, such as land, buildings, or real estate.

After that, This certificate contains important information, including the name and PAN of the

deductor and deductible, the address of the property, the amount paid for the property, and the TDS

deducted and deposited with the government.

Similarly,

Form 16B is very important for a franchisee as it allows you to claim TDS credit while filing your tax

returns. Without the document, they could end up paying more taxes than they should.

Thus, Form 16B serves as proof that TDS has been deducted and credited to the government and allows

you to claim TDS credit, which reduces your tax.

Who issues form 16B?

Form 16B is issued to the home buyer or the person responsible for deducting TDS on behalf of the

buyer. The buyer has to deduct TDS at the rate of 1% and submit Form 16B to the seller.

Download and Prepare at a time 50 Employees Form 16 Part A&B for the Financial Year 2022-23amd Assessment Year 2023-24

When is Form 16B filed?

Form 16B must be issued within 15 days after the completion of source-linked tax declaration

verification. Buyers can download Form 16B from the TRACES website after submitting the TDS

return in Form 26QB.

What information is contained in Form 16B?

However, Form 16B is the reference document for anyone looking to get a clear picture of their Tax

Deducted at Source (TDS) on the sale of real estate in India. This TOS statement is an inexhaustible

source of information including the following details:

Name and address of the deductor (purchaser of real estate).

PAN (Permanent Account Number) of the deductor

French name and address (actual real estate seller).

Revocable PAN

The address of the property sold

The amount paid for the property

Amount of TDS deducted

Date of deduction of TDS

Date of filing of TDS with the government

Reference year for n an it

Download and Prepare One by One Form 16 Part B for the Financial Year 2022-23 and Assessment Year 2023-24

TDS is deducted

Form 16B Benefits

In conclusion,

Here are some of the benefits of Form 16B:

In other words,

1. Proof of TDS: Form 16 B is the proof of taxes deducted at source (TDS) on the sale of the property.

It serves as a document for the buyer to prove that TDS has been deducted and deposited with the

government.

2. Tax compliance: According to the Income Tax Act, TDS is to be deducted on the sale of real estate.

By issuing Form 16B, the deductor complies with the tax laws and avoids any legal penalties or

judgments.

3. Therefore, Simple Property Transaction Processing – Buyer can act efficiently

on property transactions by submitting form 16B to the registrar’s office while the property is being

registered. This helps avoid any delay or inconvenience in the registration process.

4. Help in filing income tax returns: Form 16B provides all the necessary details required for the buyer

to claim credit of TDS deducted while filing his income tax returns.

5. Similar to Valid Document: Form 16B is a valid document containing all necessary details of TDS

deducted and deposited. It can be used as proof of payment in the event of a dispute or legal

proceedings.

Download and Prepare One by One Form 16 Part A&B and Form 16 Part B for the Financial Year 2022-23amd Assessment Year 2023-24

0 Comments