Budget 2021 - What is the new tax rules for ULIPs and especially after the 2021 budget? Although ULIPs were equity products, they enjoyed the same tax benefits as other endowment products under section 10 (10D).

However, in order to bring balance between ULIPs and mutual funds, during the 2021 budget, the finance minister proposed a change in the taxation of ULIPs. Let's take a look at the new tax rules for ULIPs.

All about the tax on ULIPs

There are three tax aspects to consider when investing in ULIPs. The first is the time of investment, the second is when it matures or surrenders and the third is the time of death. Now watch each one in detail.

# Tax rate on ULIPs at the time of investment

There is no change in the rules regarding tax benefits when investing in ULIPs. Therefore, exemptions under Section 80C is allowed for investment in ULIPs (up to a maximum of Rs. Can and can claim a discount for investment for any member of the HUF.

You may also like- Download and Prepare at a time 50 Employees Form 16 Part A&B for the F.Y.2020-21 in Excel as per new and old tax regime U/s 115 BAC

The exemption under section 80C is limited to 10% of the sum insured. This means the sum insured is Rs. 1.5 Lakh, then the premium you pay under ULIP should be up to a maximum of Rs. 1,50,000. If the premium is outside 10%, it is not eligible for a discount under Sec 80. Any amount of premium payable above this limit is not deductible under section 80C.

Another important point to understand here is that if you stop paying premium before the expiry of the five-year term or you stop your participation with notice of that part, the total amount of discount allowed to you in previous years will be treated as income and your income tax slab Accordingly the tax is charged in the year in which such national termination occurs.

So, closing the ULIPs is like a double-edged sword. ULIPs charge you in one way with a hefty separation charge and in another way, the opposite of the tax benefit you receive under Sec.80C.

Remember that you can pay as much premium as possible. However, the benefit of Sec.60C is limited to Rs.1,50,000 per annum and the premium must be 10% of the insured.

# Tax rate of ULIPs on maturity

The proposal to change the budget for 2021 was given here. Let us first try to understand the old rules that exist.

Tax on ULIPs (before 2021 budget)

Section 10 (10D) provides for a rebate on any money received under the ULP, including money allocated through bonuses on such policies. However, if the premium payable for any year during the term of the policy exceeds 10% of the actual insured, no discount will be allowed.

You may also like- Download and Prepare at a time 50 Employees Form 16 Part B for the F.Y.2020-21 in Excel as per new and old tax regime U/s 115 BAC

Effective from 1st February 2021, no waiver will be allowed under Sec.10 (10D) if the amount of premium payable for any of the preceding policies exceeds Rs. 2,50,000.

However, if the total premium paid for a financial year is less than Rs.250,000 (including all multiple policies), you will enjoy duty-free maturity under Sec.10 (10D).

The Finance Bill, 2021 proposes to insert a new sub-section (1B) in section 45 so that a person can receive any amount under any ULIP at any time during the previous year so that no exemption is given under section 10 (10D).

You may also like- Download and Prepare at a time 100 Employees Form 16 Part A&B for the F.Y.2020-21 in Excel as per new and old tax regime U/s 115 BAC

Apply to the account of the Fourth and Fifth Provisions, including the money allocated through bonuses in the policy of providing, then, any profit or gain from such person receiving such amount will be applicable for tax under the heading "Capital Gain" in the previous year where such amount was received. . Moreover, income tax under this head will be calculated in the prescribed manner. Thus, the method of calculating income will be informed later.

Section 112A proposes to amend the definition of 'Equity-Oriented Fund' by the Finance Bill, 2021. It is proposed to cover the cover of the exemption under serial (10D) which will not be applicable due to the application of the fourth. And of the fifth Proviso. Even if a portion of the fund is invested in the O-based project, higher premium ULIPs will be considered as equity-oriented funds.

Thus, long-term capital gains are Rs. 1,00,000 will be taxable at the rate of 10% without index under the section 112A. Although the full amount of short-term capital gains will be taxable at the rate of 15% under section 111A. ULIPs will be considered as long-term capital assets if they hold short-term capital assets for more than 12 months and for 12 months or less.

Feature of this Excel Utility:-

1) This Excel utility prepares and calculates your income tax as per the New Section 115 BAC (New and Old Tax Regime)

2) This Excel Utility has an option where you can choose your option as New or Old Tax Regime

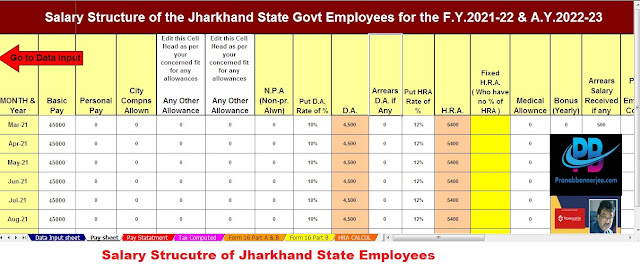

3) This Excel Utility has a unique Salary Structure for

4) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2021-22

5) Automated Income Tax Revised Form 16 Part B for the F.Y.2022-23

0 Comments