Whether you choose to pay income tax online or offline, you need to estimate your income tax liabilities in advance, especially if you are a salaried person. However, future income can rarely be accurately predicted. So, you estimate your potential taxes once at the beginning and then again at the end of the fiscal year.

Additionally, you need to file a prepaid tax, which should be at least 90% of your tax liability. Although this amount will be calculated at the end of the financial year, the prepaid tax estimates benefit you in the following two ways:

• Saves you from sudden huge liabilities at the end of the financial year

• You can plan your investments for the next year

An income tax calculator can help you estimate your tax liability early and later in the financial year.

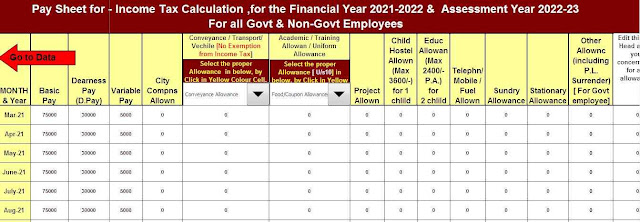

Feature of this Excel Utility:-

1) This Excel utility prepares and calculates your income tax as per the New Section 115 BAC (New and Old Tax Regime)

2) This Excel Utility has an option where you can choose your option as New or Old Tax Regime

3) This Excel Utility has a unique Salary Structure for Government and Non-Government Employee’s Salary Structure.

4) Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the F.Y.2000-01 to F.Y.2021-22 (Update Version)

5) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2021-22

6) Automated Income Tax Revised Form 16 Part B for the F.Y.2021-22

0 Comments