Download Automatic Income TaxPreparation Excel Based Software All in One for the Government and Non-Government Employees for the F.Y.2021-22 with Budget Revision 2021-22| Changes in income tax rules and the latest income tax slab are the two main things that most people look for in their budgets.

Details on income tax plates F.Y 2021-22 (A | Y 2022-23). What are the main changes to the 2021-22 Union Budget and the employee income tax?

Provisions on tax exemption

The 2021 Finance Law introduced Benami's Real Estate Transaction Prohibition Law, Income Tax Law, 19 Direct Tax Amendments to the provisions of the Finance Law (hereinafter referred to as the "Law") relating to real estate (hereinafter referred to as "law '), 198 (hereinafter referred to as the' PBPT Act '), and the Finance Act, 2013, to reduce the tax rate of Hindu cooperatives, individuals and undivided households (HUF), to accelerate direct taxes through tax incentives Deepen and broaden the tax base, eliminate the problems encountered by taxpayers, prevent abuse and improve the efficiency, transparency and accountability of the tax administration.

To achieve the above, several proposed amendments are organized under the following points:

(a) The rate of income tax;

(b) Tax incentives;

(c) Remove the problems encountered by taxpayers;

(ii) Tax guarantees measures;

(e) Broaden and deepen the scope of taxes;

(f) The methods of collecting the revenue;

(g) Improve the efficiency of the tax administration;

(h) Prevent the misuse of taxes; And

(1) Rationalization of the provisions of the law.

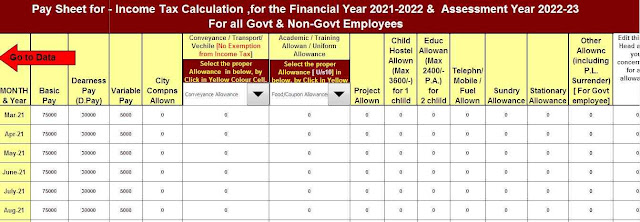

Feature of this Excel Utility:-

1) This Excel utility prepares and calculates your income tax as per the New Section 115 BAC (New and Old Tax Regime)

2) This Excel Utility has an option where you can choose your option as New or Old Tax Regime

3) This Excel Utility has a unique Salary Structure for Government and Non-Government Employee’s Salary Structure.

4) Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the F.Y.2000-01 to F.Y.2021-22 (Update Version)

5) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2021-22

6) Automated Income Tax Revised Form 16 Part B for the F.Y.2021-22

0 Comments