What is the Standard Deduction? Budget 2018: Standard discounts come back after 13 years

Effective from 1st April 2018, Rs 40,000 (or the amount of salary, whichever is less),[Now this deduction raised Rs.50,000/- from the F.Y.2018-19 Budget,] is sanctioned from salary income. However, a transport allowance of Rs 19,200 and a medical reversal of Rs 15,000 has also been omitted. Thus, on a net basis, an additional rebate of Rs 5,800 is applicable for a person receiving "income from salary".

What is a standard discount?

The standard deduction is basically a flat amount of deduction from salary income before calculating taxable income. No proof is required to claim a standard discount. Conceptually, the standard exemption speaks to taking care of expenses that are not allowed as deductions under income tax rules.

Standard discount facility

Simplicity is the maximum benefit of the standard deduction. It is approved as a direct discount from salary income. There is no need to submit any bill or proof to claim the standard discount.

Standard discount on pension income

Standard Exemption of Rs. 50,000 / - for a person receiving pension income from a former employer In such cases, pension income is taxed under the heading "Income from salary" and a standard exemption of Rs.50,000/-

However, income from insurance companies or from the nature of income under the National Pension Scheme (NPS) will not be eligible for a standard discount because such income is not of a salary nature. This national anniversary will be taxed under the heading "Income from other sources".

History of standard discounts in

The standard exemption for salaried taxpayers was introduced in 1974. However, it was discontinued from the 2006-07 assessment year. The reason Finance Minister Chidambaram stopped cutting standard concessions was that the general concession limit was raised, and the income slabs were being widened. This argument, however, was false, given that the benefits of higher general discounts and income tax slabs were available for all assessments regardless of the nature of income, not only for the salaried person but also for the person earning from business or other sources.

Prior to its closure, the standard discount was Rs 30,000 or 40% of salary (if the salary does not exceed Rs 5 lakh) in the financial year 2006-07; Or a discount of Rs. 20,000 (if the salary is more than Rs. 5 lakhs).

Total vs. Net Income Debate

A trader will deduct all expenses related to the business and pay tax only on net profit (and not on gross profit). Similarly, when you sell a capital asset, gross receipts are not taxed, but the cost of acquiring the asset and the sales cost from the gross receipt is deducted. With the same argument in mind, the amount of income from the home property is not on the total rental income, after the deduction of municipal tax and after the standard discount of 30% of the net annual value.

There are exceptions to the rule. And one wrong!

In a limited way, income from salary is taxed on a gross basis. Exemption from all legitimate expenses incurred by a person for earning salary income is not allowed. Some allowances like a certain portion of salary, i.e. house rent allowance, travel allowance, etc. are considered tax free. There is a limit to the amount of this allowance, which is considered duty free, and any amount received in excess of this limit is taxable. It should be noted that the employee may actually incur expenses on house rent or travel which is considered tax-free, but still, salary expenses are not reduced by the amount of the entire expenses, but only the limit applicable to this allowance.

Expenditure on deduction from salary is not considered as a direct reason for earning that income. For example, expenses on travel and transportation is directly responsible for salary income and thus should be allowed to be discounted without any restrictions (transportation allowance was approved earlier but not consistent with most expenses). Similarly, any expenditure incurred in acquiring new knowledge or skills, as a result of which the person is able to maintain or increase the salary income should be discounted as a result.

Such expenditures approved under the Income Tax Rules are to be considered standard exemptions. Thus the re-introduction of the standard discount removes taxability on a net basis from the total base on the basis of limitations under the tax value. Ideally, the standard discount amount should be set as a percentage of salary income rather than the same amount for everyone.

Feature of this Excel Utility:-

1) This Excel Utility Prepare Your Income Tax as per your option U/s 115BAC perfectly.

2) This Excel Utility has all amended Income Tax Section as per Budget 2021

3) Automated Income Tax Form 12 BA

4) Automated Calculation Income Tax House Rent Exemption U/s 10(13A)

5) Individual Salary Structure as per the Non-Govt(Private) Concern’s Salary Pattern

6) Individual Salary Sheet

7) Individual Tax Computed Sheet

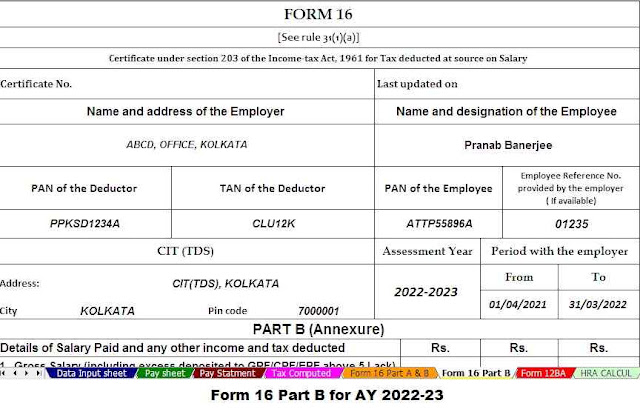

8) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2021-22

9) Automated Income Tax Revised Form 16 Part B for the F.Y.2021-22

10) Automatic Convert the amount into the in-words without any Excel Formula

0 Comments